Market Data

November 16, 2017

SMU Steel Buyers Sentiment Index: Poised to Rise?

Written by Tim Triplett

Despite all the uncertainty regarding possible trade action and steel prices, the Steel Market Update Steel Buyers Sentiment Index is holding steady, and at a higher level than last year. Steel buyers’ sentiment appears to have bottomed out in October and November and, in Steel Market Update’s opinion, is poised to pick up along with business in the coming first-quarter if the market follows the pattern of the past few years.

The SMU Steel Buyers Sentiment Index measures changes in buyers’ optimism levels, which offers some insight into their likely decision-making on such factors as purchasing and inventory levels. Most buyers and sellers of flat rolled steel remain optimistic about their company’s ability to be successful in the current market environment, as well as three to six months into the future.

Measured as a single data point, the average among those responding to this week’s flat rolled steel market trends questionnaire was +65, down just -1 point from early November, but up +10 points from early October, and up +7 points from this time last year.

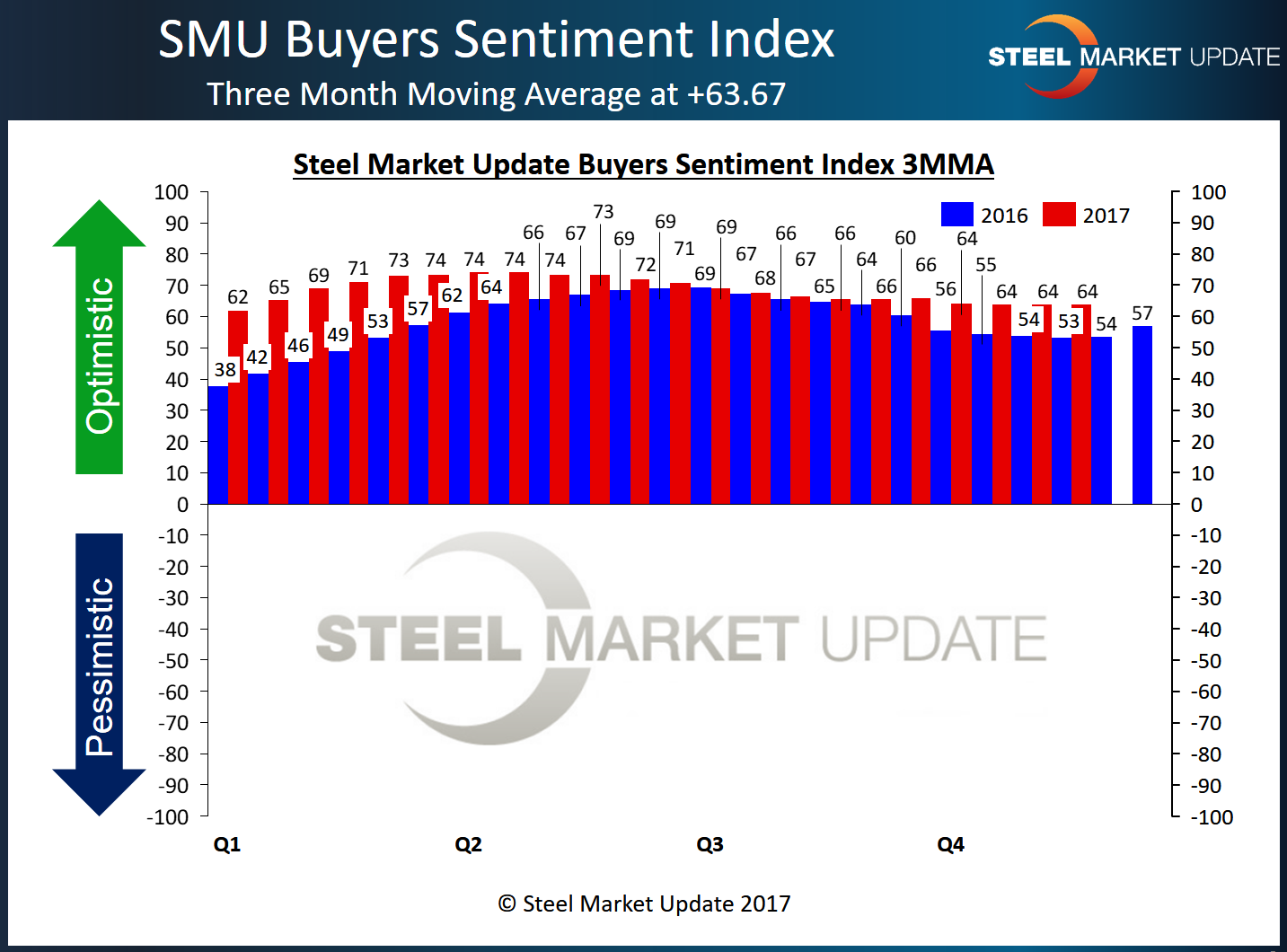

SMU’s preference is to look at the data based on a three-month moving average (3MMA), which smooths out the index and provides a truer picture of the trend. The Current Sentiment 3MMA is at +63.67, basically unchanged in the past month and +10 points more optimistic than levels in November 2016.

Future Steel Buyers Sentiment Index

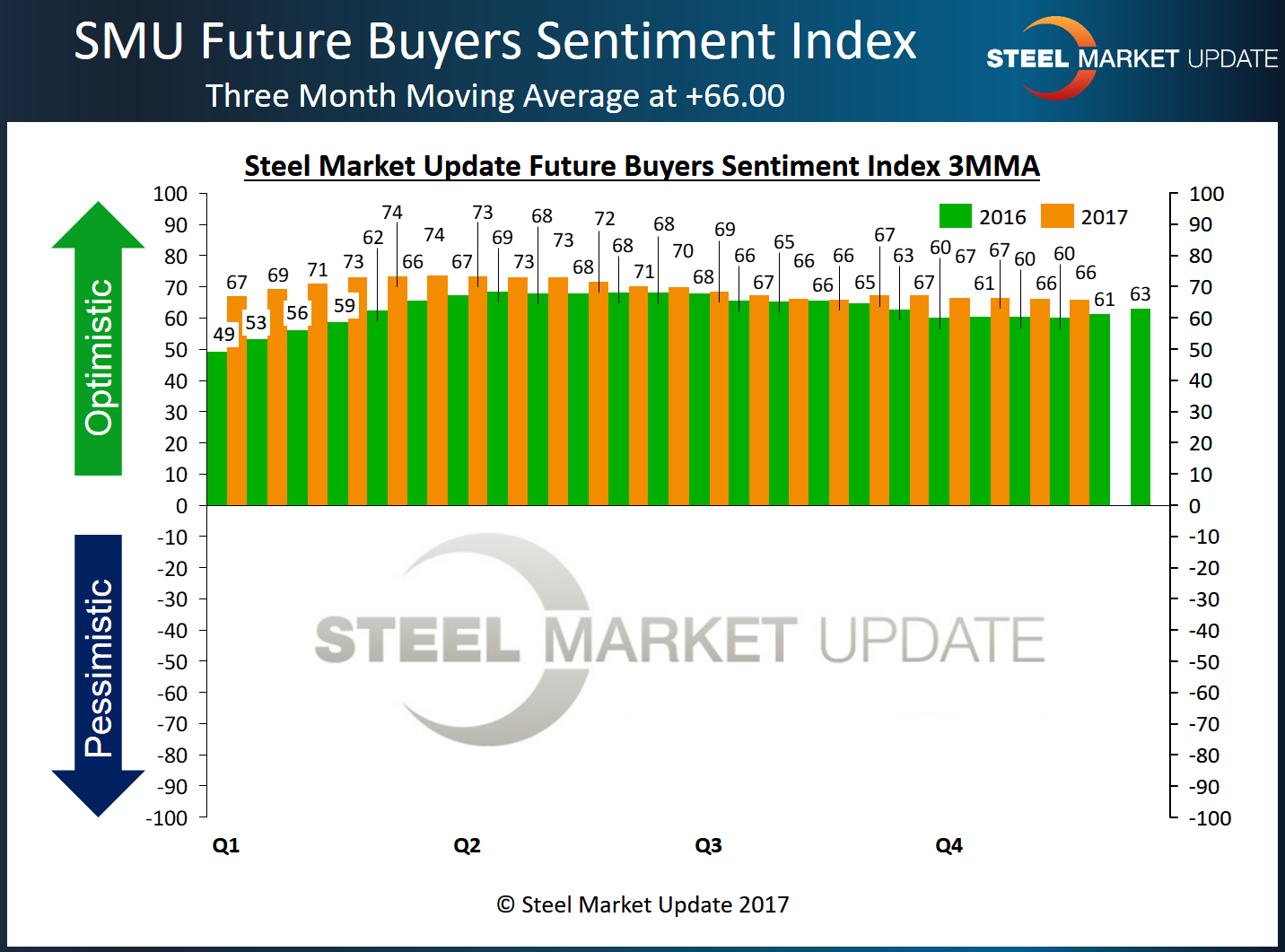

SMU also asked respondents how they feel about their company’s ability to be successful three to six months in the future. Future Sentiment indexed as a single data point also registered +65, little changed in the past month.

As a three-month moving average, Future Sentiment registered +66.00, down slightly from +66.50 a month ago. Last year in mid-November, the Futures Sentiment Index was a less-optimistic +60.17. Looking at the graphs for both current and future data, the bars illustrate that steel buyers have been more optimistic throughout 2017 vs. 2016, particularly later in the year.

· “Business is a little sluggish as we move into the holidays.”

· “I think most customers did heavy buying in October. November has not started out that great.”

· “Contractual business continues to be fiercely competitive.”

· “It has been very difficult to get customers to commit to 2018 orders. Many are demanding fixed prices for an extended period.”

· “There’s still a lot of uncertainty, especially on trade. While the current administration is now somewhat distracted and has put off any trade case decisions, I think they will keep their protectionist stance and make imports more difficult in the future.”

· “If prices don’t go up, it will be a difficult 2018.”

· “I’m very optimistic for the first half of 2018.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 38 percent were manufacturers and 46 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.