Analysis

November 13, 2017

September Heating and Cooling Equipment Shipment Data

Written by Brett Linton

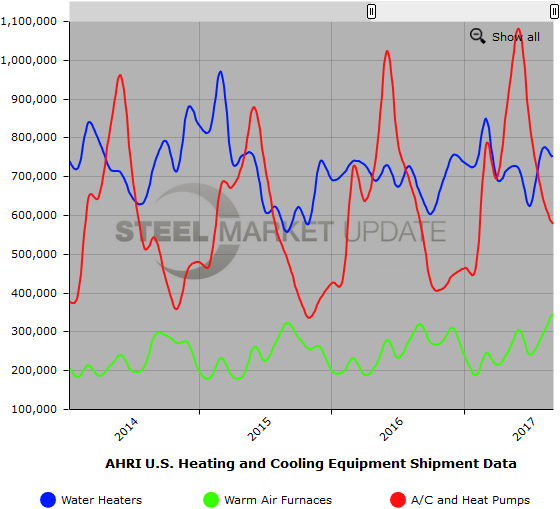

Below is the latest data released by the the Air-Conditioning, Heating, and Refrigeration Institute (AHRI) regarding residential and commercial heating and cooling equipment shipments through September 2017. You may read the press release on their website here.

Residential Storage Water Heaters

U.S. shipments of residential gas storage water heaters for September 2017 increased 14.6 percent to 377,044 units, up from 328,980 units shipped in September 2016. Residential electric storage water heater shipments increased 14.1 percent in September 2017 to 353,426 units, up from 309,720 units shipped in September 2016.

Year-to-date U.S. shipments of residential gas storage water heaters increased 3.9 percent to 3,298,549, compared to 3,173,840 shipped during that same period in 2016. Residential electric storage water heater shipments increased 3.9 percent year-to-date to 3,108,192 units, compared to 2,990,140 shipped during the same period in 2016.

Commercial Storage Water Heaters

Commercial gas storage water heater shipments decreased 6.7 percent in September 2017 to 7,731 units, down from 8,290 units shipped in September 2016. Commercial electric storage water heater shipments increased 22 percent in September 2017 to 12,509 units, up from 10,250 units shipped in September 2016.

Year-to-date U.S. shipments of commercial gas storage water heaters decreased 5.7 percent to 71,181 units, compared with 75,494 units shipped during the same period in 2016. Year-to-date commercial electric storage water heater shipments increased 14.8 percent to 107,865 units, up from 93,931 units shipped during the same period in 2016.

Warm Air Furnaces

U.S. shipments of gas warm air furnaces for September 2017 increased 7.5 percent to 338,347 units, up from 314,809 units shipped in September 2016. Oil warm air furnace shipments increased 5.7 percent to 5,266 units in September 2017, up from 4,980 units shipped in September 2016.

Year-to-date U.S. shipments of gas warm air furnaces increased 8 percent to 2,276,889 units, compared with 2,107,577 units shipped during the same period in 2016. Year-to-date U.S. shipments of oil warm air furnaces increased 2 percent to 23,422 units, compared with 22,955 units shipped during the same period in 2016.

Central Air Conditioners and Air-Source Heat Pumps

U.S. shipments of central air conditioners and air-source heat pumps totaled 575,920 units in September 2017, down 1.3 percent from 583,531 units shipped in September 2016. U.S. shipments of air conditioners decreased 1.6 percent to 377,408 units, down from 383,526 units shipped in September 2016. U.S. shipments of air-source heat pumps decreased 0.7 percent to 198,512 units, down from 200,005 units shipped in September 2016.

Year-to-date combined shipments of central air conditioners and air-source heat pumps increased 6.5 percent to 6,445,168, up from 6,050,465 units shipped in September 2016. Year-to-date shipments of central air conditioners increased 5.8 percent to 4,329,473 units, up from 4,093,777 units shipped during the same period in 2016. The year-to-date total for heat pump shipments increased 8.1 percent to 2,115,695, up from 1,956,688 units shipped during the same period in 2016.

Below is a graph showing the history of water heater, warm air furnace, and air conditioner shipments. You will need to view the graph on our website to use it’s interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.