Logistics

November 12, 2017

November Shipping Report

Written by Sandy Williams

The dry bulk shipping market continues to recover from its historic lows of 2016. Carriers are reporting positive earnings and a more optimistic outlook for the next two years. Fleet growth in 2018 is expected to be at its lowest level since 1999, a mere 1 percent, according to the latest MID-SHIP Report.

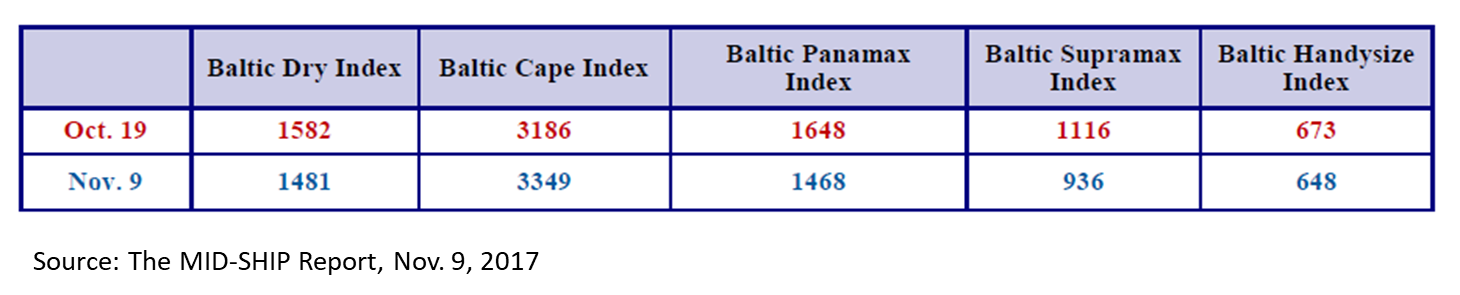

Spot rates in the Capesize, Panamax, and Supramax markets slipped since the last MID-SHIP Report, but overall sentiment is still positive. Spot rates for Handysize vessels rose about 30 percent during the fall and recently experienced a positional correction, but are expected to remain strong through the rest of the year.

The Baltic Dry Index closed at 1481 as of Nov. 9, up from 685 a year ago. The BDI tracks dry-bulk rates based on vessel size and shipping route and is used as a benchmark for overall trade volume.

River

Barges on the nation’s rivers are running into problems at Lock 52 on the Ohio River. The area has been plagued with various issues including recent closures for low water and now high water. The dam at the lock is missing some wickets causing problems controlling the flow of water. The lock is about 42 miles from where the Lower Mississippi meets the Ohio River and is disrupting traffic going to or coming from the Ohio and Tennessee Rivers (for example, NOLA to Cincinnati/Pittsburgh and vice-versa).

Fog season on the Gulf Coast is expected to cause intermittent delays for vessels entering and exiting ports and for barge traffic.

Rail

The Association of American Railroads reported October 2017 as the strongest month for intermodal rail traffic in history. U.S. railroads carried 1,054,777 carloads in October and 1,114,157 containers and trailers. Carloads of metallic ores were up 20.6 percent in October, while loads of coal declined 4.9 percent, and motor vehicles and parts were down 7 percent.

Trucking

Spot market rates for flatbed trucks have been climbing for two months, but fell during the week ending Nov. 4 by 5 cents to a national average of $2.29 per mile. The current rate is unusually high for the season and follows October’s highest rates for the year, says DAT Trendlines. The rates were boosted by truck capacity pressure from rebuilding efforts in the South. Rates during the week ranged from $3.46 per mile in the Northeast, to $2.60 per mile in the South and $1.96 per mile near Phoenix.

Flatbed load-to-truck ratio eased off in October after hitting a high of 50.2 loads per truck in the last week of September. During the week of Oct. 29-Nov. 4, the load–to-truck ratio declined to a still high ratio of 34.0 loads per truck.

In trucking news, the American Transportation Research Institute is urging an increase in the federal fuel tax to fund critical infrastructure repairs.

The deadline for installation of mandatory electronic logging devices in the nation’s truck fleets is Dec. 18. CarrierLists has been publishing a weekly survey of carrier readiness for the ELD mandate and a Nov. 3 survey shows about 60 percent of small fleets are not ready. Drivers and fleets that have not complied by April 1, 2018, will be put out of service. HDT Trucking wrote, “The low rate of ELD adoption for smaller carriers will affect the entire industry. Some of the smallest are expected to exit the industry entirely as a result of the mandate.”

Kevin Hill, president and founder of CarrierLists, said, “Anything less than 100 percent adoption will likely ripple through the trucking market in a tidal wave. Even at 90 percent compliance, it will create chaos with capacity and rates until supply meets up with demand again.”

Great Lakes

Iron ore shipments on the Great Lakes and St. Lawrence Seaway surged in September to 6.5 million tons, increasing 23.4 percent compared to a year ago, according to the Nov. 7 report from the Lake Carrier’s Association. U.S. port shipments totaled 6.2 million tons, up 25.8 percent year-over-year. Shipments from Canadian ports declined marginally to 303,000 tons.