Prices

November 9, 2017

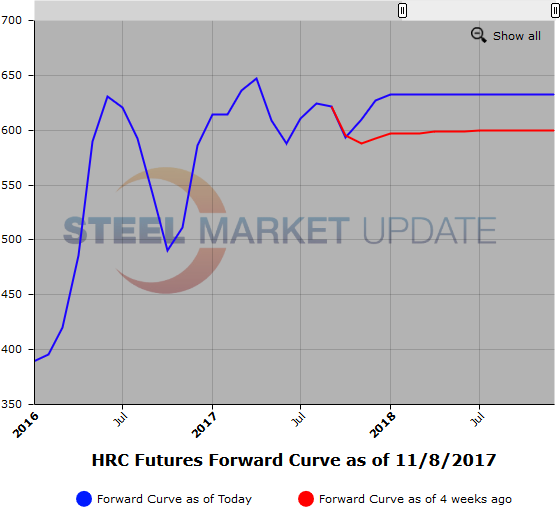

Neutral HR Market Outlook Slows Rising HRC Futures Prices

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

It has been a relatively light volume week in HR futures as the recent push higher in prices has left the average prices traded in Cal’18 at an in-between price point, which has garnered neither buying interest or selling interest from active participants. With prices hanging between the $620/ST[$31/cwt] and $640/ST[$32/cwt] value, we have seen modest buying interest. Lack of strong directional indicators has kept buyers sidelined, and discussions suggest a fairly neutral view for the time being. No further follow through on Section 232, mixed data out of China and concern commodity prices will slide along with recent weakness in spot export scrap prices seems to be offsetting any concern of an anticipated mill price increase announcement sometime this month. In addition, mill lead times remain within the 3 to 6 week window.

This past week, a modest 9,000 plus ST of HR futures traded mainly in Dec’17 through Apr’18 with a small Cal’18 trade going through, as well. Only a couple of thousand ST traded in Dec’17 at weighted $625.5/ST[$31.275/cwt]. Q1’18 traded at a weighted $627.5/ST[$31.375/cwt]. Latest trades have March’18 through May’18 trading at $628/ST[$31.40/cwt].

The curve has remained relatively flat in Cal’18 with a slight backwardation. However, values are difficult to pin down given the light volumes in the farther dates along the curve. We would expect the participants to closely watch spot transactions as represented by the indexes for further signs of market leaning. It is also worth noting that the November’17 HR CME settlement has an extra price point, which could increase the price range.

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.

Scrap

Recent trading in LME 80/20 steel scrap has been mixed. With spot cargoes trading at $310/MT and falling off to $296/MT, recent price strength has retraced fairly quickly. Q1’18 SC, which traded this past Friday at $330/MT on 2,000 MT/mo, traded earlier today at $312/MT on 2,000 MT/mo. This $18 move is pretty reflective of the choppy nature of the export scrap market of late. The prices of the further out futures have also been more volatile, as in they are bid one day and offered aggressively the next. Also, the range of prices traded in a given day for each month has widened.

In the domestic prime scrap market, prices have eased some. BUS prices for November look to be sideways for Chicago and likely down $5-10/GT for the BUS ($333/GT Oct’17 to $323-328/GT Nov’17). Latest trade prices for Dec’17 were at $349/GT, however with the metal margin backing up slightly, buying interest has retraced to the $330/335/GT level. BUS sellers have held steady with recent offers.

The latest metal margin (HR minus BUS) for Q1’18 is running around $285, and it should be noted that the spread between SC and BUS has narrowed from about $40 a month ago to roughly $26 this past week.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.