Market Segment

November 2, 2017

U.S. Steel Invests in Asset Revitalization

Written by Sandy Williams

U.S. Steel is undertaking a massive asset revitalization program to reduce unplanned outages and improve profitability and competitiveness.

The company plans to invest approximately $1.2 billion from 2017 through 2020 on repairs and upgrades. By 2020, slab production capability at Gary Works, Great Lakes Works and Mon Valley works will be increased by 1 million tons from the current 10 million tons. In 2017, costs from outages, regular maintenance and asset revitalization are expected to total $1.325 billion, up from $950 million in 2016.

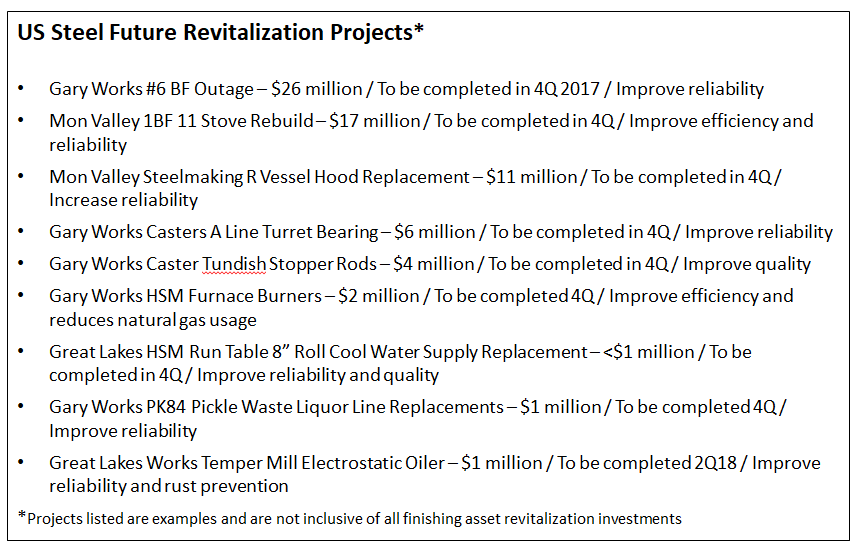

The revitalization will focus on 13 critical assets that include the blast furnaces at Gary Works and Great Lakes, the steel shop and caster at Gary Works, and the steel shop at Mon Valley Works. Hot-rolling improvements will be made at the hot strip mills at Gary Works, Great Lakes Works and Mon Valley Works. Projects for finishing will include the cold mill at Mon Valley Works.

Near-term projects include upgrades at the Gary and Mon Valley facilities. In the fourth quarter, Gary Works will see outages while work is completed on the #6 blast furnace, caster A Line turret bearing, and HSM furnace burners. At Mon Valley, a #1 BF 11 Stove rebuild will be completed in Q4. In addition, a $1 million investment in the Temper Mill Electrostatic Oiler at Great Lakes works will be completed in Q2 2018.

“We need to figure out how to manage this business in a more nimble way, and that means we have to figure out how to run our cost structure more nimbly,” said CEO David Burritt during the earnings call. “We’re trying to get rid of all the big peaks and big valleys and create greater stability and more predictable earnings.”

Burritt emphasized to one analyst on the call that asset investments are a revitalization program, not a repair program. “It’s not like our assets are in terrible shape. We’re bringing them up to superior levels,” said Burritt, which will give the company competitive advantage.

U.S. Steel recently announced construction of a continuous galvanizing line at PRO-TEC Coating Co., a joint venture with Kobe Steel. The line will allow PRO-TEC to produce Generation 3 steels with a hot-dip zinc coating.

Automotive customers are excited about U.S. Steel’s Generation 3 steels. “Remember that our Generation 3 is a little bit different than others in that others are primarily focused on the press-hardened steel and ours can use the existing tooling and dies,” said Burritt. “So, it ends up saving time and money for our customers, and they’re excited by that possibility.”

Burritt did not see any impact on the project due to the Kobe quality falsification scandal. “U.S. Steel is the substrate that’s provided to PRO-TEC. So, there should be no implication related to the Kobe Steel incident,” he said.

Burritt said an electric arc furnace remains in the company’s future, but first long-term stability needs to be seen in the tubular and North American flat-rolled sectors.

U.S. Steel’s focus in the tubular market is heat-treated seamless product and premium connections. The heat treat line in Lorain will be moved to another facility that “makes more sense for us,” said Dan Lesnak, General Manager-Investor Relations.

On Section 232, Burritt said there is a lot going on in the Trump administration right now causing the delay. “We certainly want them to think it through and do the right thing. We don’t want an anemic response. We want an appropriate response.” A report has to be brought to the president by Jan. 14 and a decision made by April. “We eagerly wait for an appropriate response, which we think we’ll get,” said Burritt.

U.S. Steel is watching the NAFTA renegotiations, but said North American trade is not the company’s highest priority. “Our focus is more on the unfair trade from overseas, the dumping of steel into our market,” said Burritt. “Steel that’s subsidized by foreign governments is undercutting the American market.”

A review of the termination of the antitrust portion of U.S. Steel’s Section 337 filing was held on April 20, 2017, and a decision is forthcoming. U.S. Steel withdrew its trade secrets claim and does not plan to appeal the terminated false designation of origin claim.

U.S. Steel reported a modest improvement in third-quarter results. Net sales totaled $3.2 billion and net earnings were $147 million. If market conditions remain stable, U.S. Steel projects net earnings of $323 million for full-year 2017.

“We believe market conditions, which include spot prices, raw material costs, customer demand, import volumes, supply chain inventories, rig counts and energy prices, will change, and as changes occur during the balance of 2017, we expect these changes to be reflected in our net earnings and adjusted EBITDA.”

The steelmaker’s flat-rolled shipments totaled 2.5 million tons in the third quarter at an average realized price of $728 per ton. Raw steel production of flat-rolled totaled 2.8 million tons.

Lead times for hot-rolled coil products are approximately 4.5 weeks and a few weeks longer for cold-rolled and galvanized. “I think, for us, it’s a little bit different because we are running on a restricted footprint, because of the work we’re doing,” said Lesnak.

The flat-rolled capacity utilization rate in the third quarter was 66 percent based on 17 million net tons of annual capacity. Excluding the 2.8 million net tons of idled capacity at Granite City Works, utilization was 79 percent.