Government/Policy

October 31, 2017

Trade Case Delays Leave Steel in ‘Perpetual Uncertainty’

Written by Tim Triplett

Nearly as disturbing as the steel imports themselves are repeated delays in promised trade relief, say steel industry executives, who find themselves doing business in a state of “perpetual uncertainty.”

While there is no official confirmation from the Department of Commerce, SMU’s sources have confirmed reports that the Commerce Department has again delayed a preliminary ruling in the Vietnam circumvention cases on cold rolled and coated steels. A final decision remains due in February 2018.

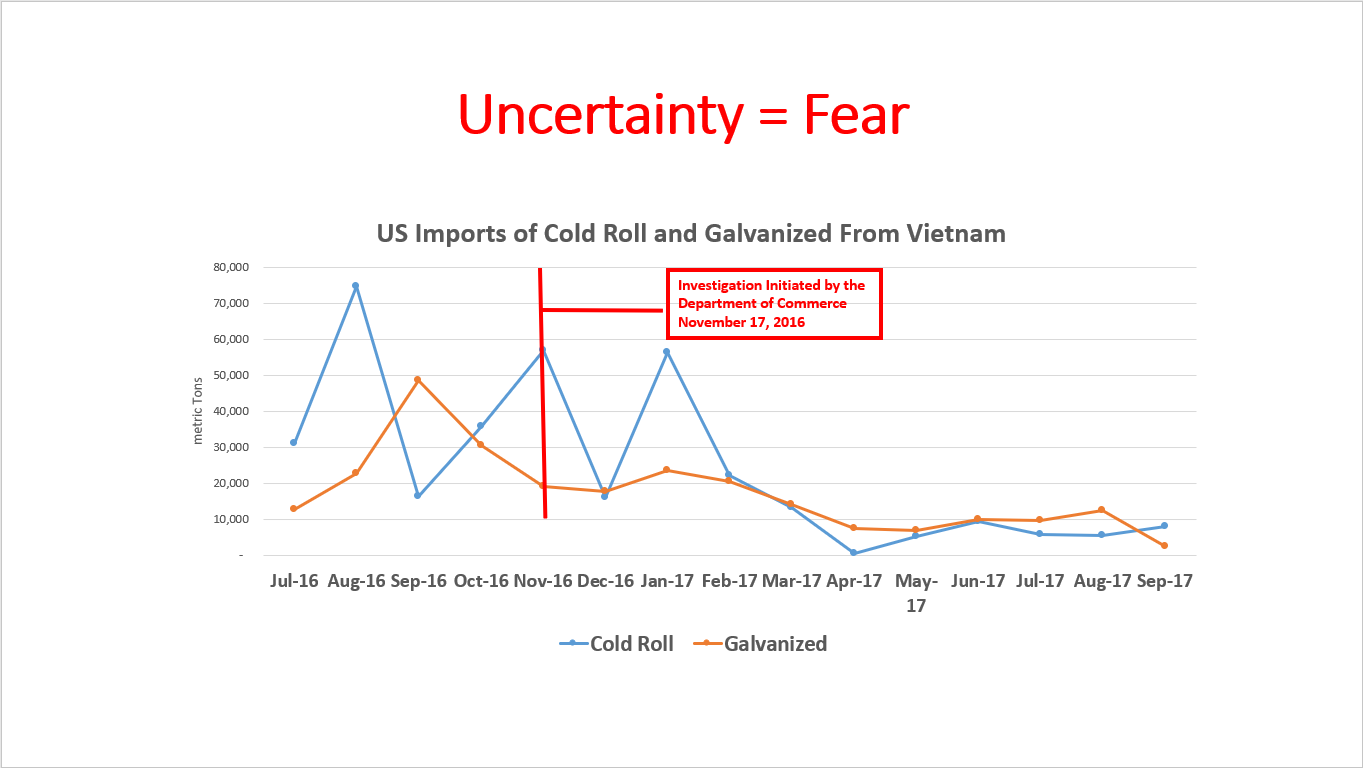

(Chart above, courtesy of AIIS, shows imports from Vietnam began dropping off soon after the circumvention case was filed.)

The Vietnam circumvention cases were initiated in November 2016. Domestic steel companies argue that China has used Vietnam to circumvent U.S. duties and that the Vietnamese products are made from Chinese substrate. The industry is watching the case closely as it may set a precedent on what constitutes “substantial transformation.” If Commerce finds that the cold rolling and coating processes performed in Vietnam do not effectively change the products’ country of origin, they could be subject to the same high antidumping and countervailing duty margins as Chinese steel.

The steel industry has also been disappointed by the Trump administration’s inaction on Section 232, which would restrict steel imports because their impact on the domestic steel industry poses a threat to national security. Comments early in the year by President Trump signaled to the market that “a very good” decision could be expected by June. In apparent response to a backlash from the steel-consuming sectors, the Commerce Department has delayed its report to the president indefinitely. By law, the DoC’s findings must be on the president’s desk by mid-January. In the meantime, the market is left in a cruel state of uncertainty, to the benefit of some and the detriment of others.

“I have never experienced an attempt like this to perpetuate market uncertainty,” said Washington trade attorney Lewis Leibowitz. “To be fair, Commerce has not, so far, extended the final determination in the Vietnam case now scheduled for mid-February. If they extend that date, the perpetual uncertainty will be a real threat.”

Which begs the question, are the delays intentional and calculated or just the result of bureaucracy? “Commerce may be uncertain as to how to end this circumvention case, so they are keeping everyone in limbo, including U.S. importers, while they figure it out,” Leibowitz said. The final determination could cover imports dating back to the date of initiation last year. “This is manifestly unfair to U.S. importers, who would be liable for potentially ruinous cash deposits for entries since Nov. 7, 2016. The legal authority for Commerce to keep everyone in suspense like this is not only dubious, but extremely unfair. Imagine the mayhem if a similar device were employed in dozens of other cases.”

Analyst John Anton of IHS Markit speculates that the delays may be calculated to benefit domestic steelmakers, and to give them more time to make the case that they’ve been harmed by imports. “In general, uncertainty strongly favors sellers. As long as sellers can make a plausible case that protection may be imposed, buyers must build in some level of risk premium. The fear of protection, and especially critical circumstances, is what keeps U.S. prices 10 to 40 percent above other nations.”

Anton is among those who view the Section 232 case as much ado about nothing at this point. “I think most buyers are discounting 232. They see it as I do, that it is a risk, but the most likely scenario is little or no protection. Thus, they feel they overpaid during the summer when they stocked up before 232. They aren’t asking for a crash, but don’t feel inclined to keep paying a premium.”

“I believe the steel community has now realized that a big bang from this administration is unlikely and has moved on,” added another industry consultant. “My sense is that the steel producers are over it, meaning they no longer expect the kind of support the administration promised, and are back in the mode of addressing trade issues using the traditional system.”

He shared a recent comment from another steel executive that echoes the sentiment of many in the market: “We never asked for 232. It would have been nice had the president and his administration followed through, but we didn’t spend a lot of time and money lobbying for it. We’re back to business as usual.”

Former ITC Chairman Daniel Pearson points out that the delays by regulators are actually hurting those the trade cases are meant to help. “The hiatus in the Section 232 process likely will continue to attract imports until a decision is forthcoming. Although they likely don’t see it this way, it may be in the best interest of the domestic steel mills to ask that the 232 investigation be withdrawn so the uncertainty goes away quickly.”

Another factor to consider is the effect of AD/CVD measures on U.S. steel prices, Pearson said. “Every time a new AD/CVD order is implemented and leads to a relative increase in U.S. prices, traders have an incentive to look around the world for any source of supply from a country not already covered by a restriction. With the United States offering basically the highest prices in the world, any sane producer or trader should be doing everything possible to bring steel legally into this country. That’s a tough and ironic dynamic for U.S. steel producers. Their past policy choices intended to limit imports have created a strong inducement to bring product into this country.”