Prices

October 31, 2017

SMU Analysis: Commodities Prices Mixed

Written by Peter Wright

Commodities prices are a mixed bag. The price of iron ore is falling, but zinc is at a 10-year high. In this report, we examine the latest prices for iron ore, scrap, coking coal and zinc.

On Oct. 25, commodities analyst Andrew Hecht wrote: “President Xi is likely to consolidate his power and take greater control of the Chinese nation, but the path will continue to be slow and steady when it comes to economic growth. The rallies in many industrial commodities based on optimism about the Party Congress could eventually turn to disappointment as China is never in a hurry, and in the great race to the top they are the tortoise rather than the hare. I expect industrial commodities prices to follow the path of the U.S. dollar over the coming months, and it is possible that recent rallies could turn into corrections for the balance of 2017. However, I expect higher lows as the demand side of the equation for raw materials continues to grow and an ever-increasing world population will compete for finite commodities. While raw materials prices rallied on optimism surrounding Chinese growth, the rate and slow pace of initiatives that have worked for decades may not be enough to support price acceleration from current levels in many of the raw material markets over the coming weeks and perhaps months. I am cautiously bullish on commodities prices, but for the rest of the year the path of least resistance for the U.S. dollar is likely to be the chief determinate of price direction for the raw materials asset class.”

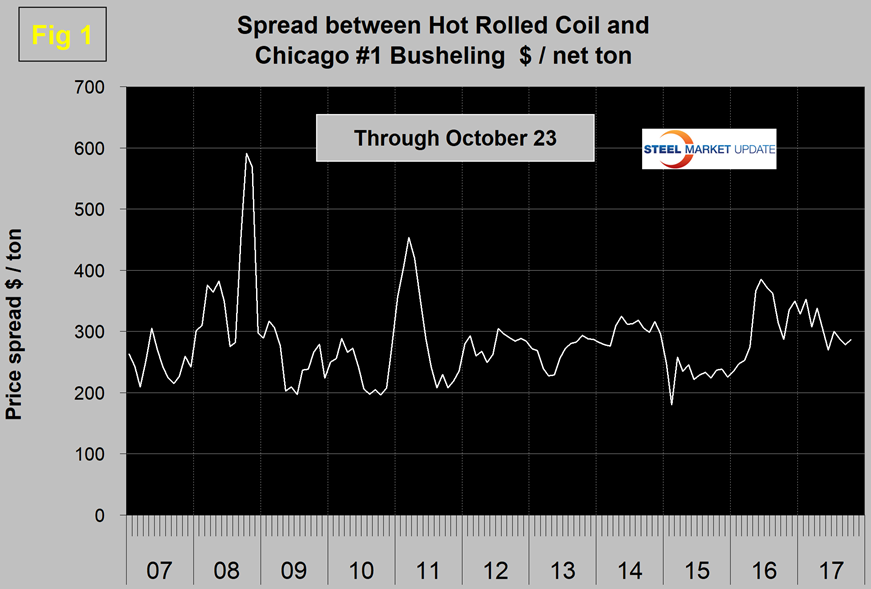

To put the raw materials analysis into perspective, we begin with Figure 1, which shows the spread between Chicago #1 busheling and hot rolled coil ex works Indiana through Oct. 23, both in dollars per net ton. On this date, Chicago busheling was priced at $305.80/net ton ($342.50/gross ton) and HRC ex works Indiana was $592.25/net ton for a spread of $286.45/net ton. The spread reached a recent high of $385.46 in June last year.

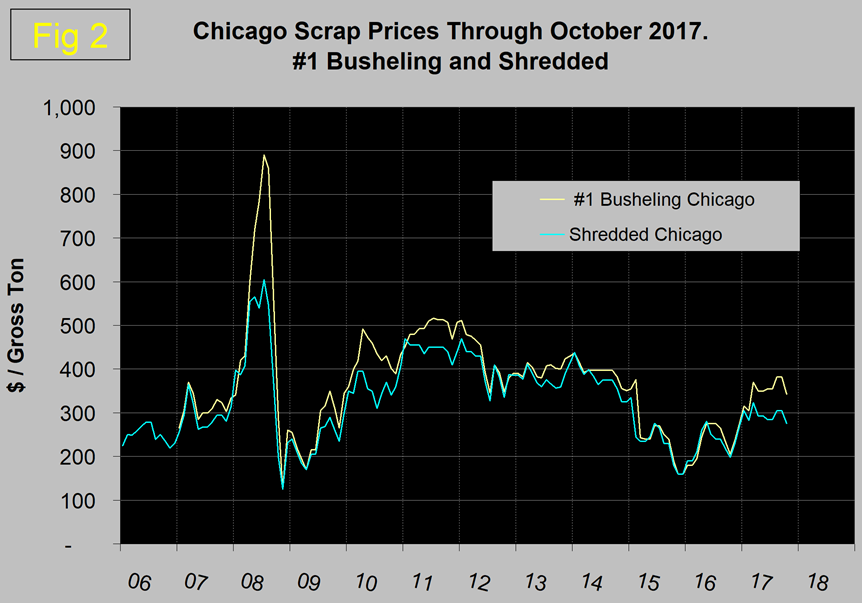

Scrap: Figure 2 shows the relationship between shredded and #1 busheling both priced in Chicago. In October, both grades declined in price. Shredded was down from $305 to $275/gross ton and busheling was down from $382.50 to $342.50. The busheling premium was $67.50, down from $77.50 in September, which was the highest premium since February 2015.

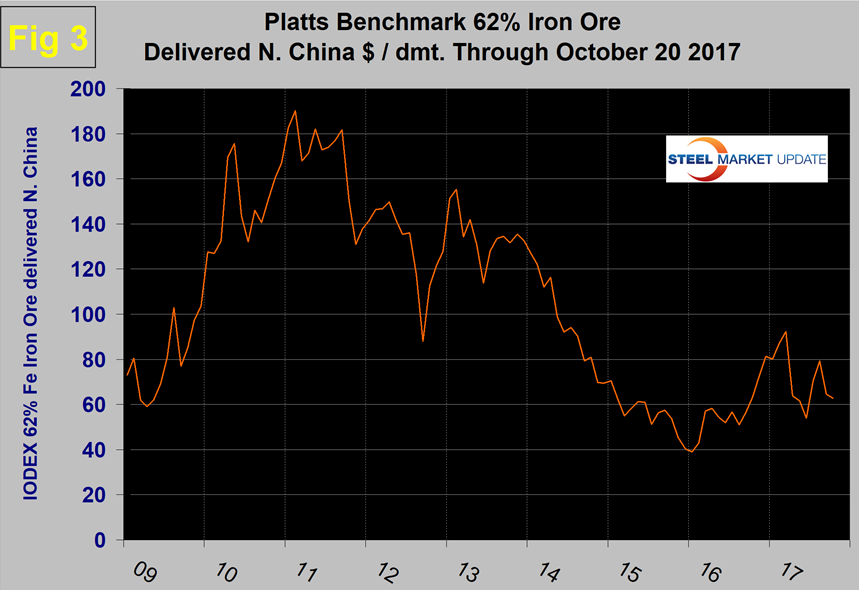

Iron ore: Figure 3 shows the Platts IODEX of 62 percent Fe delivered North China since January 2009. The Index recovered to $92.30 on March 17, but has since declined to $62.75 on Oct. 20. There is a long- term relationship between the prices of iron ore and scrap.

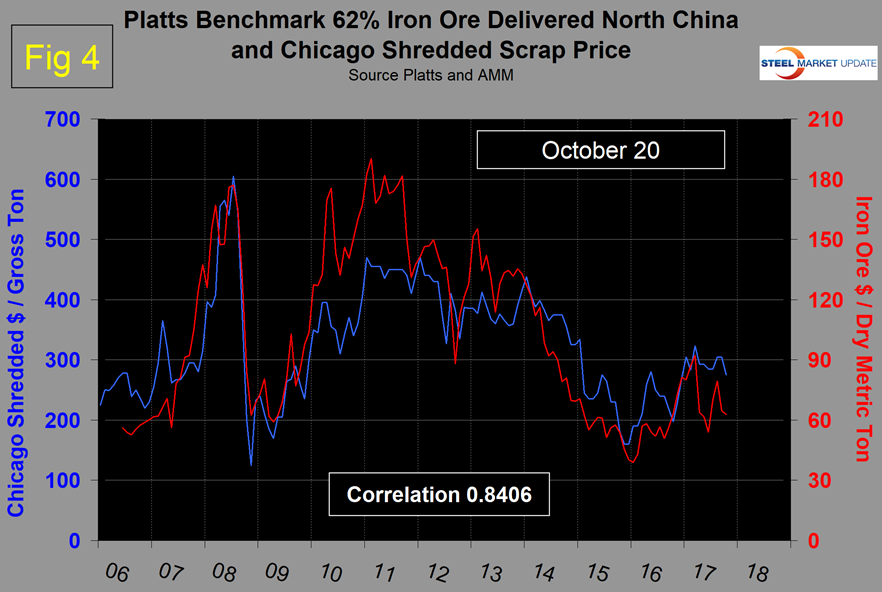

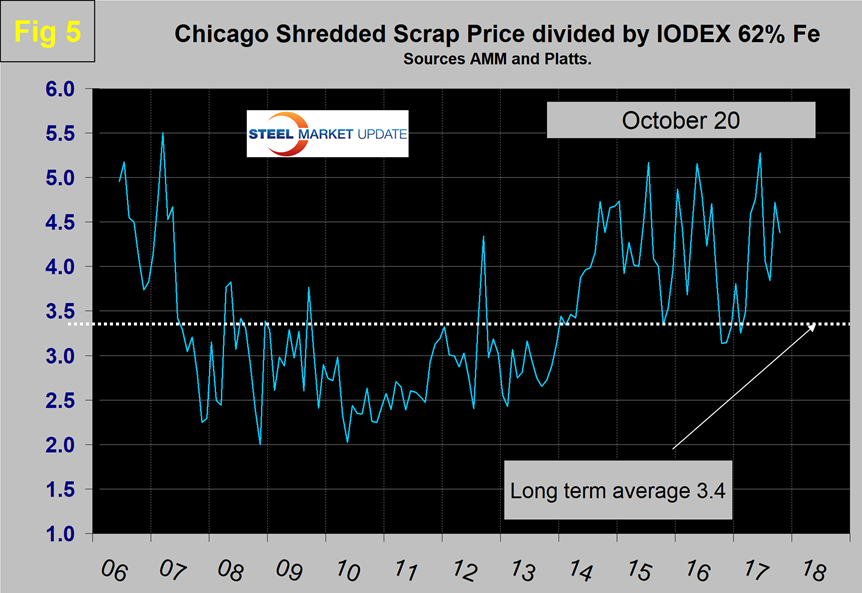

Figure 4 shows the IODEX and the price of Chicago shredded through Oct. 20. The correlation since January 2006 has been 84.06 percent; and in the last 10 years on average, scrap in $/gross ton has been 3.4x as expensive as ore in $/dmt.

The ratio has been erratic since mid-2014, but overall since then has benefited the integrated producers. There was a six-month respite for the EAF operators in Q4 2016 and Q1 2017, but now the ratio is once again high with a value of 4.38 on Oct. 20. The June ratio of 5.28 was the highest in over 10 years (Figure 5).

Since Chinese steel manufacture is 93 percent BOF, this ratio has allowed them to be more competitive on the global steel trade market. In addition, in the last four years, there have been times when China could supply semi-finished to the global market at prices competitive with scrap.

On Oct. 28, Platts reported that capsize freight rates hit a three-year high in October with overcapacity dissipating. Western Australia to China capsize iron ore freight rates are now over $20,000 per day, up from just over $4,000 per day at the end of June.

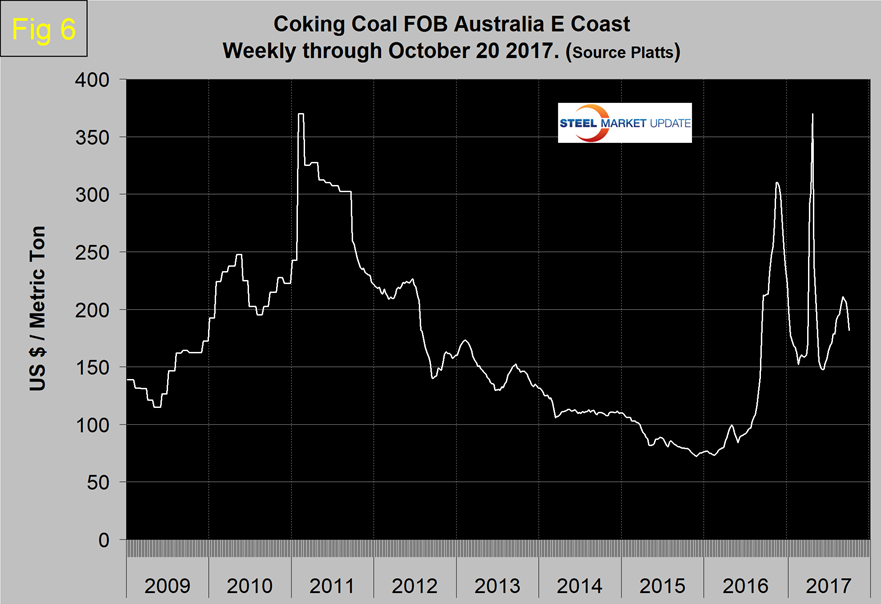

Coking coal: On Oct. 20, Platts reported that premium low volatile coking coal was down $1.00 per metric ton on the week to $181.5 FOB Australia. The Asia pacific spot metallurgical coal market softened amid low international market demand and China’s absence (Figure 6).

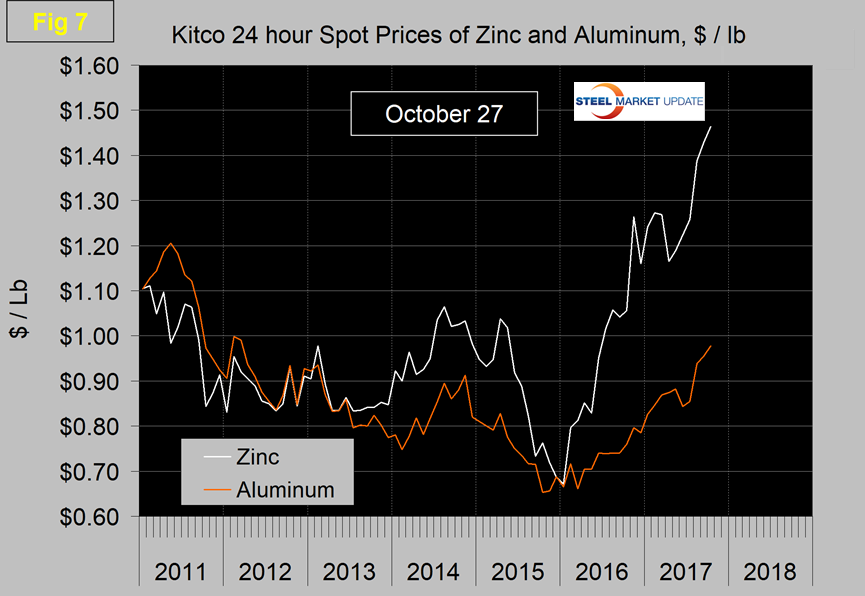

Zinc: The major use of zinc is for galvanizing. Other significant uses include the alloying of brass and bronze and in zinc-based alloys used in the die-casting industry. Kitco publishes a daily spot price of zinc, which we have transcribed to Figure 7. Just as a point of reference, we have included aluminum in the same graph. The price of zinc soared to $1.4635/lb. on Oct. 27.

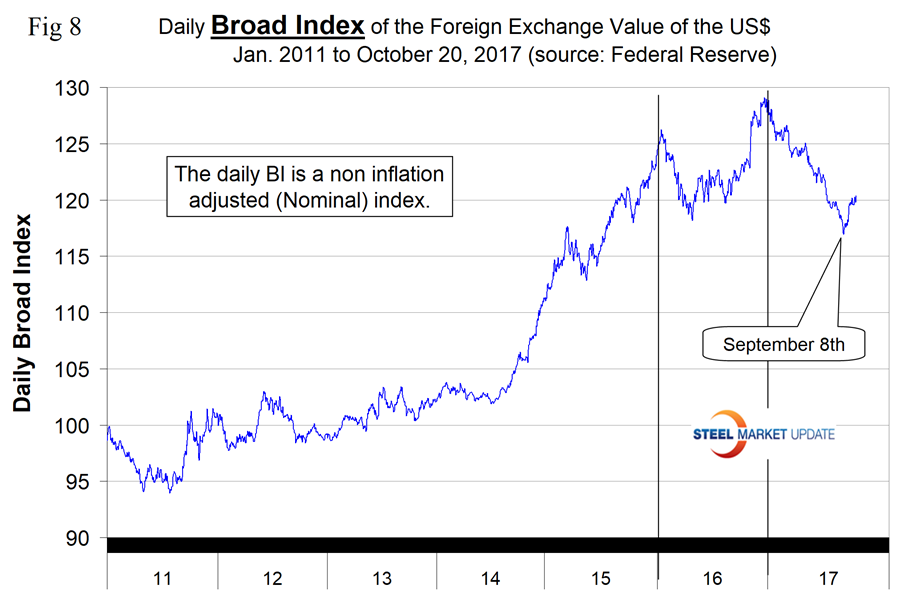

SMU Comment: There is an inverse relationship between commodity prices and the value of the U.S. dollar on the global currency markets. As we reported in our recent currency update, the value of the dollar declined by 9.3 percent between Jan. 3 and Sept. 8 this year, but then turned around and appreciated by 2.9 percent between Sept. 8 and Oct. 20 (Figure 8).

A weakening dollar puts upward pressure on the price of those global commodities that are priced in dollars. If the present strengthening trend continues, the reverse will be the case.