Prices

October 31, 2017

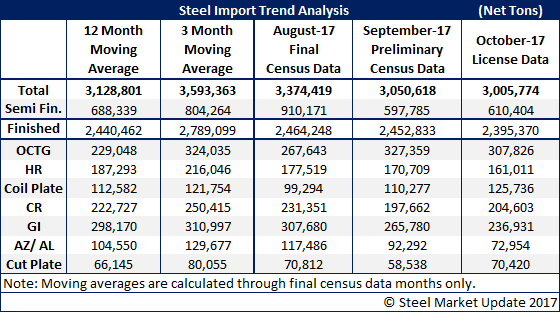

Finished Steel Imports Expected to be 2.4 Million Tons for October

Written by John Packard

Today the U.S. Department of Commerce released foreign steel import license data for the month of October. Based on the license data imports for October will be approximately three million net tons. This is essentially unchanged from the 3,050,618 net tons reported as Preliminary Census Data for September.

As you can see by the table below, finished imports (which eliminate semi-finished imports, most of which are slabs going to the domestic steel mills) are flattening out around 2.4 million net tons per month.

The three-month moving average referenced is for the last three months where Final Census Data has been reported (June, July, August).

A note for those who are not familiar with the DOC steel import monitor. The first step in the process is to gather foreign steel import licenses. Licenses will provide a guide as to what to expect for the month but, because the government allows some flexibility in the system (license could be for prior month or next month) the data should not be taken as the final word for a month. The DOC collects the data in metric tons. For the sake of our readers we display the data in net tons (2,000 pounds to 1 net ton).

As time progresses the DOC then provides Preliminary Census Data based on actual receipts. This has already been done for the month of September. There can still be adjustments and once those are made the DOC produces Final Census Data with the final numbers.