Market Segment

October 31, 2017

AK Steel Earnings Disappoint in Q3

Written by Sandy Williams

AK Steel reported a net loss of $5.8 million in the third quarter compared to net income of $50.9 million in Q3 2016. Results were impacted by $13.1 million in acquisition and debt refinancing costs and a LIFO charge of $49.0 million, compared to a LIFO credit of $24.2 million in the prior-year third quarter.

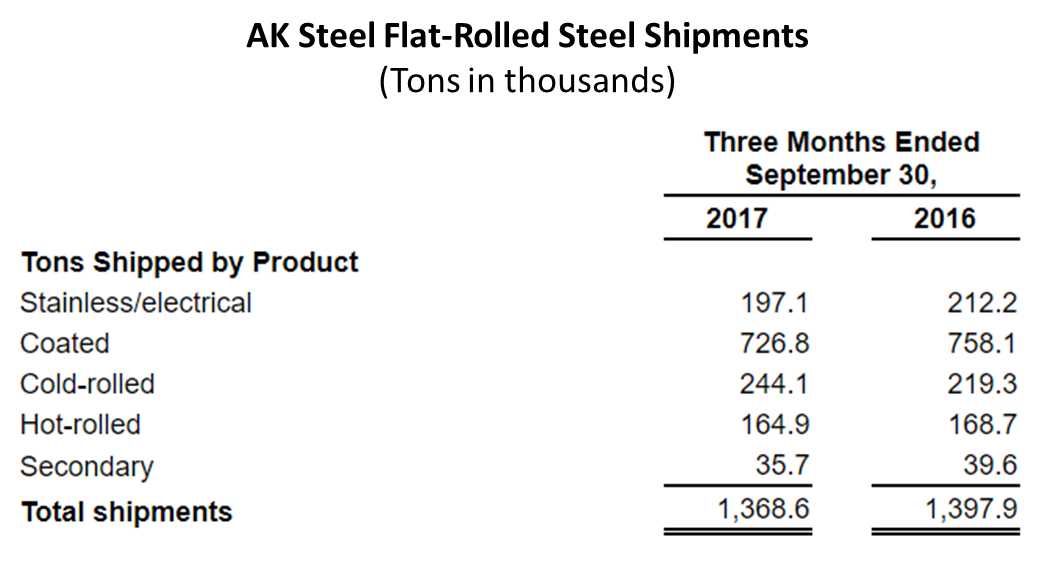

Net sales were up 3.0 percent year-over-year to $1.49 billion. Flat-rolled steel shipments declined 2.0 percent to 1,368,600 tons as a result of softer automotive demand.

Average selling price per flat-rolled steel ton increased 2 percent to $1,021 from $1,001 year-over-year due primarily to higher average selling prices on contract and spot market sales and higher surcharges on specialty steels.

AK Steel will seek higher prices in contract renewals to recover higher costs for raw materials. Price increases for graphite electrodes, zinc and chrome are currently being addressed with surcharges.

Planned maintenance outages were completed at Mansfield and Middletown totaling $8.5 million for the quarter. Work on the electrogalvanizing line at Middletown began last week and will be completed in the fourth quarter. Fourth-quarter outage will total around $50 million. No major outages are currently planned for next year.

AK Steel completed the acquisition of metalformer Precision Partners in the third quarter and has 20 new joint products under way. The acquisition of PP has enabled AK Steel to provide fully formed prototype parts to customers to show the advantages of light weight high-strength steel products.

CEO Roger Newport is disappointed with the progress of the Section 232 case. The delay has contributed to a surge of electrical steel imports, he said. Imports of the electrical steel products are up 260 percent and not in line with domestic demand. Carbon steel imports are about 27 to 28 percent of the flat rolled market, up from what is traditionally 18 to 23 percent.

Service center inventories are relatively low at 3.2 months for carbon products, but should increase as spot prices gain momentum. AK Steel doesn’t view inventory as abnormally low, but rather following the ups and downs of pricing in the market. Service centers are paying more attention to working capital and speculating less, said AK Steel.

Residential and commercial construction is experiencing slow and steady growth. Rebuilding following the dual hurricanes should help electrical steel sales as repairs of the electrical grid continue.

The automotive market softened in 2016 and a 3.0 percent decline is expected for 2018 in light-vehicle build rates. The increase in auto purchases after the hurricanes helped stem production cuts and inventory reductions at automakers rather than spurring new production.

Flat-rolled market prices are in a fairly tight band with some recent softening due to seasonality, but AK Steel expects recent prices increases to help support prices.

Although minimills are making inroads into the automotive market, AK Steel’s niche products help differentiate them from others, allowing the company to shine, said Newport.

The NAFTA negotiations are not causing AK Steel any major concern. About 10 percent of company sales go overseas and to Canada and Mexico, so NAFTA sales are in the single digits.