Market Data

October 27, 2017

SMU Currency Analysis: Dollar Sees Turnaround

Written by Peter Wright

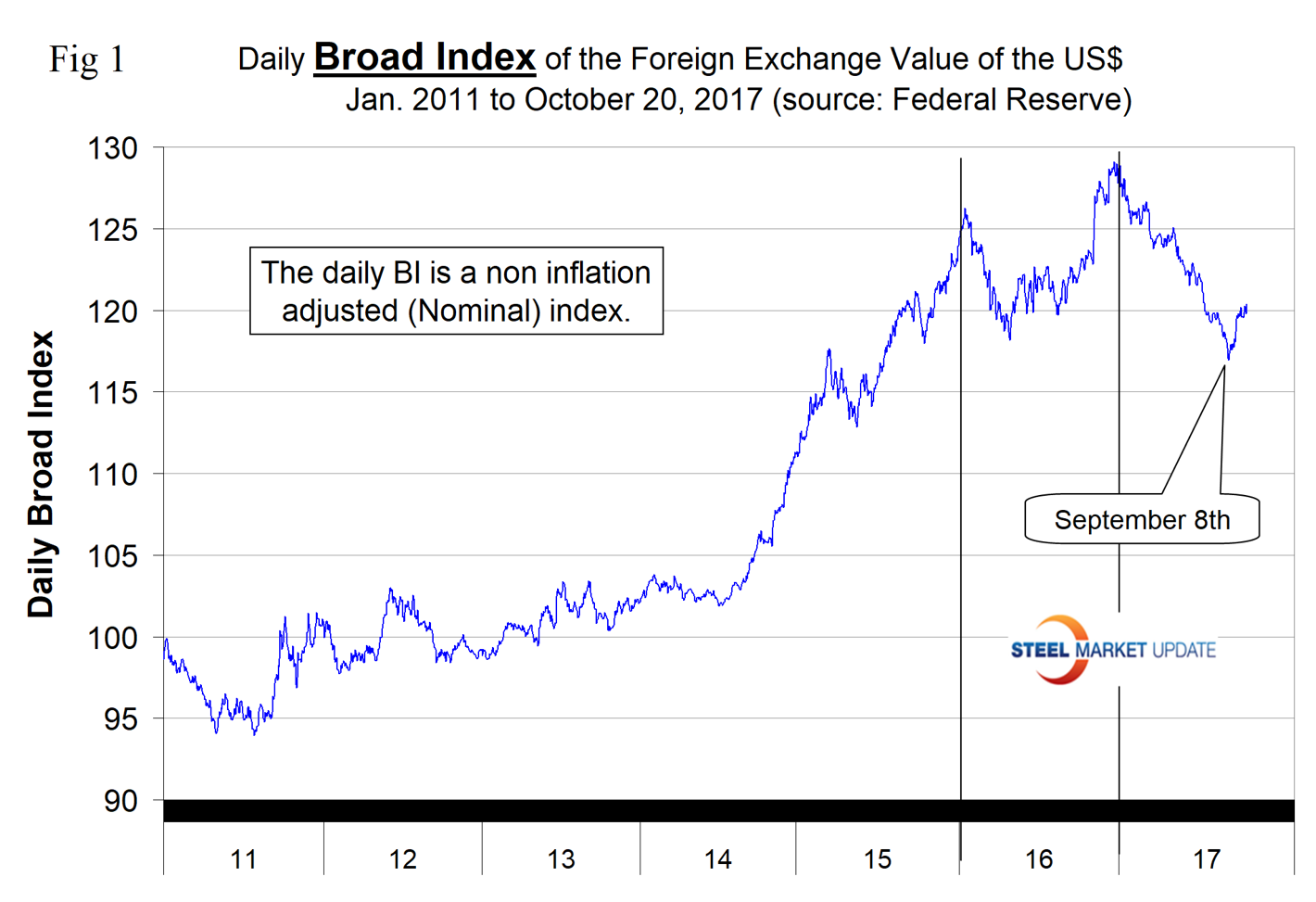

The value of the U.S. dollar has seen a turnaround that began on Sept. 8. From Jan. 3 through Sept. 8, the Broad Index value of the U.S. dollar depreciated by 9.3 percent. But the value rebounded by 2.9 percent from Sept. 8 through Oct. 20. (Please see the end of this report for an explanation of data sources.)

The analysis of currency trends is a highly technical undertaking; therefore, in this monthly SMU update, we incorporate the opinions of analysts we deem credible to add color to our own data analysis.

The Broad Index value of the U.S. dollar is reported several days in arrears by the Federal Reserve, the latest value published was for Oct. 20. Figure 1 shows the index value since January 2011.

The dollar had a recent peak of 128.96 on Jan. 3, which was the highest value since July 4, 2004, almost 15 years. The recent low point was Sept. 8 at 116.95. Since then, the dollar has recovered to 120.38 on Oct. 20. The dollar broke through 119.0 on Sept. 26 and therefore, in the latest month of data, was stable.

On Oct. 24, Mark Chandler, a global capital markets analyst wrote: “The U.S. dollar is narrowly mixed in mostly uneventful turnover in the foreign exchange market. There is a palpable sense of anticipation. Anticipation for the ECB meeting on Thursday, which is expected to see a six or nine-month extension of asset purchases at a pace half of the current $60 billion a month. Anticipation of the new Fed Chair, who President Trump says will be announced: ‘very, very soon.’ The 10-year U.S. yield is sitting just below the 2.40 percent level, which marks the upper end of the six-month trading range. It has finished the North American session once above there since the end of Q1. This has helped put a floor under the dollar against the yen. When the yield faltered at the cap yesterday, the dollar pulled back to JPY113.25 and recovered in the afternoon session in Tokyo and through the European morning to return to the JPY113.75 area. There is nearly a $1 billion option struck at JPY113.50 that expires today and a nearly $720 million strike at JPY114.00 that will be cut.”

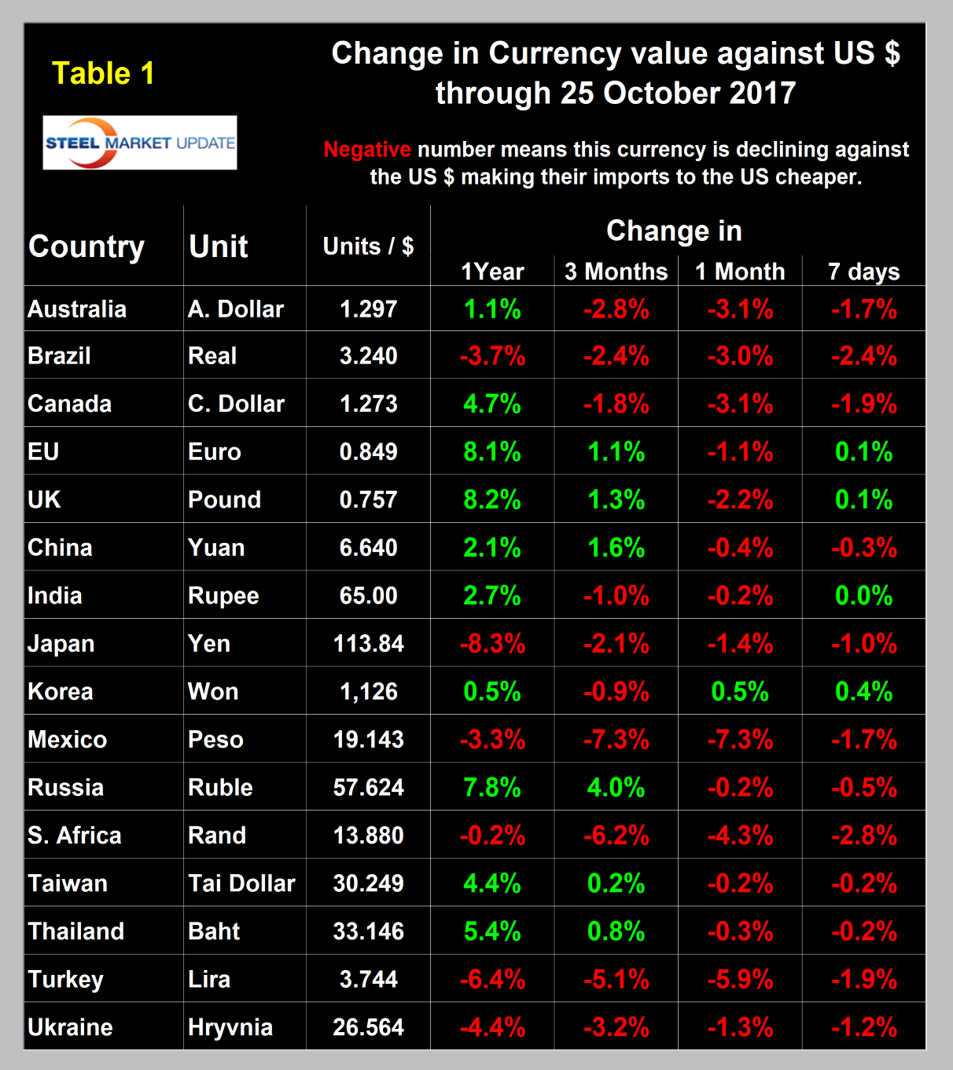

Each month, SMU publishes an update of Table 1, which shows the value of the U.S. dollar against the currencies of 16 major global steel and iron ore trading nations. The table shows the change in value in one year, three months, one month and seven days. Table 1 is color coded to indicate strengthening of the dollar in red and weakening in green. We regard strengthening of the U.S. dollar as negative and weakening as positive because of the effect on the trade balance of all commodities and also on the total national trade deficit. A rising dollar puts downward pressure on all commodity prices that are greenback denominated.

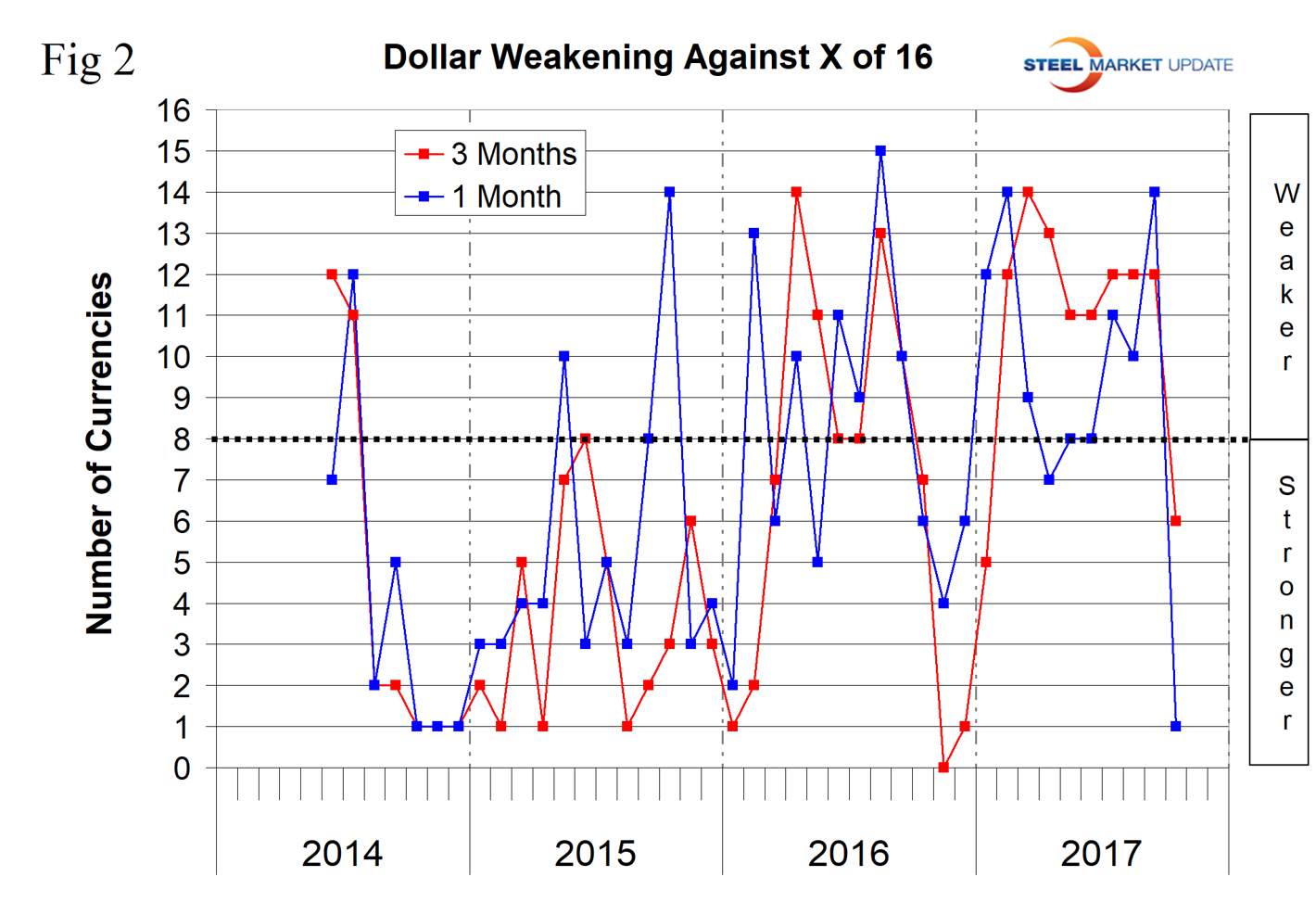

Sometimes the change in value of these 16 currencies does not accord with the broad index and this is one of those times. Figure 2 gives a long-range perspective and shows the extreme gyrations that have occurred in the last three years. Figure 2 shows that the dollar strengthened against 15 of the 16 currencies in the last month. The Korean won was the only exception and that presumably was for political reasons.

In each of these reports, we comment on several of the 16 steel and iron ore trading currencies listed in Table 1 and over a period of several months will describe the history of all of them. Charts for each of the 16 currencies are available through Oct. 15 for any premium subscriber who requests them.

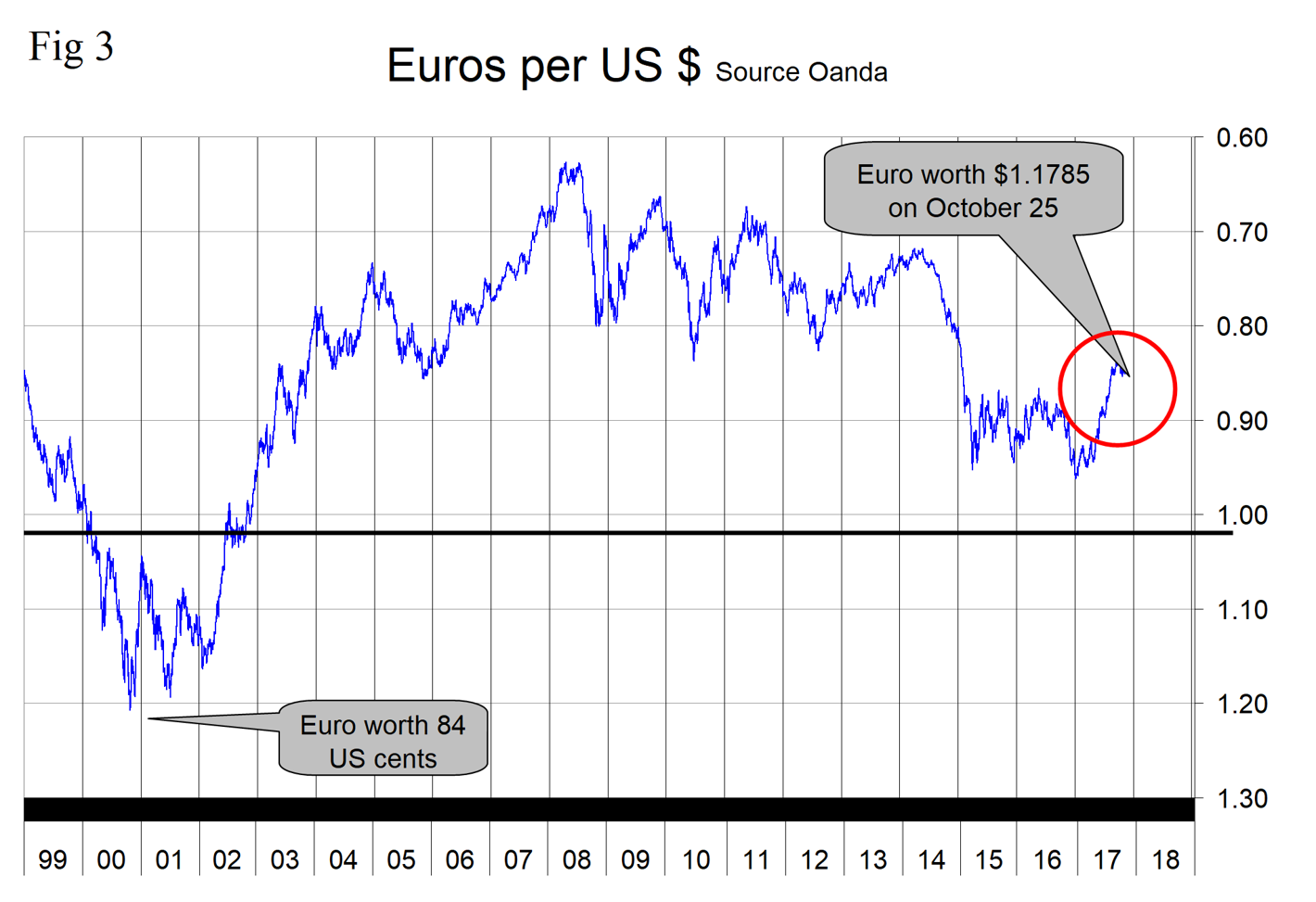

The Euro: On Oct. 25, the euro was worth 1.1785 U.S. dollars. In the last month, the euro declined by 1.1 percent against the dollar (Figure 3).

Also on Oct. 25, commodities analyst Andrew Hecht wrote: “It will not be long before the European Central Bank moves from accommodation to tightening based on recent moderate growth data in Europe. The ECB has nowhere to go but higher when it comes to short-term rates that currently stand at negative 40 basis points. Quantitative easing will likely end in late 2017 or early 2018, and when the ECB begins tapering the program, it is likely that the euro will continue on its current path higher, which began at lows in December 2016. When the U.S. central bank announced that tapering would commence, and interest rates would rise in 2014, the dollar rallied by 27 percent in 10 months. While the euro currency may take longer, it already has a jump start.”

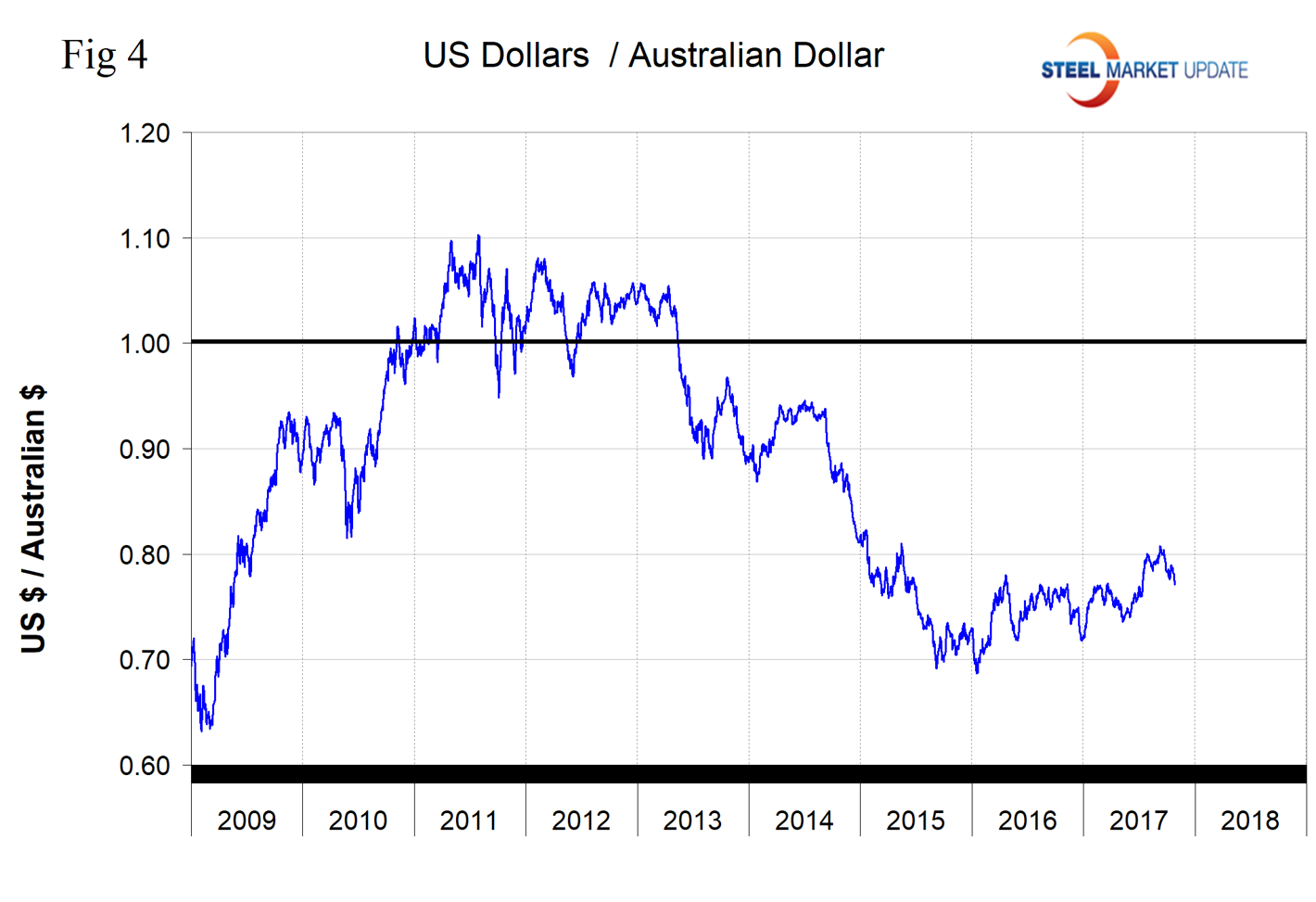

The Australian Dollar: Figure 4 shows the value of the Australian dollar since January 2009. The Ausie has weakened by 3.1 percent against the dollar in the last month after appreciating by 12.5 percent between Dec. 26 last year and Sept. 8 this year.

On Oct. 15, Economy.com reported: “The Reserve Bank of Australia noted in its October monetary policy statement that a higher exchange rate is weighing on the outlook for continued improvement in output and employment. The Australian dollar has appreciated 8.8 percent year to date against the greenback, from around U.S. $0.72 to U.S. $0.78.” Evidently the RBofA is getting its wish.

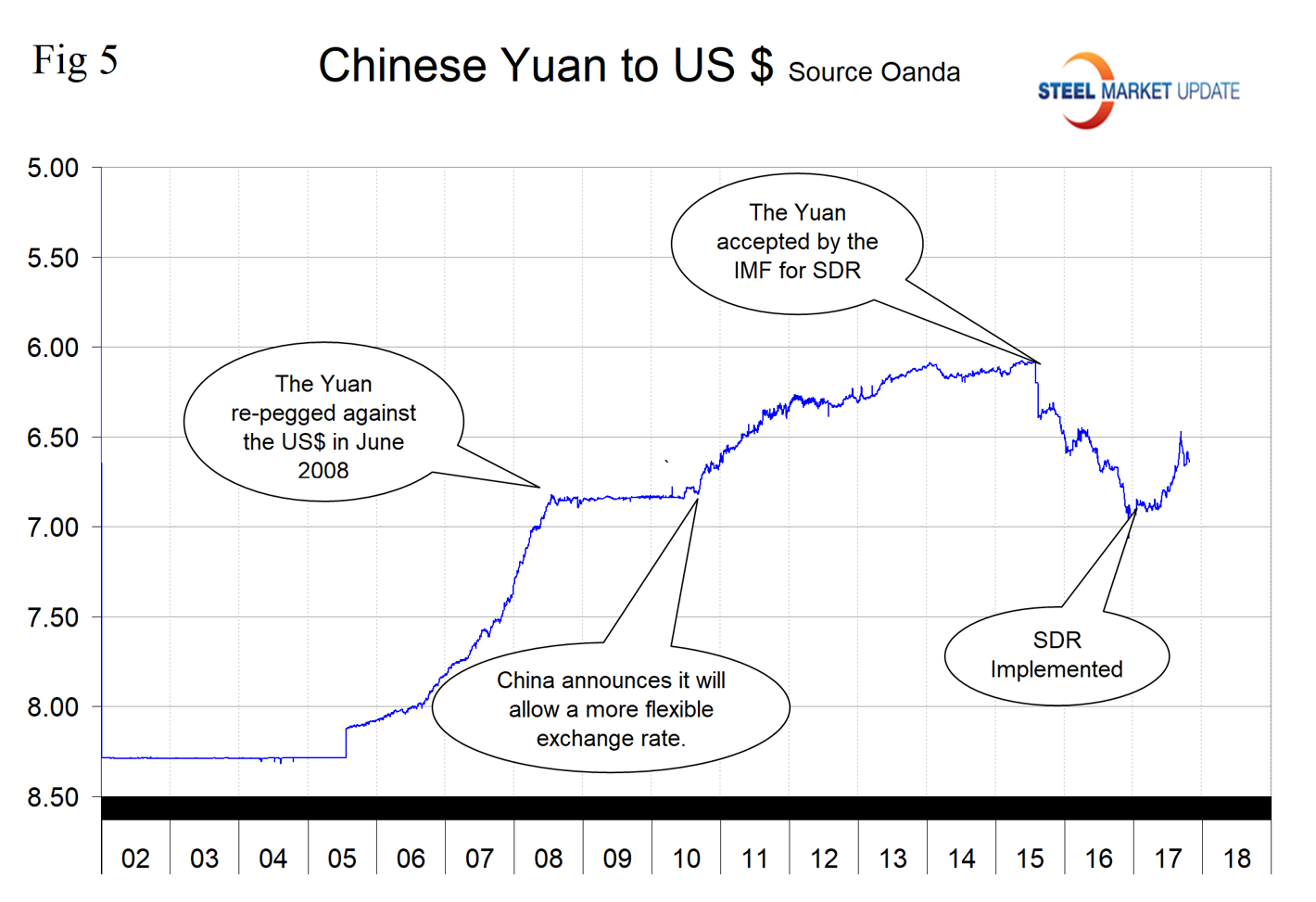

Chinese Yuan: The Chinese yuan weakened by 0.4 percent in the last month, but is down by 2.1 percent in 12 months (Figure 5). The dollar was worth 6.640 yuan on Oct. 25.

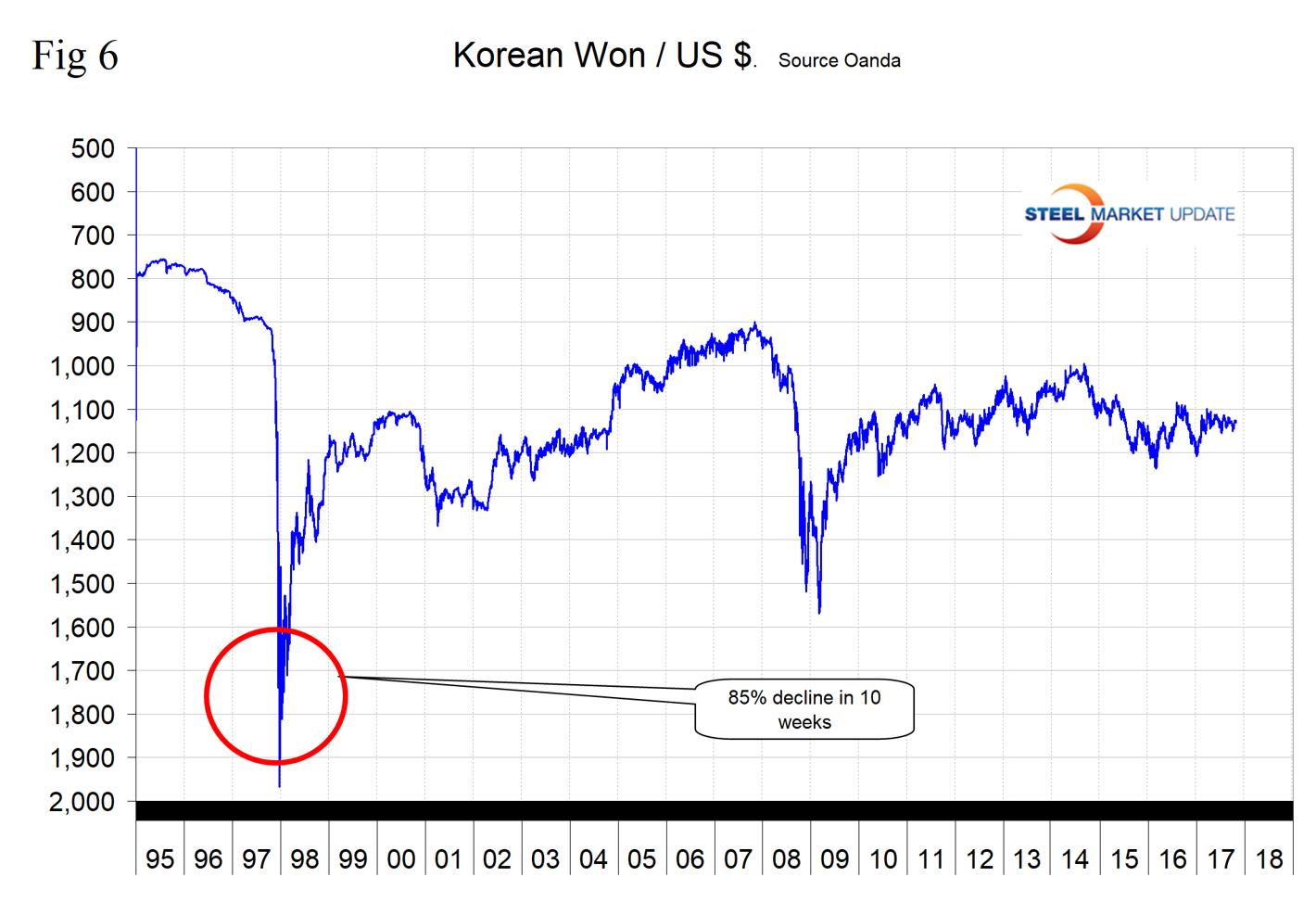

Korean Won: The Korean won appreciated by 0.5 percent in the last month and on Oct. 25 the dollar was worth 1,126.4 won. Compared to most other currencies, the won has been relatively stable for the last eight years (Figure 6). In 12 months through September, Korea was the third highest volume importer of steel products to the U.S. after Canada and Brazil. The volumes were Canada 5,539,000 tons, Brazil 4,476,000 tons and Korea 3,440,000 tons.

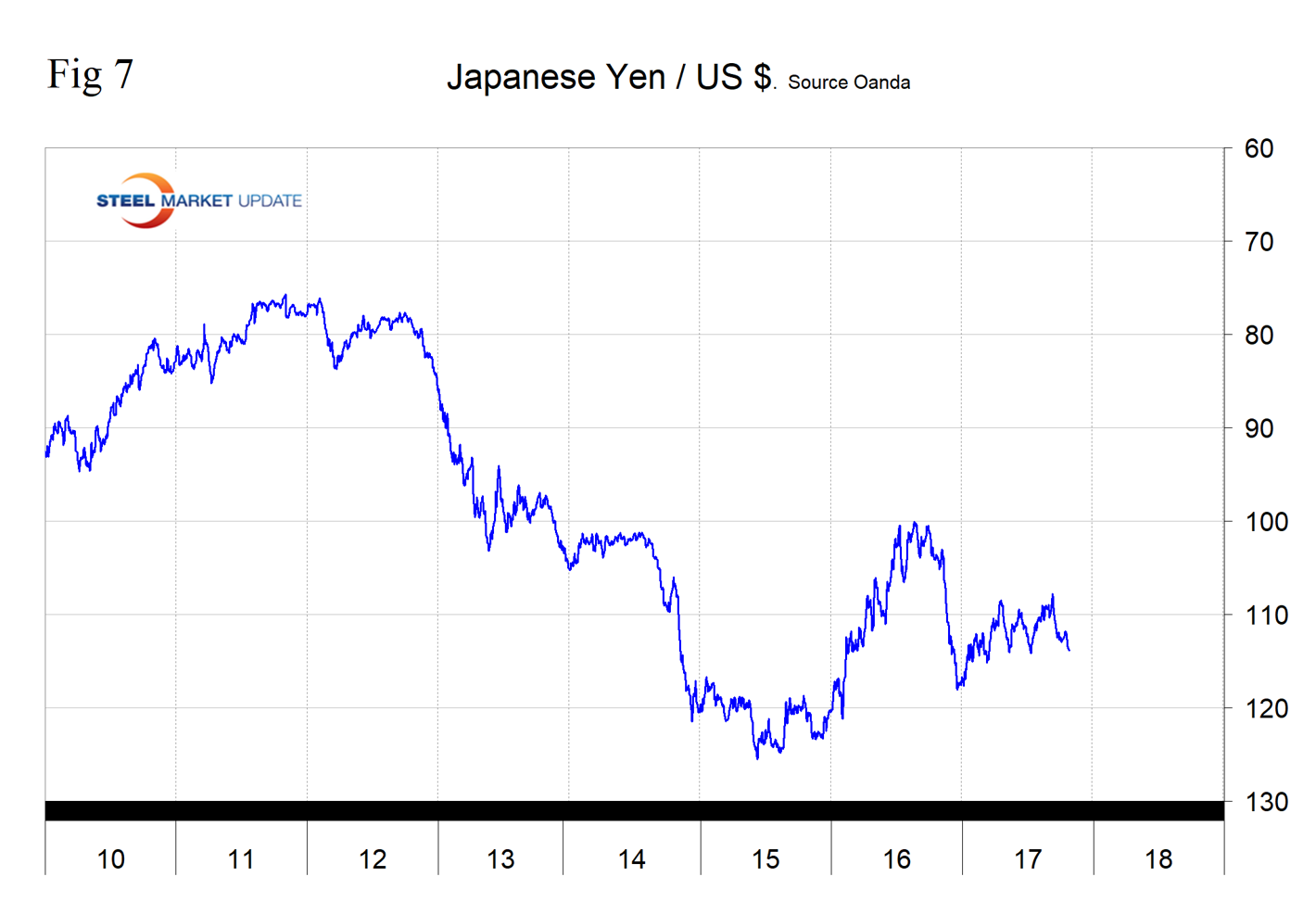

Japanese Yen: The Japanese yen has weakened by 1.4 percent in the last month, and on Oct. 25 the dollar was worth 113.84 yen. Abe’s Liberal Democratic Party won big as expected and retained a two-thirds majority in last week’s general election. Abe’s win makes the continuation of ultra-easy monetary policy significantly more likely.

On Oct. 26, currency analyst Dean Popplewell wrote: “With U.S. tax reform getting more priced into the risk equation, a significant near-term move towards 115 yen/U.S. dollar will need some help from a hawkish shift at the Fed helm.” Figure 7 shows the number of yen it took to buy one U.S. dollar in the period January 2010 through Oct. 25, 2017.

Explanation of Data Sources: The broad index is published by the Federal Reserve on both a daily and monthly basis. It is a weighted average of the foreign exchange values of the U.S. dollar against the currencies of a large group of major U.S. trading partners. The index weights, which change over time, are derived from U.S. export shares and from U.S. and foreign import shares. The data are noon buying rates in New York for cable transfers payable in the listed currencies. At SMU, we use the historical exchange rates published in the Oanda Forex trading platform to track the currency value of the U.S. dollar against that of 16 steel and iron ore trading nations. Oanda operates within the guidelines of six major regulatory authorities around the world and provides access to over 70 currency pairs. Approximately $4 trillion U.S. dollars are traded every day on foreign exchange markets.