Prices

October 24, 2017

Foreign Steel Flat Rolled Trending Lower

Written by John Packard

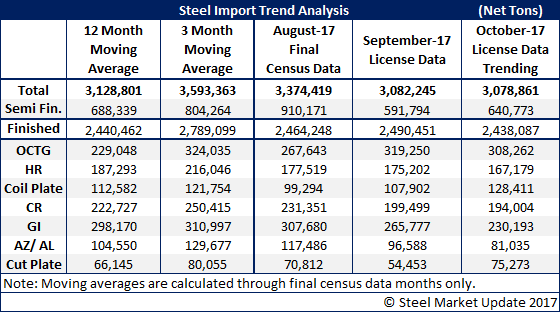

The trend for foreign steel imports into the United States continues to be right at 3 million net tons for the month of October.

The U.S. Department of Commerce (DOC) updated license data collected for the month of October through today, Oct. 24. We take the license data for the first 24 days of the month. We then convert it into a daily rate and expand it for the entire 31-day month. The results are shown in the table below.

Imports of most flat rolled products continue to slip compared to their 12-month and 3-month moving averages.

Hot rolled is now trending toward a 167,000-ton month, which if correct will be the lowest level seen since February 2017 when the U.S. imported 111,731 net tons.

Cold rolled imports are also trending lower, now expected to come in around 194,000 tons. This is lower than the 12-month moving average of 222,727 tons and 3-month moving average of 250,415 tons. The last time we saw CR imports at the trending level was December 2016 with 189,960 net tons.

Galvanized is also trending much lower than its 12-month and 3-month moving averages. Our expectation is for galvanized to end the month of October around 230,000 tons. The last time GI imports were 230,000 tons or less was January 2016 at 214,593 net tons.

Other metallic, most of which is Galvalume, is trending toward the 81,000-ton level, which is below both its 12-month and 3-month moving averages. The last time AZ was less than 81,000 tons was November 2016 at 78,532 net tons.

It will be interesting to see if the bloom is off the rose and flat rolled imports continue to shrink from here. If so, it could help to eventually strengthen domestic mill order books once inventories are worked down.