Market Data

October 3, 2017

Global Trade of Hot Rolled Coil Through Q2 2017

Written by Peter Wright

We are continuing our analysis to quantify the players in the global trade of both hot rolled coil (HRC) and cold rolled coil (CRC). We now have data for the second quarter of this year. This information is sourced quarterly from the Iron and Steel Statistics Bureau in the UK. It takes about 11 weeks after the close of a quarter before all the countries have submitted their information. However, even if rather late, we think the history does explain where we are now and shines a light on the relative position of the U.S. in the global picture.

This update covers the global trade of HRC through Q2 2017.

![]() Data was received from 45 exporting nations and 172 importing nations, not including those within the EU. For the purpose of this analysis, we consider the EU as a single trading block. Figure 1 shows the global total by quarter both including trade within the EU and excluding that volume. In Q2 2017, total global trade decreased sharply and all of this change was outside of the EU.

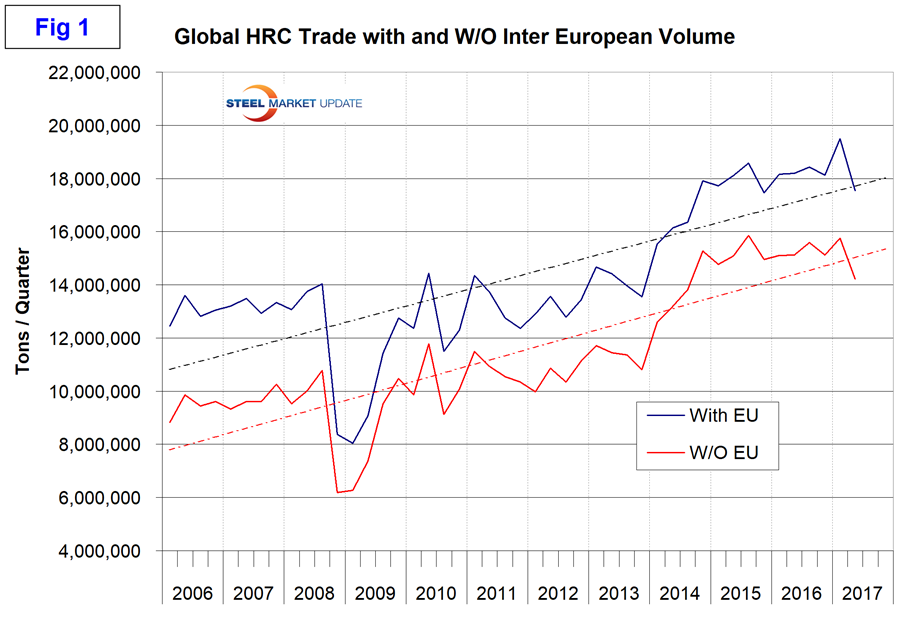

Data was received from 45 exporting nations and 172 importing nations, not including those within the EU. For the purpose of this analysis, we consider the EU as a single trading block. Figure 1 shows the global total by quarter both including trade within the EU and excluding that volume. In Q2 2017, total global trade decreased sharply and all of this change was outside of the EU.

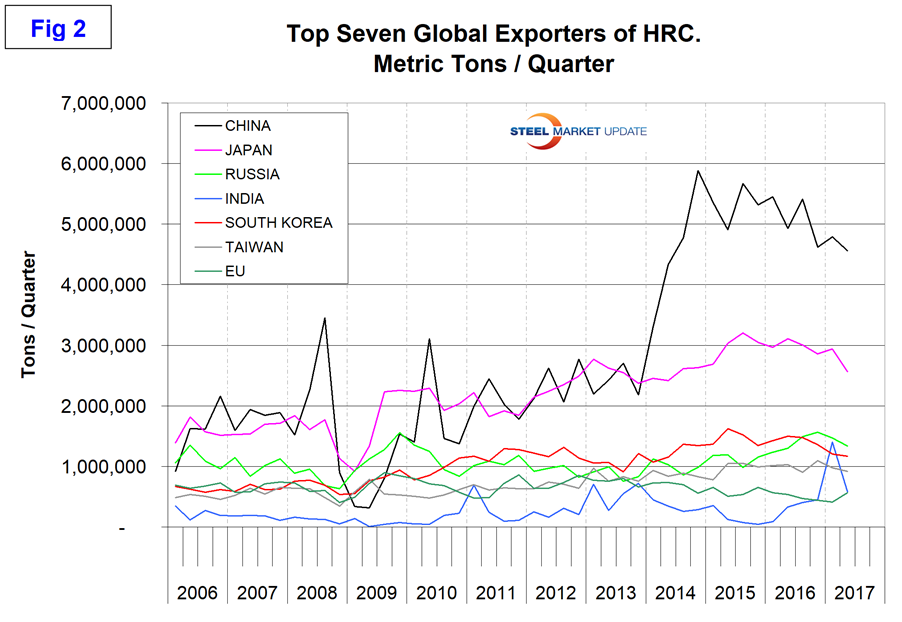

In 2016 as a whole, 60,780,000 metric tons of hot rolled coil were traded around the world not include trade within the EU. In the first half of 2017, the annual rate was 59,963,000 metric tons. The top six exporters in Q1 in order of volume were China, Japan, Russia, South Korea, Taiwan and India. The EU, Ukraine, Turkey and Brazil comprised the next group and all were less than half Taiwan’s volume. Figure 2 shows the relative size of China as an exporter and that their export volume has been declining since Q4 2014. It also shows that Japan is exporting well over half as much as China. The most significant change in Q2 2017 was that the surge in India’s volume that occurred in the first quarter was not maintained. China exported 20.4 million tonnes of HRC in 2016 and at an annual rate of 18.7 million metric tons in the first half of 2017. Their tonnage has been contracting since Q4 2014.

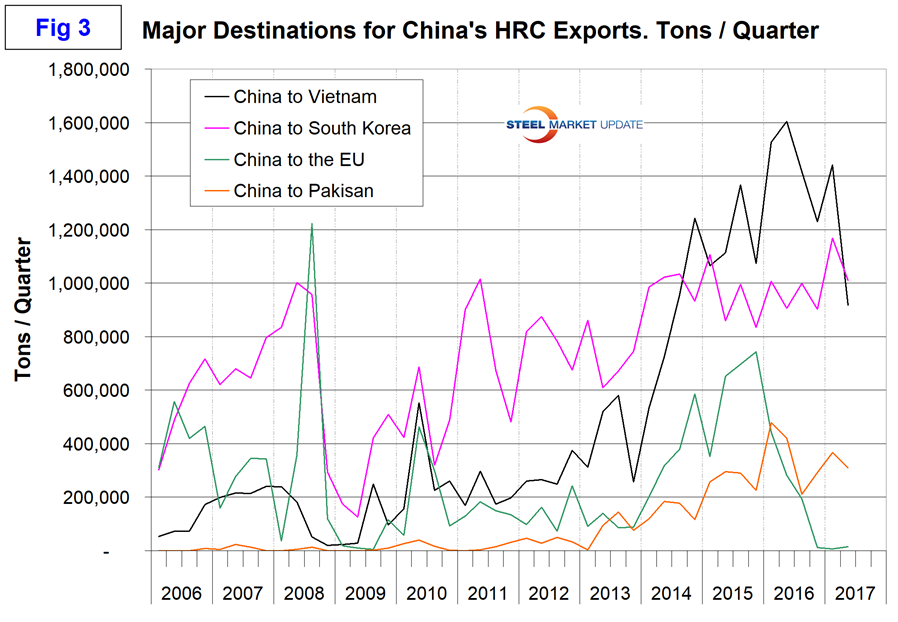

Figure 3shows the top three destinations for China’s HRC exports and includes the EU, which has been successful in shutting out China’s HRC imports since Q3 2016. The top three destinations are South Korea, Vietnam and Pakistan. One of the main points of this analysis is to identify trends such as this because as one nation successfully defends against another, the volume will pop up somewhere else. As we will see below, the defending nation doesn’t necessarily experience a decline in total import volume.

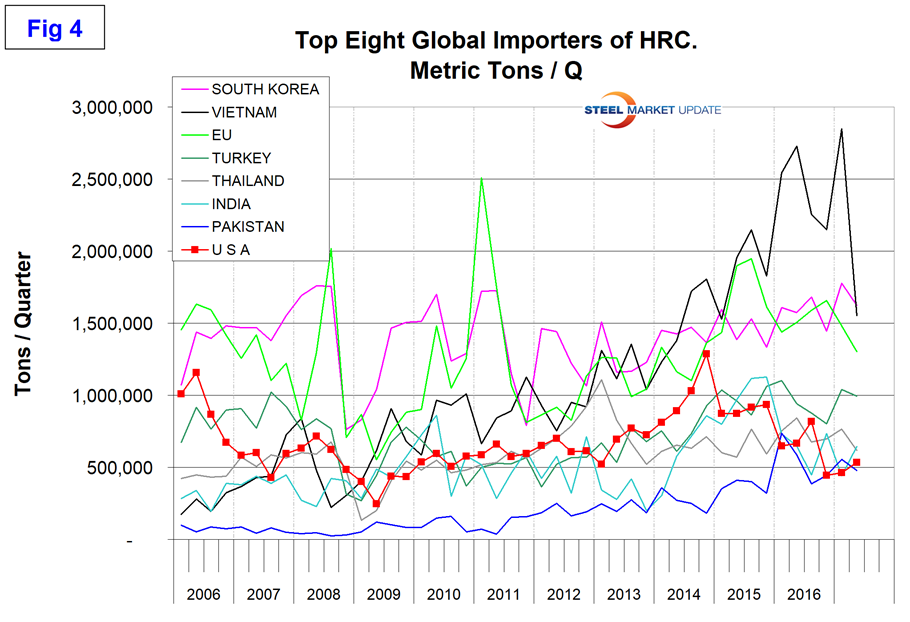

Figure 4 shows the top eight importing nations through Q1 2017. In the second quarter, the U.S. was in seventh place. Vietnam had by far the highest volume of any importing nation from Q3 2015 through Q1 2017, which on the face of it seems impossible as their annualized import rate of HRC in Q1 2017 was 11.4 million metric tons. Vietnam’s volume declined in Q2 2017, putting them in second place behind South Korea. We assume that much of this Vietnamese volume must be the further processing and re-export of Chinese coil and that this activity has declined in response to international pressure.

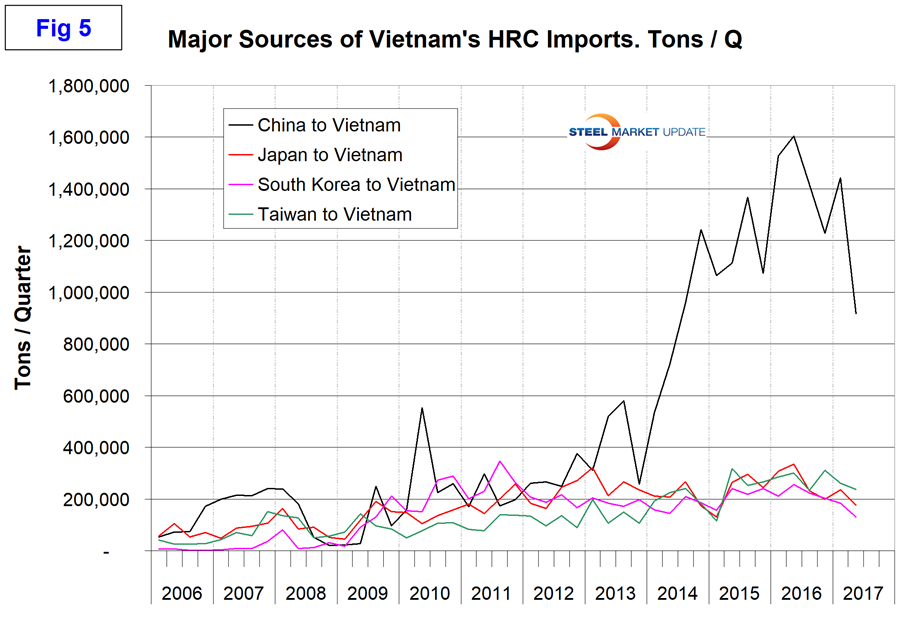

In Figure 5, we see the startling increase in tonnage shipped from China to Vietnam since Q4 2013. Vietnam’s other sources have been relatively unchanged. It is evident that the U.S. is not (as has been frequently claimed) the most porous import market in the world. The EU was in third place for total HRC imports in Q1 and Q2 2017 in spite of shutting out China.

We intend to continue this exercise quarterly for our premium subscribers.