Market Data

September 17, 2017

SMU Service Center End-of-Month Inventories Data - August 2017

Written by John Packard

Steel Market Update is working on a new index to measure flat rolled steel inventories in service center warehouses at the end of each month. Our goal is to assist the flat rolled steel industry to better understand inventories and their potential impact on steel mill order books and lead times. SMU will also analyze data provided from distributors to track steel inventory trends.

We are working to accomplish this in a variety of ways:

- We are developing a list of service centers across the country who will regularly supply us inventory information at the end of each month.

- We will use the collected data to come up with a flat rolled inventory average for the group.

- We will communicate directly with each distributor and collect comments on why inventory levels change from one month to the next.

- We will use our regular bi-monthly flat rolled steel market trends survey to provide further information, such as whether service centers are reporting a need to build inventories.

Initially, we have been working with “months of supply,” which is somewhat subjective. As we build up the number of participating companies, we will switch to the number of days of inventory on hand, which we believe will be more accurate.

However, our initial reports will be relatively simple as we will just ask distributors to report the number of months of supply of flat rolled their company is carrying as of the end of each month.

Over time, our goal is to ask service centers to break out individual products—hot rolled, cold rolled, galvanized and Galvalume steels—so that we can focus in on specific product trends.

We also will look to expand our coverage to include plate, for which we will develop a second group of distributor sources independent of our flat rolled group.

Steel Market Update understands we need to attract large national chains as well as medium and smaller distributors to participate as data providers. Currently, we have a good cross section of the market, but are working to expand the number of data providers to bring more depth and confidence to our analysis.

We plan to provide the information collected first to those companies that share data with SMU, at no cost. Then we will provide an analysis to the industry through either our newsletter or a special product dedicated to the inventory index.

Our goal is to publish our analysis in advance of any other inventory data provider. If possible, we would like to provide our findings by the 10th of the month, if not earlier. The final date will depend on how quickly we can get data from the service centers after the end of each month.

We are also considering a “flash” report that would come from perhaps 10 strategic service centers who are able to provide their data within a few days of the end of each month. If you have interest in participating in our “flash” project, please let us know by reaching out to: John@SteelMarketUpdate.com.

All data providers and their information will be kept strictly confidential and will not be shared with any outside company or individuals.

July 2017 – Flat Rolled Service Centers Averaged 2.77 Months of Supply

At the end of July 2017, flat rolled steel service center inventories averaged 2.77 months of supply based on the responses we received from the service centers reporting to us at that time. Inventories ranged from a low of 1.8 months to as high as 4.0 months.

August 2017 – Flat Rolled Service Centers Average 2.72 Months of Supply

Flat rolled steel service center inventories remained stable at 2.72 months of supply at the end of August. This is down .05 months from what we measured at the end of July 2017. The August number includes 16 new data providers.

Of the original data providers in July, almost an equal number of companies reported inventories as higher, the same or lower for the month of August. However, of those reporting higher inventories, a few companies reported large movement in inventories, for example, from 2.5 to 4.0 months. The average of our original July data providers was 3.106 months of supply as of the end of August. To the original list of data providers, we added an additional 16 service centers. Of the 16 new distributors added to our list of data providers for August, their average was 2.375 months of supply. Combined, we got our 2.72 months of supply for the end of August.

Service Centers Not Ready to Build Inventories

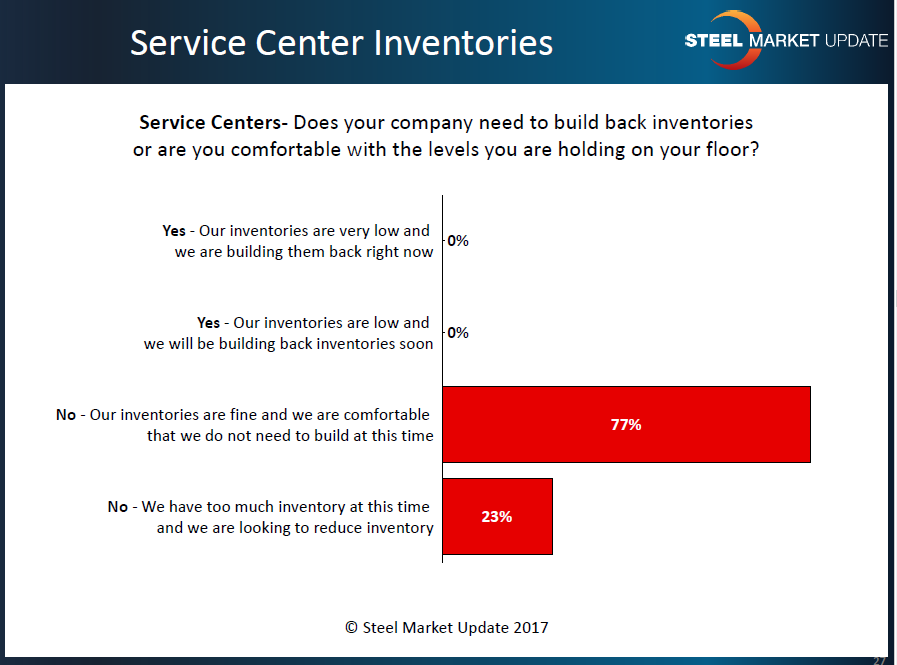

Separate from the data we collected this week regarding service center flat rolled inventories, our market trends survey last week had no distributors reporting they were building or would need to build back flat rolled inventories soon. About 77 percent of the responding service centers reported their inventories were “balanced,” while the rest (23 percent) told SMU their inventories were too high and needed to be reduced.

The combination of average inventories at just below three months, and service centers reporting balanced or higher than needed inventory levels, is not a good sign for the collection of higher spot steel prices right now. This is yet another reason why our SMU Price Momentum Indicator remains at Neutral. We will continue to watch momentum closely as we conduct our mid-September flat rolled steel market trends analysis during the course of the coming week.

What Our Inventory Data Respondents Told Us

When we probed for the reasons behind the data collected, we heard “preparation for Section 232,” as well as “a good buy,” as the main reasons for those who increased their inventories. Here are a few of the responses received as we collected the data on Thursday and Friday of last week:

· “On flat-rolled only, we are at four months right now. Definitely a little heavier than usual. We did buy a little extra as 232 fears hit.”

· “Unfortunately, I think September will be higher. We have some large customers doing some ‘rationalization’ for their finished goods, and we’re seeing lower volumes. I think that’s likely unique to us vs. the market trend, from what I’m hearing otherwise around the horn.”

· “[Higher inventory caused by] a nice buy that came in.”

· “We had two months of inventory on hand, primarily due to all the imports landing early to beat the supposed 232 situation. As we head into the end of the year, we will migrate down to 1.25-1.5 months for buying opportunities at year end. We like to stay around 1.5-1.75 months of supply.”

· “Our HR inventory is intentionally getting lower. Shorter lead times have helped us lower our HR inventory. SDI can provide HR in a two-week time frame.”

How to Become a Data Provider

Steel Market Update continues to look for qualified flat rolled distributors or supply houses who are able to share (confidentially) inventory data on hot rolled, cold rolled, galvanized and Galvalume steels. The initial inquiry into your data will be based on months of supply of all flat rolled on the floor at the end of each month. As everyone gets comfortable with the flow of information, we will break out the various products (HR, CR, GI, AZ). Ultimately, we will be looking for shipment information and total inventories so we can move from months of supply to days of supply, which we believe is more important to buyers and sellers.

We are looking for both U.S. and Canadian service centers who are willing to contribute inventory data.

Steel Market Update wants to be able to provide plate data to our subscribers. Therefore, we need plate warehouses who are willing to provide similar inventory information as discussed above with the flat rolled distributors.

If your company has any questions or is interested in becoming a data provider, please contact John Packard at John@SteelMarketUpdate.com or by phone at 800-432-3475. All companies supplying information will be kept strictly confidential, as will their individual company data.

Written by: John Packard – John@SteelMarketUpdate.com