Prices

September 15, 2017

Sheet Demand Grows; So Does Imports’ Share

Written by Peter Wright

Imports continued to increase their share of the steel sheet market in July.

Apparent supply is a proxy for market demand. For all sheet products except other metallic coated, demand had positive momentum in three months through July.

This report summarizes total steel supply from 2003 through July 2017 and year-on-year changes. It then compares domestic mill shipments with total supply to the market. It quantifies market direction by product and enables a side-by-side comparison of the degree to which imports have absorbed demand. Sources are the American Iron and Steel Institute and the Department of Commerce with analysis by SMU.

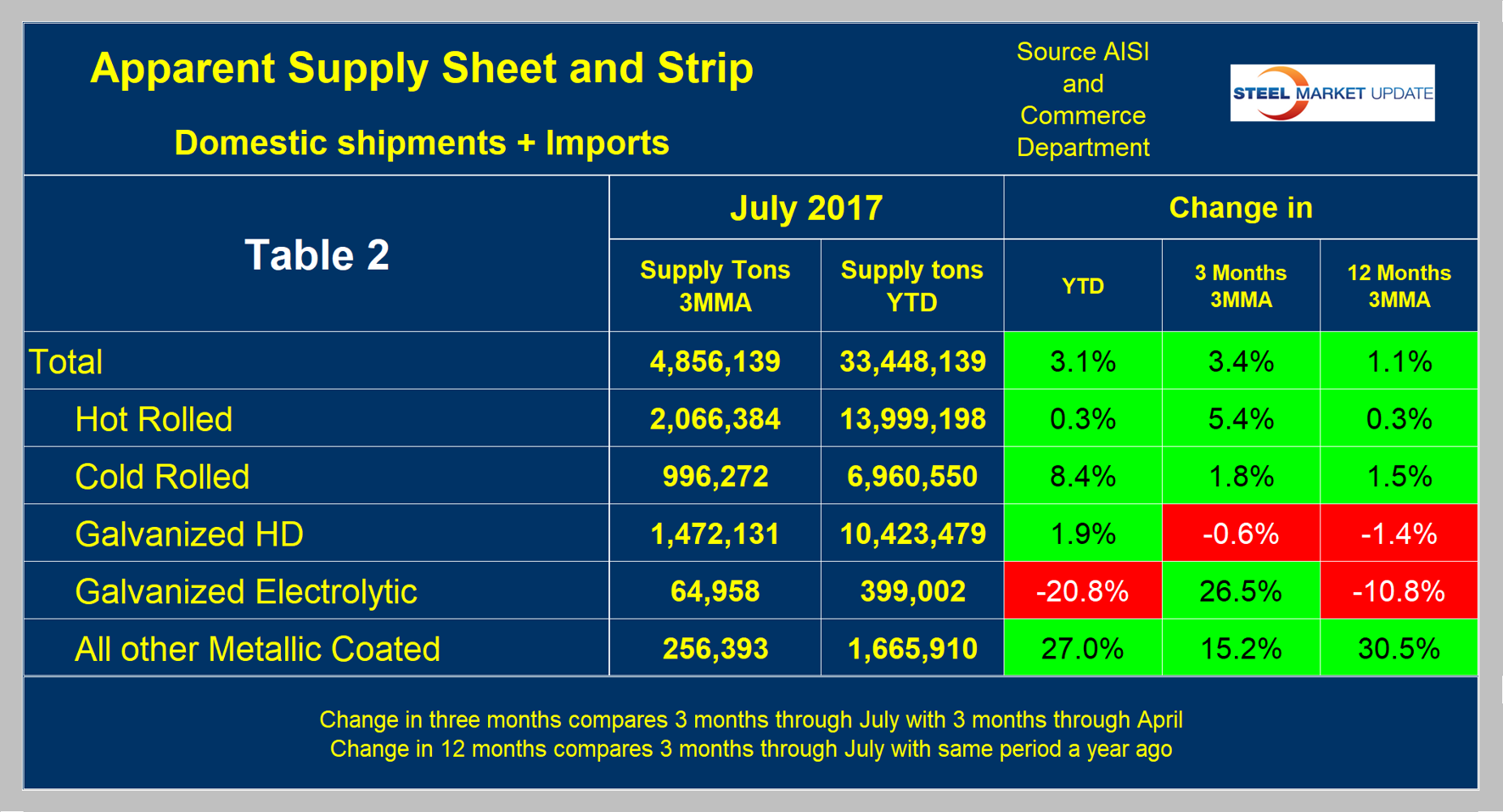

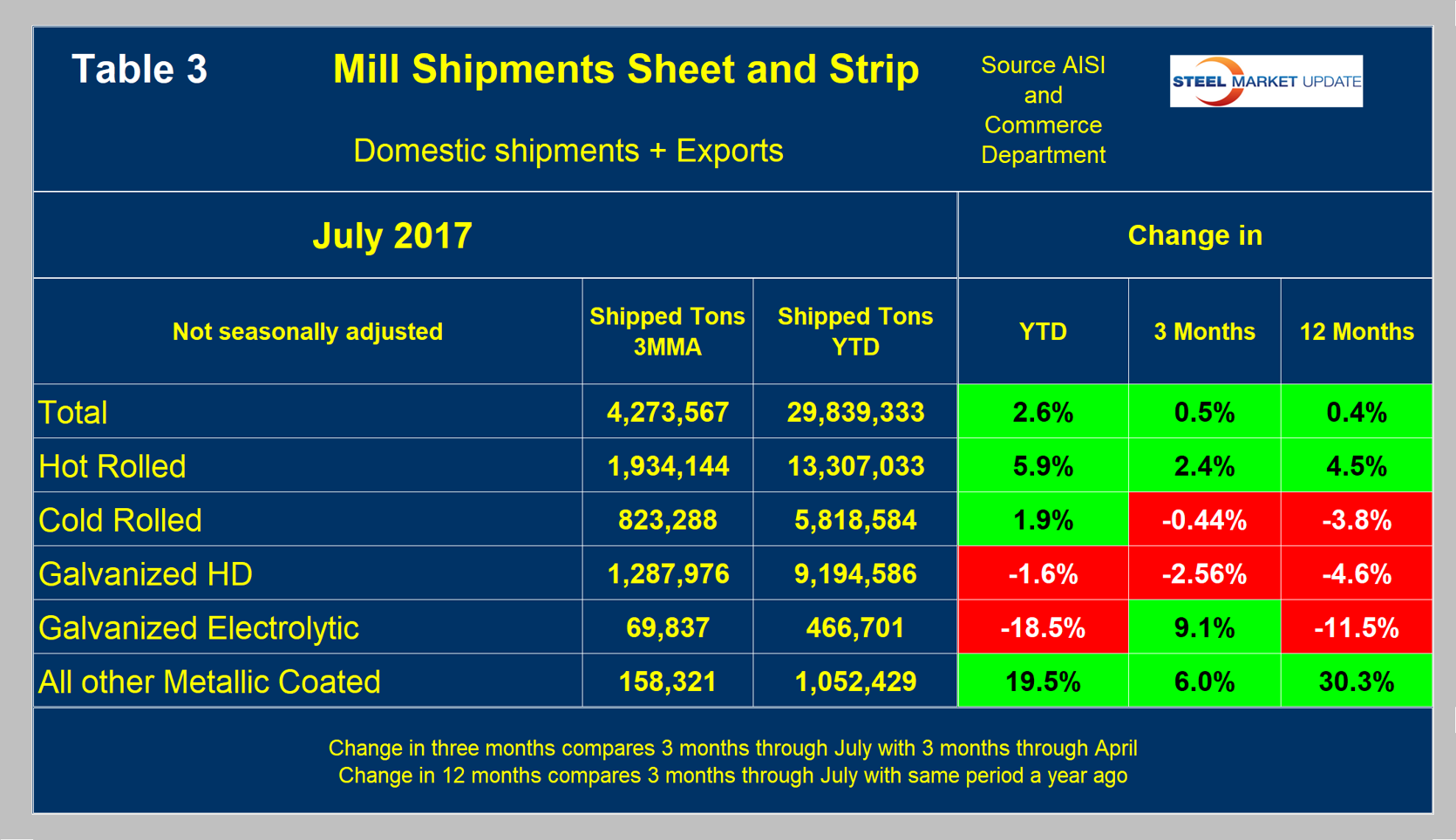

Table 1 describes both apparent supply and mill shipments of sheet products (shipments include exports) side by side as three-month averages through July for both 2016 and 2017. Apparent supply is a proxy for market demand.

Comparing these two periods, total supply to the market was up by 1.1 percent, but mill shipments were up by only 0.4 percent. The fact that supply was up by more than mill shipments means that imports were more of a factor in the market compared to the same three months last year. Table 1 breaks down the total into product detail and shows that supply grew by more than shipments for every product except HRC, which was a repeat of the April, May and June results. The only other difference in July was that other metallic coated (mainly Galvalume) had very strong growth, and domestic shipment growth almost kept up with imports.

A review of supply and shipments separately for individual sheet products is given below.

Apparent Supply: Apparent supply is defined as domestic mill shipments to domestic locations plus imports. In the three months through July 2017, the average monthly supply of sheet and strip was 4.856 million tons, up by 1.1 percent compared to the same period ending in July 2016 (year/year). In the three months through July compared to the three months through April, supply was up by 3.4 percent. The short-term increase (three months) compared to the long-term improvement (12 months) means that through July momentum was positive. There is no seasonal manipulation of any of these numbers. By definition, year/year comparisons have seasonality removed, but 3m/3m comparisons do not. Table 2 shows the change in supply by product on this basis through July. Momentum was positive for all sheet products except OMC, but OMC still had the highest growth rate.

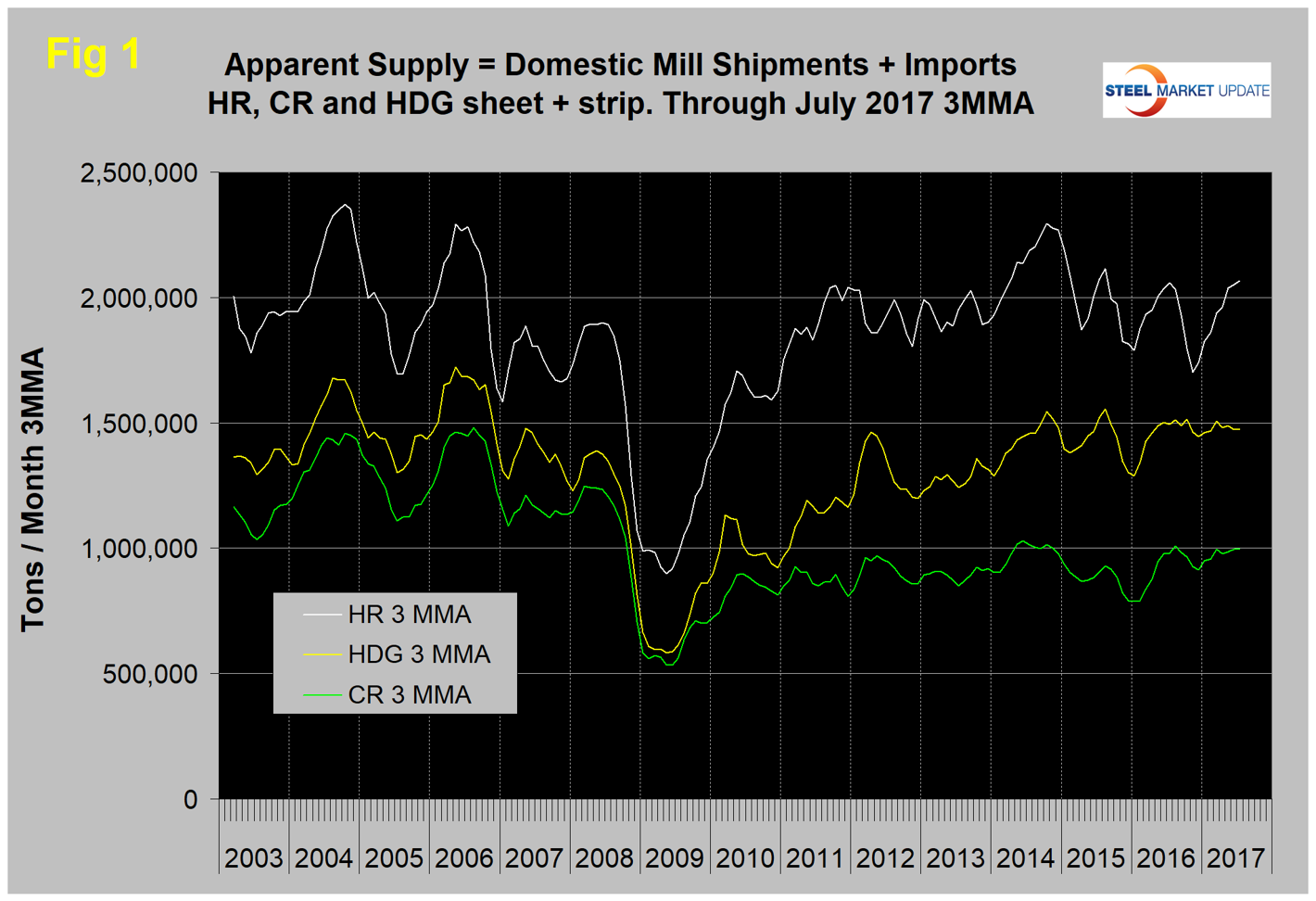

Figure 1 shows the long-term supply picture for the three major sheet and strip products, HRC, CRC and HDG, since January 2003 as three-month moving averages. HRC has performed very well this year, but cold rolled and HDG have not made much progress.

Mill Shipments: Table 3 shows that total shipments of sheet and strip products including hot rolled, cold rolled and all coated products were up by 0.4 percent in three months through July year over year, and up by 0.5 percent comparing three months through July with three months through April. This means that mill shipment momentum for sheet products as a whole was close to zero. Electrogalvanized had very strong momentum, but this is the lowest volume product. Shipments of CR and HDG declined in both time comparisons.

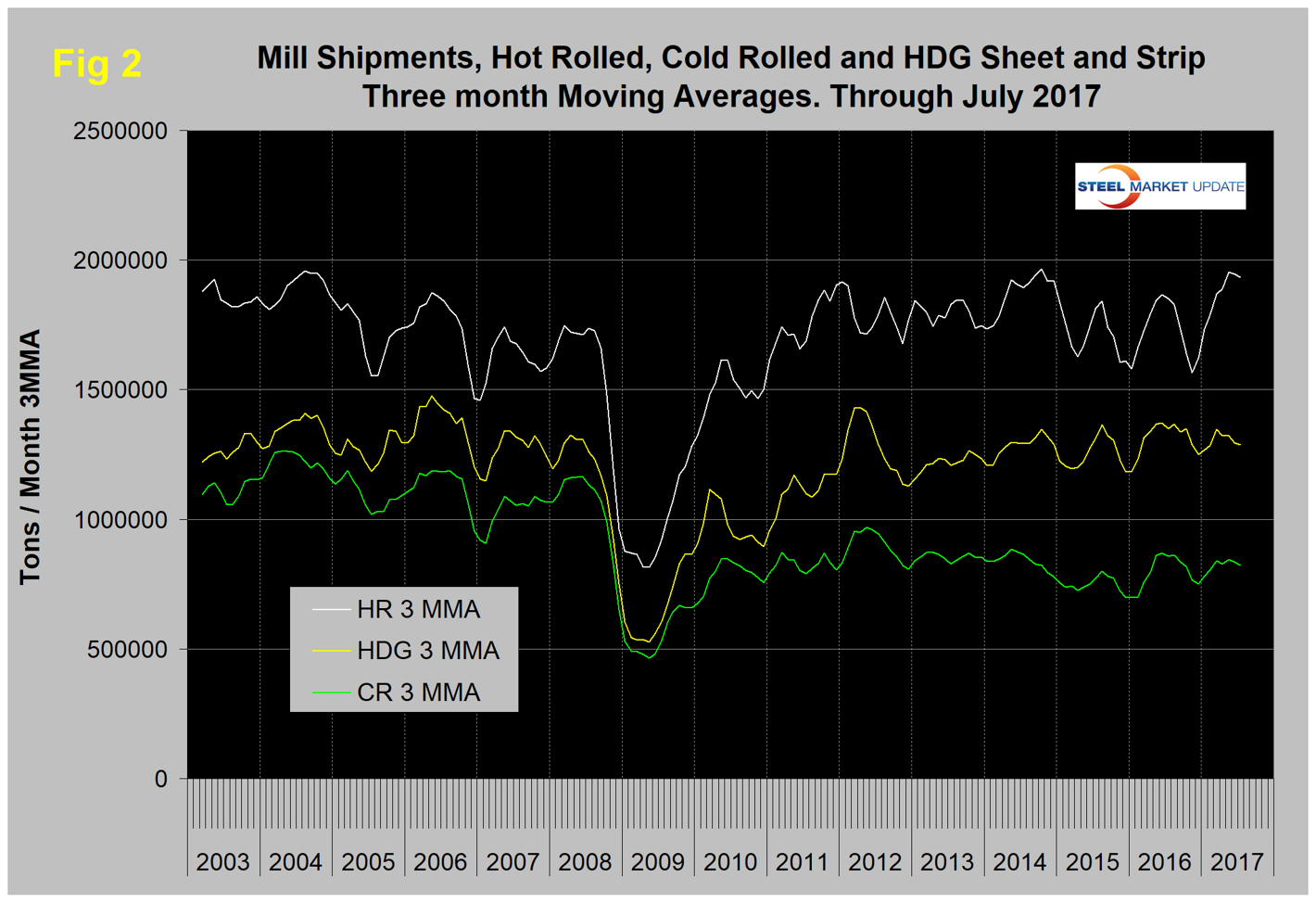

Figure 2 puts the shipment results for the three main products into the long-term context since January 2003. Shipments of cold rolled have not recovered to the pre-recession level as import market share has increased from 12 percent in 2008 to 24 percent in 2017.

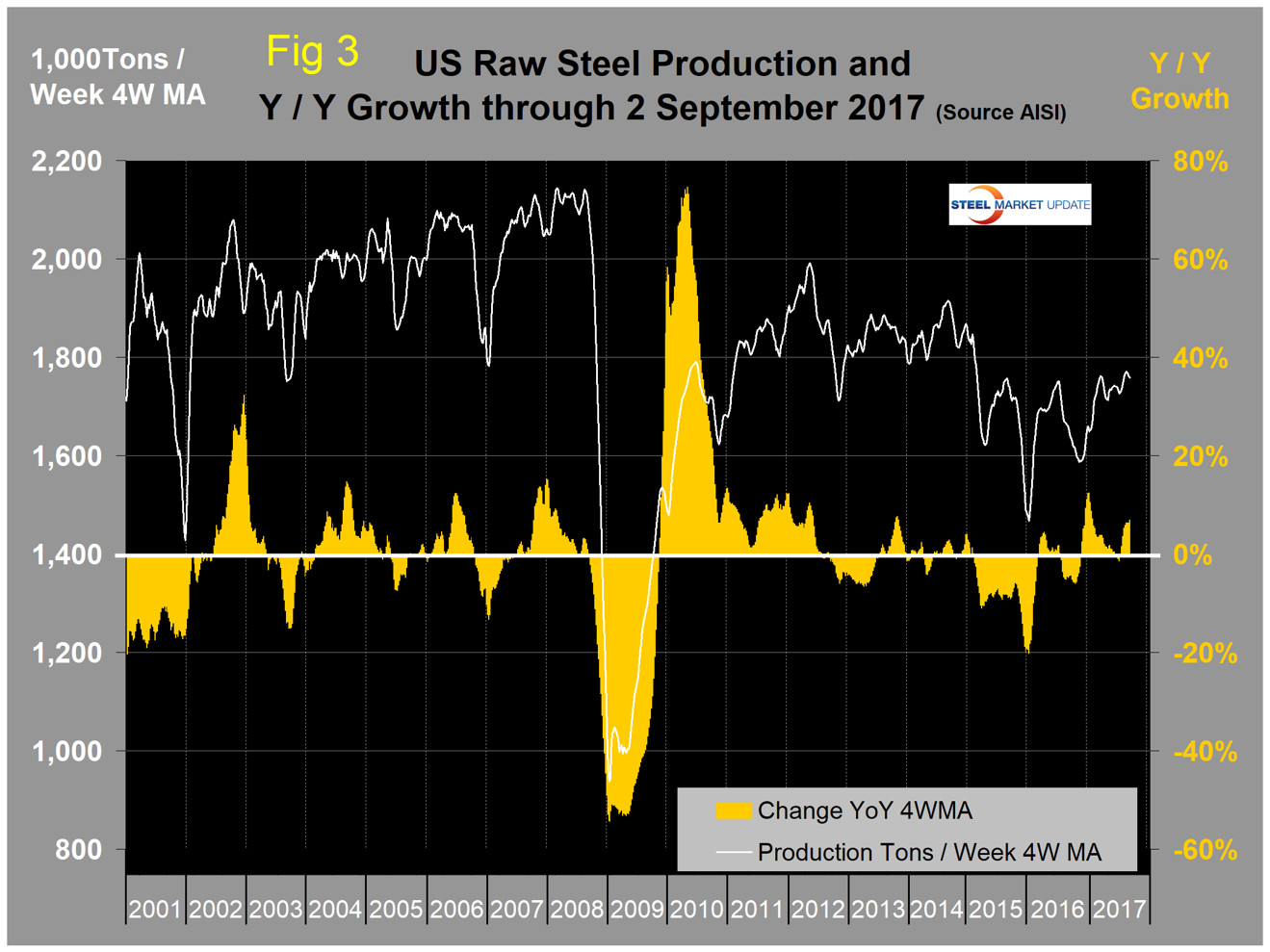

SMU Comment: A problem with this data is that it’s now well into September and the latest information that we have for shipments and supply is for July. AISI puts out weekly data for crude steel production, the latest of which was for the week ending Sept. 2. This provides the most current data for steel mill activity. Figure 3 shows the year/year change in weekly crude output on a four-week moving average basis.

Growth became positive year/year in the week ending July 15 and has been increasingly positive since then to reach 6.9 percent year/year in the week ending Sept. 2. Imports in June, July and August (licenses) show a surge in sheet products when volume exceeded a million tons per month for the first time since September 2015. Based on the strength of the economic indicators analysis that SMU performs and our proprietary measure of buyer sentiment, we are expecting demand for sheet products to continue to increase through the balance of the year.