Prices

September 13, 2017

September Foreign Steel Import Trend is 1 Million Tons Less than 3MMA

Written by John Packard

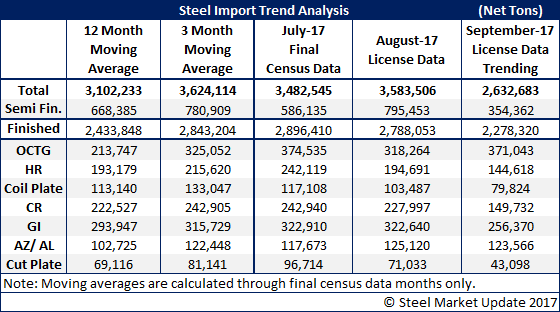

The U.S. Department of Commerce updated foreign steel license data on Tuesday. Based on data through the first 12 days of September, foreign steel imports are trending toward a 2.6 million net ton month. If the numbers hold, the 2.6 million tons would be one million tons lower than the three-month moving average, which is currently at 3.6 million tons.

We are seeing a big reduction in slabs, hot rolled, cold rolled, galvanized and plate products. The trend is for OCTG (oil country tubular goods) and other metallic (mostly Galvalume) to see continued high import levels on both products.

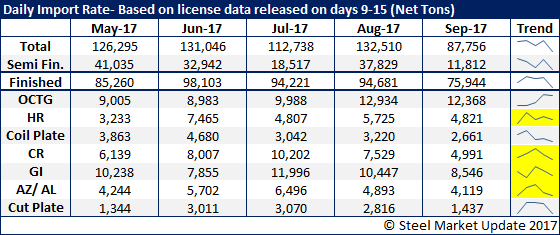

To get a better feel of how license data for September compares with prior months, see the table below. The license data below was collected between the 9th and 15th days of each respective month.