Market Data

August 17, 2017

SMU Steel Buyers Sentiment Index: Lower Optimism Trend Continues

Written by Tim Triplett

Steel Market Update (SMU) is releasing our SMU Steel Buyers Sentiment Index for mid-August. The Index measures how buyers and sellers of flat rolled steel feel about their company’s ability to be successful both in the current market environment, as well as three to six months into the future. Overall, our Indexes remains optimistic. However, the trend since the beginning of May 2017 has been for the level of optimism to be lower than what we were seeing earlier in the year.

Indexed by SMU as a single data point, Current Sentiment is at +65 (on a positive scale that ranges from 0 to +100), down 2 points from the data collected two weeks ago. One month ago, sentiment was +63; a year ago it was +61.

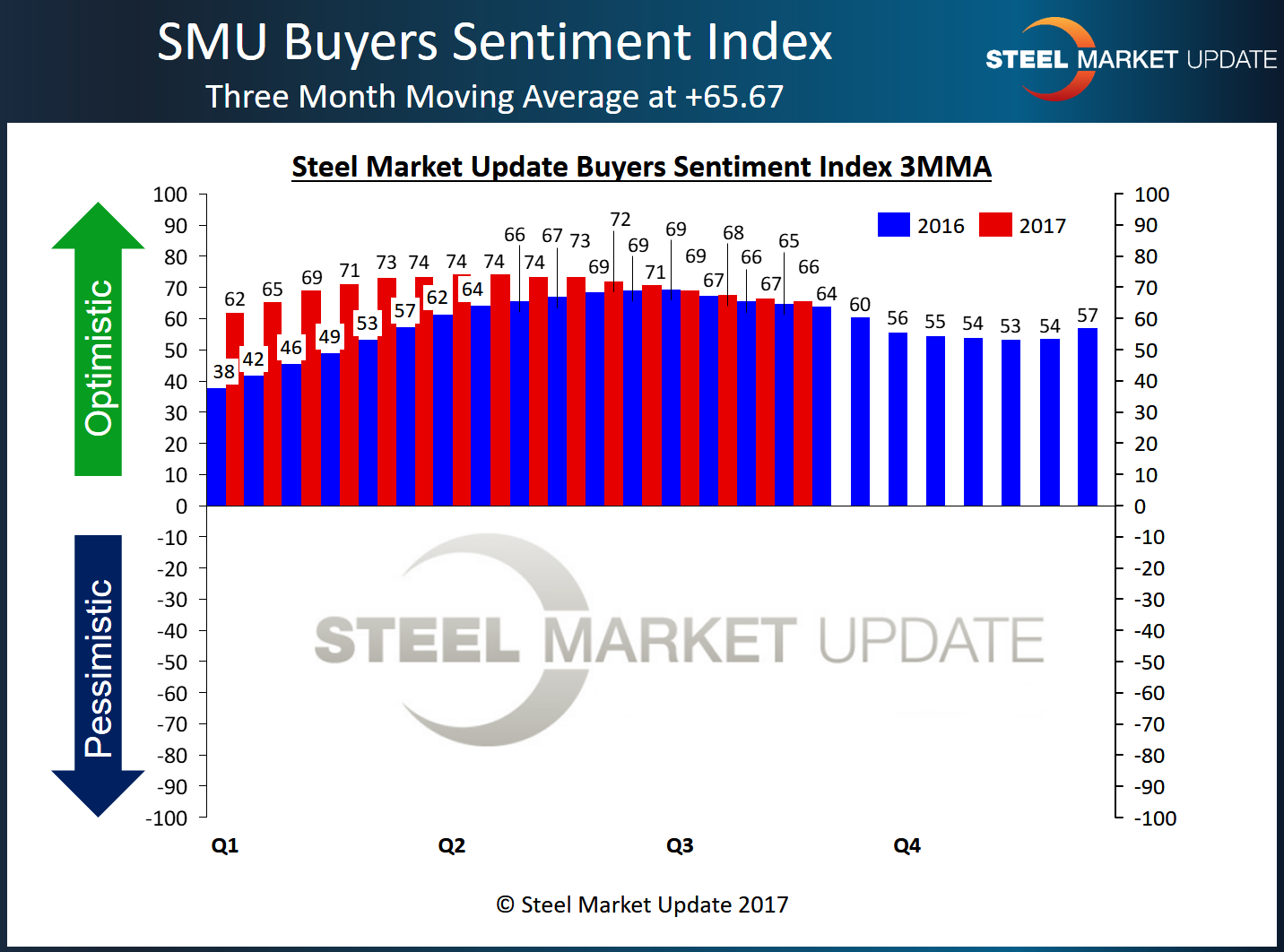

SMU’s preference is to look at the data based on a three-month moving average (3MMA) which smooths out the index and provides a better look at the true trend. The Current Sentiment 3MMA is at +65.67, down slightly from +66.50 two weeks ago and +67.50 one month ago. The 3MMA has seen a gradual decline since peaking at +74.17 in early April (see chart).

SMU also asked respondents how they feel about their ability to be successful three to six months in the future. Our analysis is finding Future Sentiment to be on a similar trajectory as our Current Sentiment Index. The Index continues to be optimistic with the trend continuing to be less optimistic than what was recorded in each analysis going back to the middle of February 2017.

Future Sentiment indexed as a single data point registered +66, down from +68 in early August and a mid-February peak of +75.

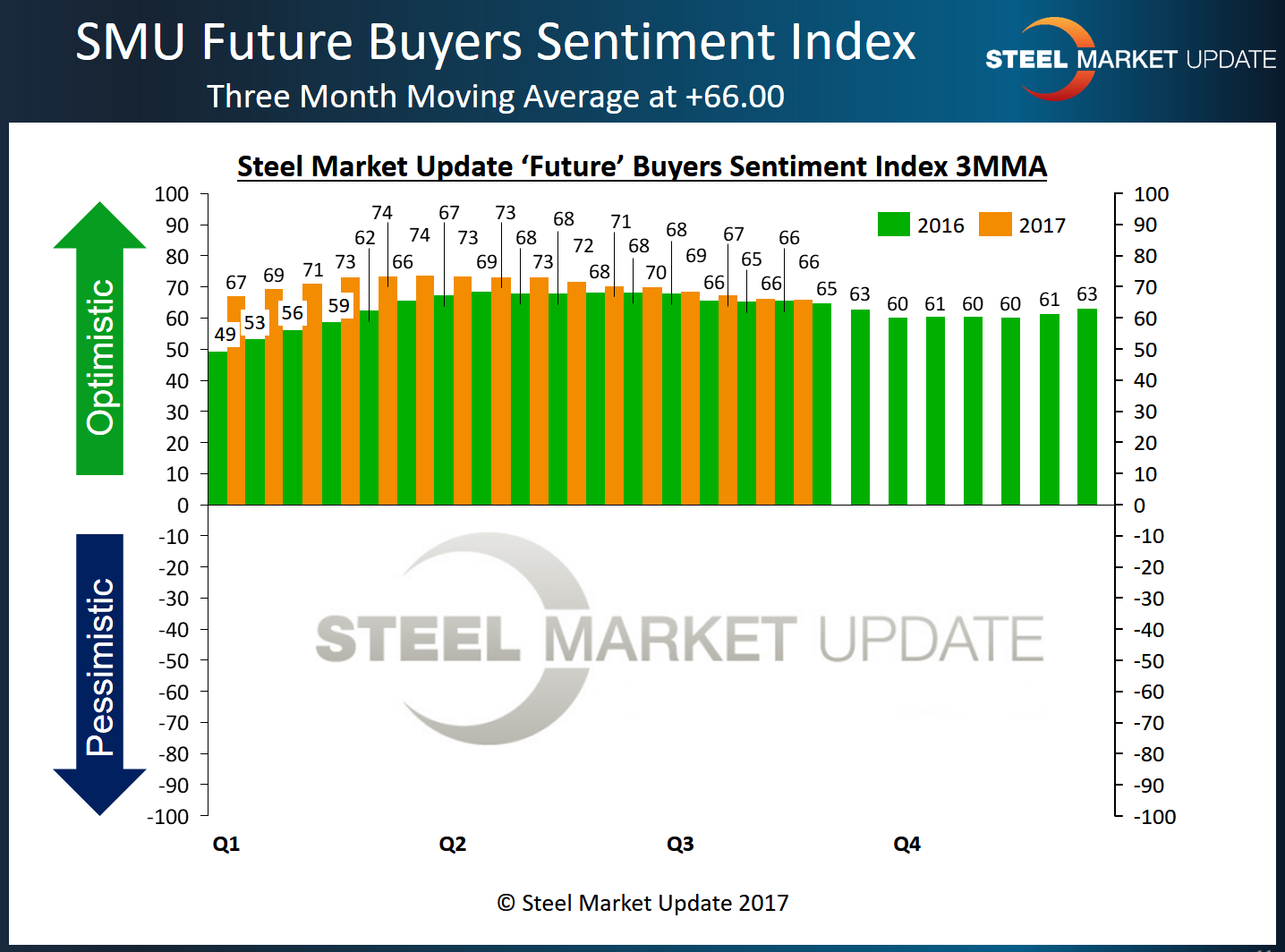

As a three-month moving average, Future Sentiment registered +66.00, little changed from two weeks ago (see chart). One month ago, the Future Sentiment 3MMA was slightly higher +67.33. Buyers and sellers are feeling about the same level of optimism as they were at this time last year. The peak in Future Sentiment 3MMA in the past year occurred in mid-March at +73.67.

What Respondents are Saying

Commenting on their prospects for current success, some slowness in the market appears to be coloring individual responses. “Seems like there has been a lull in business,” said one service center executive, who considers market conditions to be only fair. “August has been quiet so far,” says another. “July and August are not as strong as Q2,” observed a third. “Existing business conditions need to start improving quickly or else,” added a wholesaler.

Like many others, one service center executive said he is continuously concerned about labor costs and price risk. “Demand is still good. However, trade action is still unclear, and this cloud will shade all business for the foreseeable future,” said a trader.

Looking a few months into the future, a few respondents were particularly optimistic. “I think there is a better chance of upside than downside,” said one service center. “We are positioned and poised for greatness,” said another. “We just need a much better business climate. We need infrastructure spending to get moving.”

One trader noted that the next 3-6 months will be key for decisions on trade action. “We do expect some action on imports from the Trump administration consistent with their campaign promises and announcements when the Section 232 investigation was launched,” added a mill exec.

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right-hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the left-hand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 35 percent were manufacturers and 49 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.