Logistics

August 10, 2017

U.S. Ports Report Rising Steel Imports

Written by Sandy Williams

Steel imports are higher this year than 2016, but still below levels of 2015, according to ports on the West and Gulf Coasts.

The Port of New Orleans has seen imports increase slightly over a year ago. In the first six months of 2016, imports rose to 1,186,630 tons from 1,179,037 tons in the same period of 2016, but have not reached the 1,921,348 ton level seen in 2015. Imports surged in 2015 on stronger demand and improving economic conditions, but are currently impacted by the looming Section 232 decision, said Matt Gresham, director of external affairs. Import flow has been steady across geographic origins.

“We don’t see any changes until the Section 232 investigation is resolved,” said Gresham in a note to SMU. “For shippers, caution will continue to be paramount, and both buyers and sellers will be watching closely for any decision on the issue.”

“We don’t see any changes until the Section 232 investigation is resolved,” said Gresham in a note to SMU. “For shippers, caution will continue to be paramount, and both buyers and sellers will be watching closely for any decision on the issue.”

New Orleans maintains one of the largest steel importing ports in the United States. Imported steel accounted for 45 percent of all imported cargo moving across the port’s publicly owned facilities in 2016 and 35 percent of its revenue. The 2002 steel tariffs imposed by then-President Bush under Section 201 of the Trade Act of 1974 resulted in a 46 percent decline in steel imports at the Port of New Orleans in the ensuing year.

“Section 232 of the Trade Expansion Act (the law on which the Trump administration is relying) is far broader than the law used in 2002 and could result in far steeper tariffs on a wider variety of steel products from many more foreign countries,” said Gresham.

Steel imports at the Port of Houston jumped 49 percent year-to-date compared to the period through July in 2016. July steel imports totaled 339,792 tons. As at New Orleans, steel imports are higher than last year but still under 2015 levels. Houston has seen a broad-based increase, with 18 out of the top 20 countries for steel imports registering growth of over 10,000 short tons each in the first six months of this year.

Imports levels are expected to be “highly influenced by the level of oil and gas exploration activity, which is difficult to predict,” said Bill Hensel, manager of external communications. The port had no comment on the Section 232 investigation at this time.

The Alabama State Port Authority is expecting to handle about 5.1 million tons of import and export steel for the fiscal year ending Sept. 30. Approximately 3 million tons of that are imports.

Out on the West Coast, the Port of Los Angeles is unsure how Section 232 will affect port volumes. “The product mix can change or the severity of the import restriction can outweigh the cost of domestic production to the West Coast area,” said Phil Sanfield, director of media relations

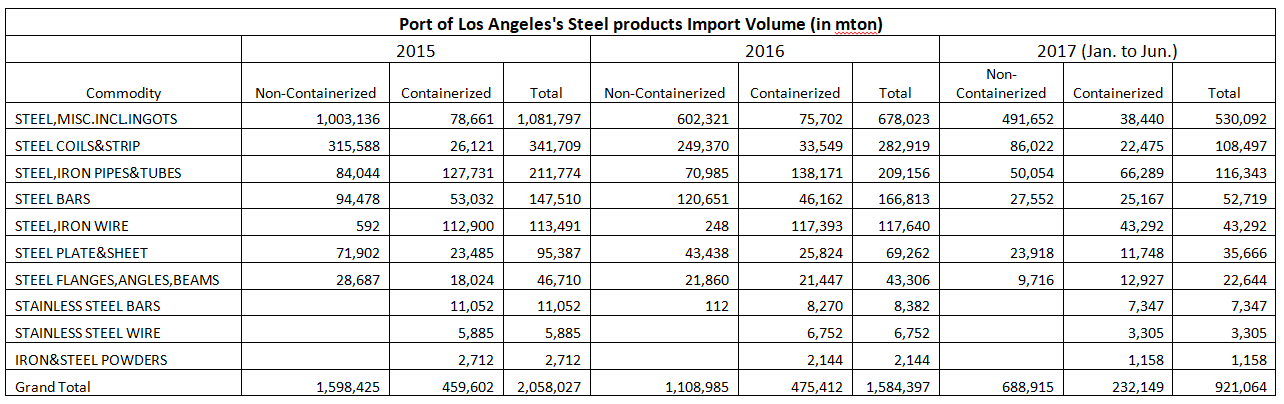

Steel imports from January to June totaled 1,016,282 short tons compared to 1,746,469 tons in all of 2016, and 2,268,548 tons in 2015. The chart below gives the breakdown by product in metric tons.

Bobby Landry, vice president-commercial for the Port of New Orleans, gave testimony at the Section 232 hearings in May. Here is a portion of his comments outlining the negative impact steel import restrictions may have on commerce:

The impact of a tariff on imported steel would have a broad impact. Just recently, the Association of General Contractors cited the rise in commodity prices as one of the major reasons home prices have increased. Steel was one of the main commodities mentioned in their study. While one would expect sanctions on imported steel to only exacerbate the rise in steel prices, the ripple effect on other commodities would be less noticeable but just as adverse. For example, 80 percent of the steel moving through the Port of New Orleans moves up the Mississippi River by barge. Those same barges are then used by U.S. farmers to deliver agricultural products to the grain elevators located on the Lower Mississippi River. Without those barges moving upriver, the cost to transport U.S. grain increases, making U.S. agricultural products less competitive with those in other producing countries like Brazil and Russia.

The Port of New Orleans, like other commercial enterprises, needs and depends upon a strong U.S. economy. A vibrant, healthy, and competitive U.S. steel industry is essential to that goal. However, the wide imposition and enforcement of new tariffs on imported steel would do the opposite, creating a negative impact on ports, the larger maritime community, manufacturers throughout the U.S., and other steel-consuming industries. Free and open trade policies, combined with appropriate incentives for the U.S. steel producers, would be the best means to promote all sectors of the U.S. economy.