Market Data

August 3, 2017

SMU Price Momentum Indicator Still at Higher (Why?)

Written by John Packard

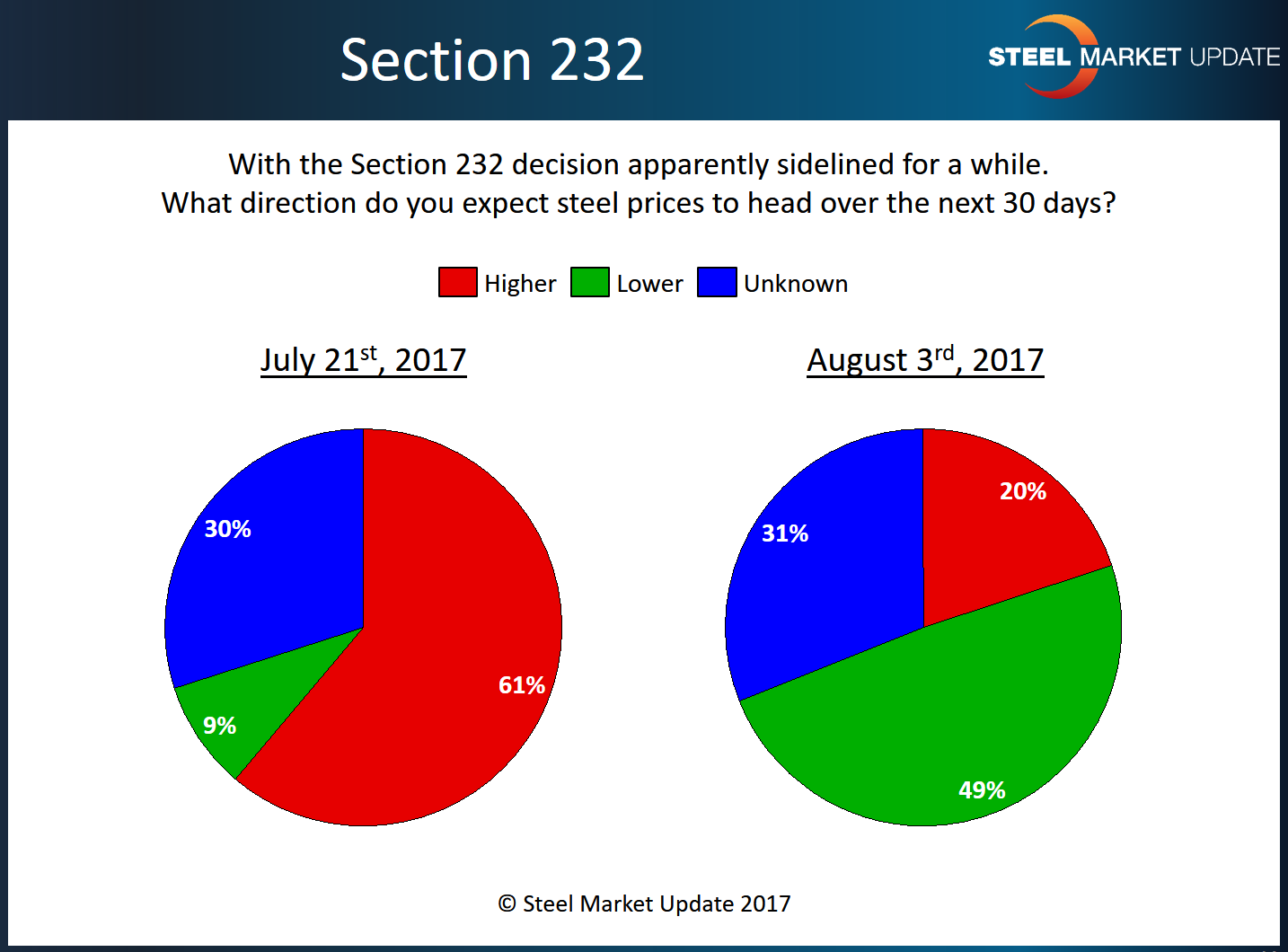

Despite getting pressure to adjust our SMU Price Momentum Indicator due to uncertainty associated with the Section 232 investigation and the lack of a recommendation to date, along with small signs of a need by one or two steel mills for orders on galvanized, SMU is continuing to reference flat rolled steel prices as moving Higher over the next 30 to 60 days.

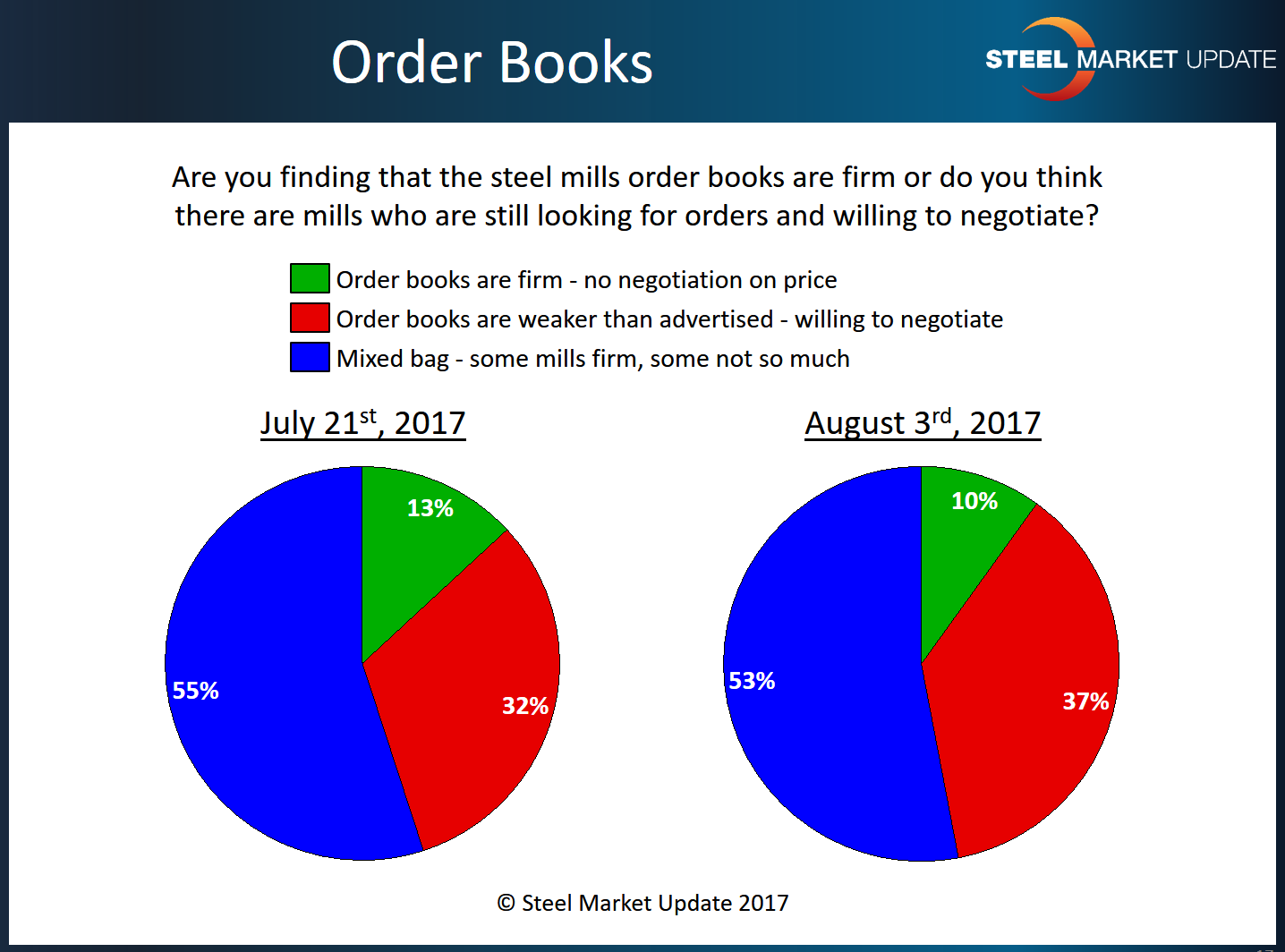

Over the course of the past four days, Steel Market Update has been conducting one of our flat rolled steel market trends surveys. As we analyzed the results, we noticed we still have more than 50 percent of those manufacturing and service centers responding to our queries reporting that steel mills are willing to negotiate prices (all flat rolled products). We have an article on our findings elsewhere in tonight’s issue of Steel Market Update.

At the same time, steel buyers are advising SMU that at least one mill (Nucor) has been hinting of a potential price increase due to higher scrap prices for the month of August.

There are many opinions as to where flat rolled steel prices go from here. What your opinion might be on the subject may depend on who you spoke with last. From SMU’s perspective, we continue to be more bullish on the manufacturing and steel sectors than some. We still see auto as strong (albeit at slower than the 2016 pace – but 17.0 million units is still very strong!), construction as doing well, agriculture markets as improving, energy as improving and mining as improving.

One service center executive whose business is 60 percent automotive told us this morning, “We buy 35,000 tons a month of hot rolled and I’m not getting any calls.” He went on to tell us that they are active in the spot markets all the time and if mills aren’t offering, then order books are good. He pointed to ArcelorMittal’s book as being strong with two of their mills (Riverdale and AM/NS Calvert) being essentially closed. He reported SDI, North Star BlueScope, NLMK USA and U.S. Steel as all having good order books and not shopping any cheap tons.

The president of another service center reported that one of their mill suppliers advised them galvanized spot base prices were going lower.

So, there are mixed messages out there. But when we added up the responses from some of our key sources today, the message we received was that it might be a little early to throw in the towel on the domestic steel mills.

So, there are mixed messages out there. But when we added up the responses from some of our key sources today, the message we received was that it might be a little early to throw in the towel on the domestic steel mills.

“It doesn’t surprise me that you’re hearing mixed messages,” said one service center VP of Purchasing. “The perceived market varies wildly from mill to mill. We’re also finding that the quoted price can vary wildly depending on whether the mill believes you’re just shopping, or if you have legitimate tons to place. There are a lot of ‘price-check’ quotes out there as people try to determine market direction since the announced 232 delay.”

He continued: “It’s funny (not really) because for months we’ve said that if we only knew what was happening with 232, we’d be in a better position to manage our business and help our customers. Now that we know something, we don’t feel any less confused in the short-term. In the medium-term, we don’t see any fundamental change from the market fundamentals of early 2Q when the market began to drift downward.” He added that his company’s inventories are high and, due to the lack of clarity regarding market price direction, they are inclined to work inventories down and wait for the end-of-the-year deals.

Others also mentioned that the smart money may be on waiting for those “end of the year” deals. We heard comments like this one from a large service center buyer: “Mills are trying not to show any fear. I know that BRS is closing September today and Calvert has a big backlog. The foreign prices have come down some, now that the immediate fear of 232 action has dissipated. Material coming in right now from Asia and Brazil is on a level plane with where mill pricing is, so we are seeing a slow month with buyers having an upper hand because of inventory. Producers should still have strength for contracts. Spot market will be down in the fourth quarter.”

Another large automotive service center shared some of their insights with SMU this afternoon. “Overall, the mills seem pretty content with booking levels and I don’t see a lot of movement on pricing. There may be a little aggressiveness on Galvanized since at the spread between HR and Galv base they are making so much money, but I expect them to hold the line and not give back the increases that they’ve been working on.” This lead buyer continued, “I expect the automotive manufacturing adjustments to result in service centers cutting related September and October orders. But again, since we are nearing 2018 contract season, I don’t think this will cause pricing to take too large a drop. Based on current mill lead times, I think service center inventory levels are controlled. But now that 232 isn’t imminent, I see most people booking only as needed and staying short in the market. If bookings slow and lead times shorten, we move back into that delicate dance. I don’t think it is one that will be influenced by increase announcements, only by real change in demand (or supply).”

Out of the Texas/Arkansas/Oklahoma markets, we heard business conditions are quite strong with ranch equipment and other markets doing well. “Demand is very good from what I can see in our region,” said the general manager of one steel distributor. “We have not slowed down at all, and I’m hearing the same from my customer base. We are very busy in our region.” This same GM reported lead times as actually moving out from their suppliers and that contract tons were running “a little behind.”

Out of the Texas/Arkansas/Oklahoma markets, we heard business conditions are quite strong with ranch equipment and other markets doing well. “Demand is very good from what I can see in our region,” said the general manager of one steel distributor. “We have not slowed down at all, and I’m hearing the same from my customer base. We are very busy in our region.” This same GM reported lead times as actually moving out from their suppliers and that contract tons were running “a little behind.”

This evening, just prior to our newsletter being published, we got a note from one of our steel mill sources who has an interesting perspective. He tends to look at the “global” market where he is seeing a situation where global prices could go higher “unabated” for awhile. This, he says, “…causes the average end user who thinks the sky is going to fall, to buy less import due to a perception that import price increases are not ‘real.'” He then points out that when the “beat-the-232” tons being received in June, July and August dry up, “…the end users will find themselves with a lot less leverage with domestics and a dearth of imports. If people think auto weakness will prevail into Q4, scrap will stop going up, and BRS/AJ will produce a lot more, then perhaps they have leverage on domestics – but, I fall on the side of the fence that sees global and scrap moving up long enough for import inventories to be drawn down.” He then concluded, “I am guiding my friends not to get caught short on inventory. The story is not 232. The story is people need to analyze supply and demand moving foward. The market in the U.S. is not full of downside price risk only, there is plenty of upside potential as well.”

Many buyers are sitting on their hands, and it is the opinion of Steel Market Update that service center inventories are quite healthy. If we are correct, then we could see some pressure over the short term from a mill or two.

One of the questions will be how much foreign steel is coming in August, September and October. If we start to see a sharp drop, that could help deplete the high inventories. If, however, we see another month of 3.5 million tons or greater, then we need to adjust our Indicator.

Just not willing to move quite yet. This doesn’t mean that steel buyers can stop listening to their customers and suppliers. Watch lead times and deliveries of your existing orders closely. If you see something changing, please drop us a line: John@SteelMarketUpdate.com.