Analysis

July 28, 2017

Final Thoughts

Written by John Packard

I had to smile on Friday when Brett in my office forwarded an email to me from one of the steel mills. Here is part of what this mill executive had to say:

“I occasionally write to John just to vent. It doesn’t help him, but it makes me feel better. Section 232 is the dominant alpha numeric of the last, certainly 6 weeks, maybe couple months in our industry. Now that the dust is settling and this administration once again swung and missed (see health care, infrastructure, tax reform), what hasn’t changed is the amount of unfairly traded imports that enter the U.S. Government-subsidized steel and illegal circumvention are obvious and irrefutable, and I am a little concerned that in all of Lewis’ [trade attorney Leibowitz] comments these illegal imports were not even mentioned as part of the greater issue.”

He went on to say, “I am very sensitive that the steel industry gets accused of wanting protection, or basically asking for something for nothing… All we have ever asked for is a level playing field and right now, for a decade in a row, we don’t have it.”

He then concluded with, “A few examples and not sure if numbers are right, but they are close. Our ratio of import to exported tons for Russia is 296:1, for Turkey 189:1, for Korea 132:1. We have raw materials, we have infrastructure, we have talent, we have a mature industry. These numbers are only achieved one way and it is not free trade. There you go, didn’t help you or John, but I feel better.”

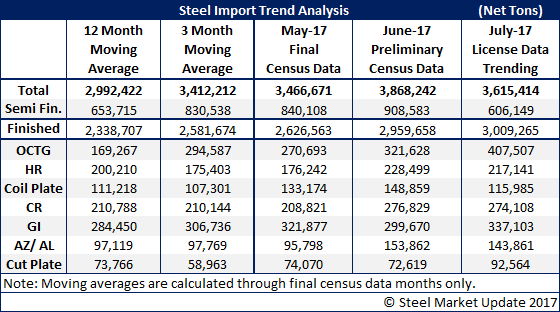

From my perspective, it does seem odd that even with trade case rulings in favor of the domestic steel mills we are seeing foreign steel imports exceeding 3.5 million tons. We reported in Thursday’s issue of Steel Market Update that preliminary census numbers for June were 3.8 million tons and license data for July was still trending well over 3.0 million tons (3.5 million).

Finished steel imports (less semi-finished, which are mostly slabs used by domestic steel mills) are at, or above, 3.0 million tons. Here is the table again in case you missed it on Thursday:

During my conversation with steel trading companies and steel mills late last week, one of the comments made by more than one executive was would the slowdown of the Section 232 decision result in more trade cases being filed by the domestic steel mills?

I have a feeling there are a great many opinions on the subject of trade, Section 232, steel prices and much more. We will continue to address all of these as evenly as possible, and we always appreciate the comments we receive from all sides. You can send your comments directly to me at: John@SteelMarketUpdate.com.

We are dedicating a couple of items in our SMU Steel Summit Conference program to the subject of trade and trade cases. You can find more details on our website. I intend to send out a detailed description about our full conference program early this week. When you receive it please feel free to forward it on to others in your company, as well as your suppliers, customers or friends in the industry.

Our next Steel 101: Introduction to Steel Making & Market Fundamentals workshop will be held in Fort Wayne, Ind., and will include a tour of the Steel Dynamics steel mill in Butler, Ind. We are working with a service center located next to the SDI mill to expand our tour to include their service center operation (we are trying to see if we can move our schedule around in order to give our attendees this second tour opportunity). The dates for this workshop are Oct. 4-5. Details can be found on our website or you are welcome to contact us at info@SteelMarketUpdate.com or 800-432-3475.

We will begin our early August flat rolled steel market trends analysis on Monday morning at 8 AM. If you receive an invitation to participate, please click on the button and spend a few moments providing your opinions and observations about the industry. Our SMU Steel Buyers Sentiment Index, service center inventories, as well as information about demand, buying patterns, lead times and negotiations all come from this analysis, which we conduct twice per month. At the end of this week, our Premium level members will receive a link to a PowerPoint presentation with much of the results gathered. If you would like information on how to become a Premium member, please contact us at: info@SteelMarketUpdate.com

As always, your business is truly appreciated by all of us here at Steel Market Update.

John Packard, Publisher