Prices

July 27, 2017

Foreign Steel Imports Continue Breakneck Pace

Written by John Packard

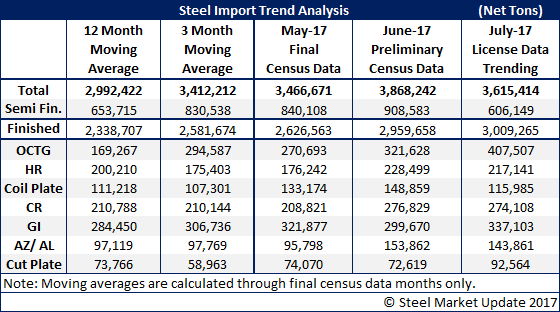

Foreign steel imports continue to trend well over the 3.0 million net tons mark as steel buyers placed heavy tonnage once the Section 232 investigation was announced in March (March orders = June/July delivery). The U.S. Department of Commerce (DOC) released preliminary census for June and license data for July earlier this evening. According to the DOC June imports were 3.8 million net tons and July is trending toward close to the 3.5 million ton number.

A trading company shared some data with Steel Market Update on Wednesday afternoon using data from the U.S. Census Bureau:

“Despite the numerous trade cases, imports of HRC and CR keep on going up. Attached is a summary of the U.S. import statistics for carbon flat rolled steel products for June 2017: “HRC: HR sheets + HR plates in coils increased 25% M-O-M. The AD/CV duties for imports from Russia, Korea, Japan, Australia, Japan are not enough of a deterrent. In addition, newcomers such as Italy, Serbia and Egypt are now shipping large quantities of HRC to the U.S.

“Average import prices from Egypt, Turkey, Italy and Serbia are: $530 to $540/mt CFR Port of entry.

“CRC: Jumped 41% M-O-M. Russia and Turkey were the largest exporters to the U.S. with 36,000 metric tons and 49,000 metric tons, respectively.

“Lowest import prices were from Turkey $637/mt CFR and Vietnam $631/mt CFR.

“HDG: No significant changes.”

SMU is seeing OCTG (oil country tubular goods) surging to almost double the products’ 12-month moving average during the month of June and on pace to exceed June’s numbers in July.

Each of the following products are trending well above their 12-month moving averages: hot rolled, cold rolled, galvanized, Galvalume/aluminized and cut plate.