Market Segment

July 25, 2017

AK Steel Seeks Broad Section 232 Action

Written by Sandy Williams

AK Steel is looking for a broad application of Section 232 that will address the continued increase in unfairly traded imports. CEO Roger Newport said during the second-quarter earnings conference call that trade cases are not working the way they were designed and hopefully Section 232 will address loopholes and those who figure out how to “beat the system.” Newport disagrees with the use of the word “protectionism” and said the industry simply wants a fair and level playing field.

The company is especially concerned about the unfairly traded import of grain-oriented electrical steels that are used in the nation’s electrical grids and are crucial to national defense. GOES imports from Japan, China and Korea have nearly doubled in the first five months of this year compared to last year. AK Steel was disappointed in the unsuccessful conclusion to the grain-oriented electrical steel trade case. Whatever the outcome of the Section 232 investigation, AK Steel plans to fight imports by coming up with new innovations such as its new non-oriented electrical steel that will increase electric motor efficiency for industrial applications and in hybrid automobiles.

“We’re not sitting idly by waiting for Section 232, hoping it comes in,” said President and COO Kirk Reich. “We’re doing plenty of other things that will bear fruit regardless of what happens there.”

Carbon spot prices have been more volatile than expected in second quarter with the completion of the successful trade cases. Projections indicate that carbon spot pricing may rise in the second half. AK steel increased prices $30 per ton in June and $25 per ton last week. Uncertainty regarding the pending Section 232 investigation makes predicting further increases difficult. Recent price increases were supported by rising raw material costs.

Inventories are currently low at service centers with estimates at 2.1 months for carbon products. This suggests buying activity may increase should spot market price increases continue to gain momentum, said Newport.

Extended outages are planned for several AK steel facilities for routine maintenance, as well as enhancements to equipment. During late third quarter and continuing into October, an extended maintenance outage is scheduled for the blast furnace at Middletown Works, along with equipment upgrades including replacing a BOF vessel in the melt shop. Planned maintenance outages of several days are scheduled in the second half for Coshocton Works, Mansfield Works and Zanesfield Works. Mansfield will have an additional extended outage to install new equipment at the melt shop and caster. No interruption of customer deliveries is expected as a result of any of the outages.

Ashland Work’s hot idle situation is being closely monitored but, so far, market demand domestically and globally does not justify bringing 2.1 million tons of annual capacity back on line, said Newport.

Looking forward, AK Steel expects automotive shipments to be down in third quarter due to seasonal model changes and reductions in automotive production. Since last year was a record year for auto shipments, it is difficult to compare volumes for this year, said CFO Jaime Vasquez.

“We still think at the end of the year, though it’s likely that we will ship fewer tons in the automotive space than we did last year, we expect to be down less than the overall market trends and still overall gain some market share.” The acquisition of Precision Partners is expected to expand AK Steel’s capability to provide lightweighting solutions for automotive customers. Demand in the construction sector is improving at a slow and steady rate.

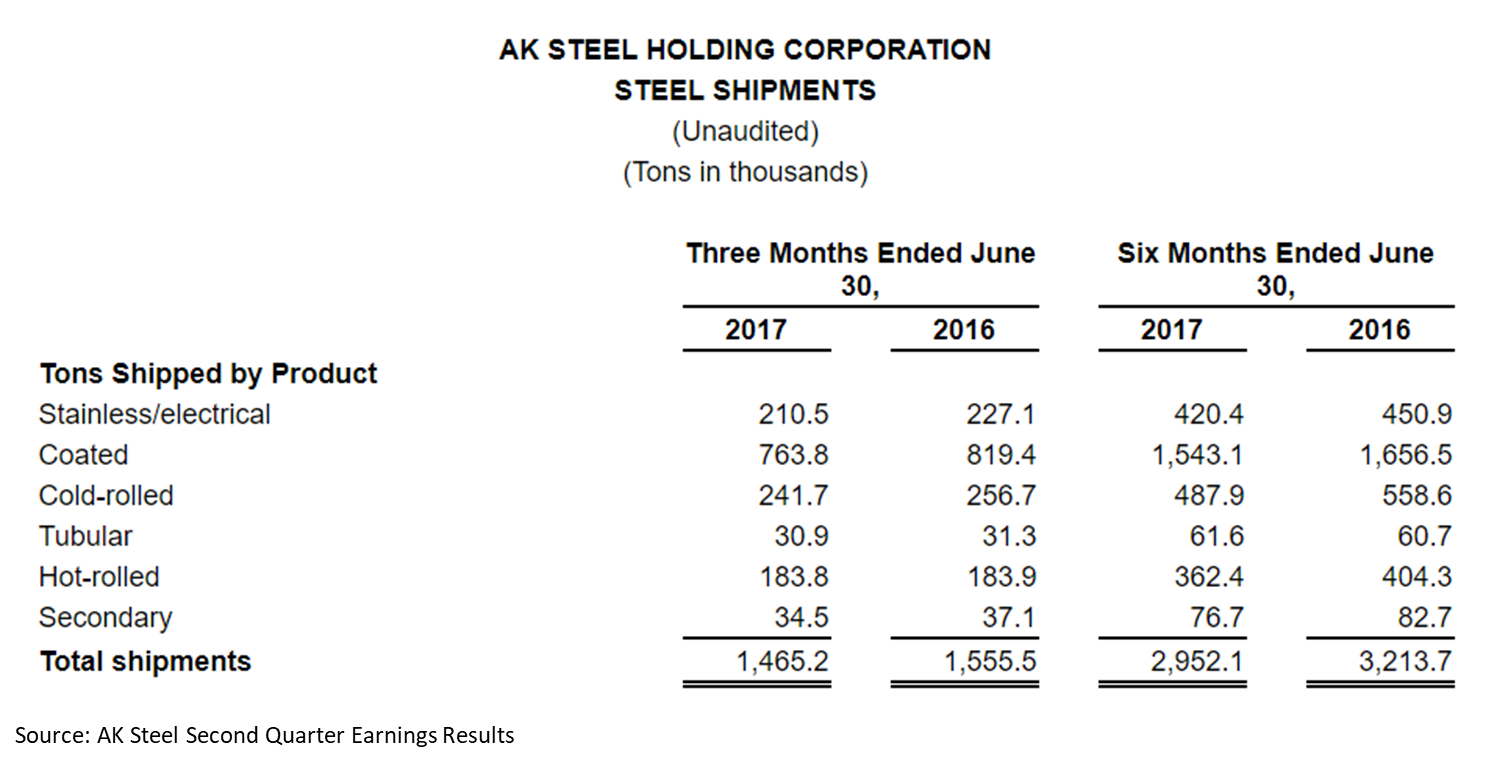

AK Steel reported a strong quarter with net income of $61.2 million. Net sales increased 4 percent to $1.56 billion. Shipments declined 6 percent during the quarter to 1.47 million tons, primarily as result of a decrease in automotive demand. The increase in net sales and focus on cost management initiatives, although partially offset by increased raw material charges, contributed to a 43 percent increase in EBITDA to $142 million in second quarter compared to a year ago.