Prices

July 12, 2017

First Look at July Steel Imports

Written by John Packard

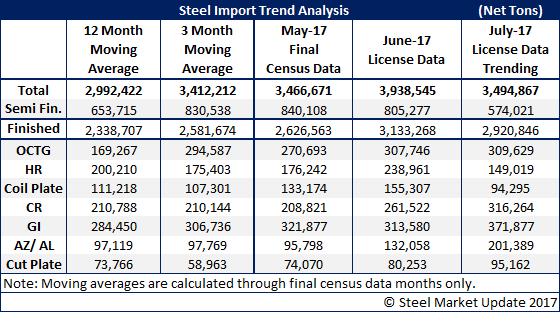

The U.S. Department of Commerce (DOC) released license data for the month of June as well as the first 11 days of July. The bottom line is imports of foreign steel into the U.S. continue to be worrisome (to the domestic steel mills) and the early trend is for July 2017 to be another three million plus ton month.

June imports, based on license data, are being reported at 3.9 million tons. Finished steel imports (less slabs/billets) are being reported as being 3.1 million tons. During the month of June we saw very high imports of OCTG (oil country tubular goods), hot rolled, coiled plate, cold rolled, galvanized and Galvalume. Each product exceeded both their 12-month and 3-month moving averages.

When looking at the July tonnages please take them with a grain of salt as they are based on only 11 days of data. The totals shown are based on the daily average (see second table below) and then extrapolated at that level for the entire month. The result is what we refer to as the trend (or trending) for the month. The closer we get to the end of the month the more confidence we have in our trending numbers.

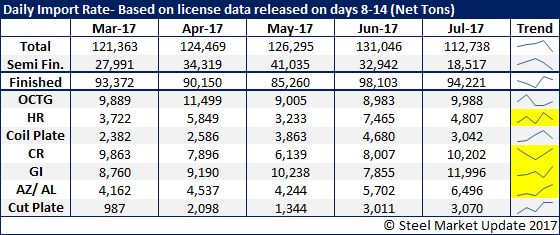

The table below compares import license data collected between the 8th and 14th days of each respective month. We highlighted HR, CR, GI and AZ as the key flat rolled products we watch on a regular basis. The trend is reflected in the highlighted lines. The hot rolled trend is down slightly while cold rolled, galvanized and Galvalume/Aluminized are trending higher.