Market Data

July 6, 2017

SMU Steel Buyers Sentiment Index Shows Market’s Nervous about Section 232

Written by Tim Triplett

SMU Steel Buyers Sentiment Index has come off historical highs set during the late first and early second quarters 2017. However, buyers and sellers of flat rolled steel continue to be optimistic about the potential for their company to be successful in both the existing market as well as three to six months into the future.

Buyers and sellers of flat rolled steel are clearly concerned about the pending Section 232 decision and its potential effects on the market, according to Steel Market Update’s latest market survey. The Trump administration continues to study whether steel imports are a threat to national security and should be restricted with new tariffs or quotas. Results of the investigation were to have been released by the end of June, but were delayed, keeping the market on pins and needles.

Looking at the Numbers

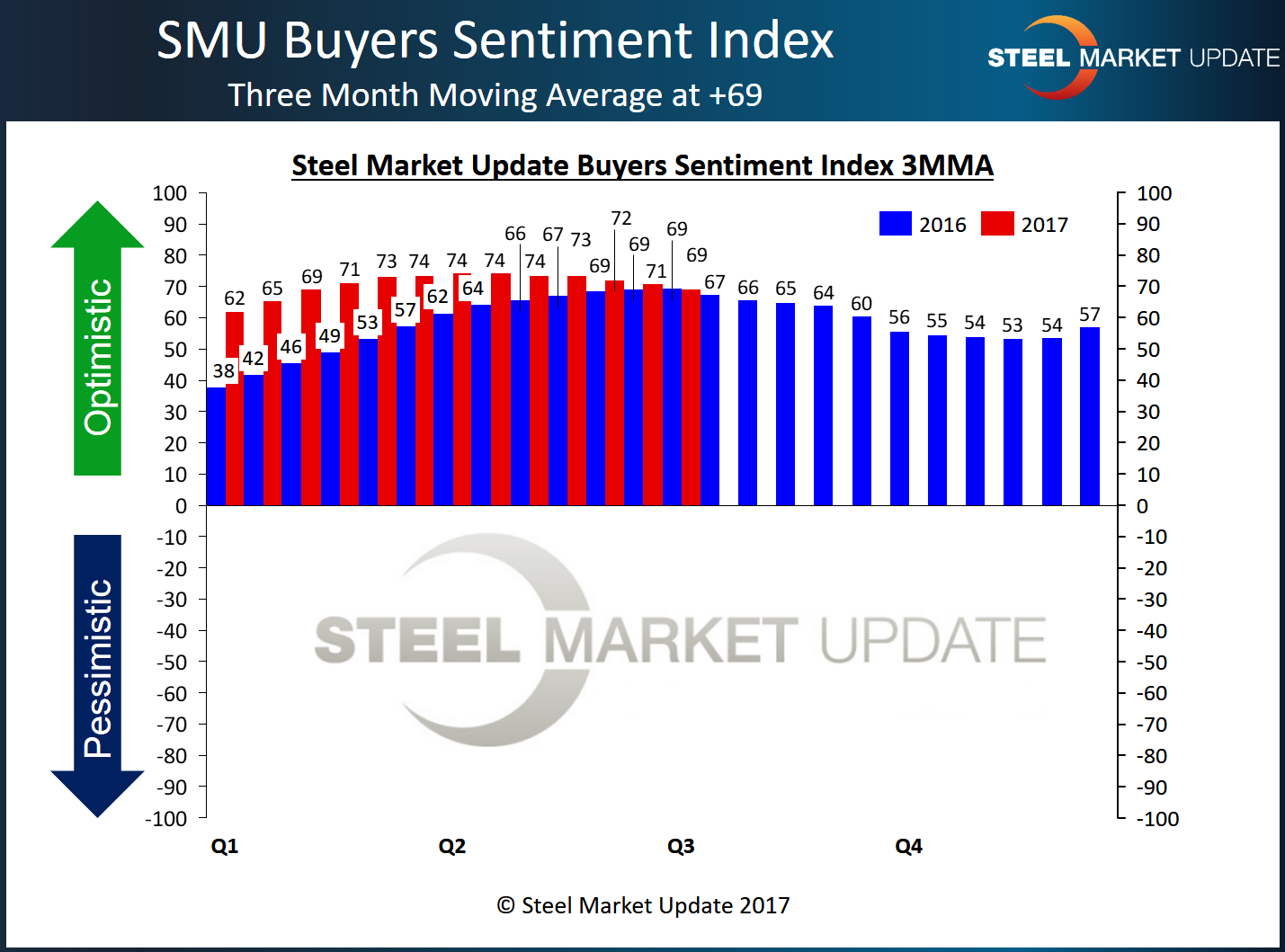

As a single data point, Current Sentiment is at +65, down 4 points from a month ago and down six points compared to the +71 reported one year ago.

Steel Market Update preference is to look at the data based on a three-month moving average (3MMA). This smooths out the Index and provides us a better look at the true trend. The Current Sentiment 3MMA has been slipping over the past four months having peaked at +74.17 during the first week of April 2017. The latest 3MMA is the first time this year that, when compared to the same period one year ago, the 2017 reading was below what we measured last year.

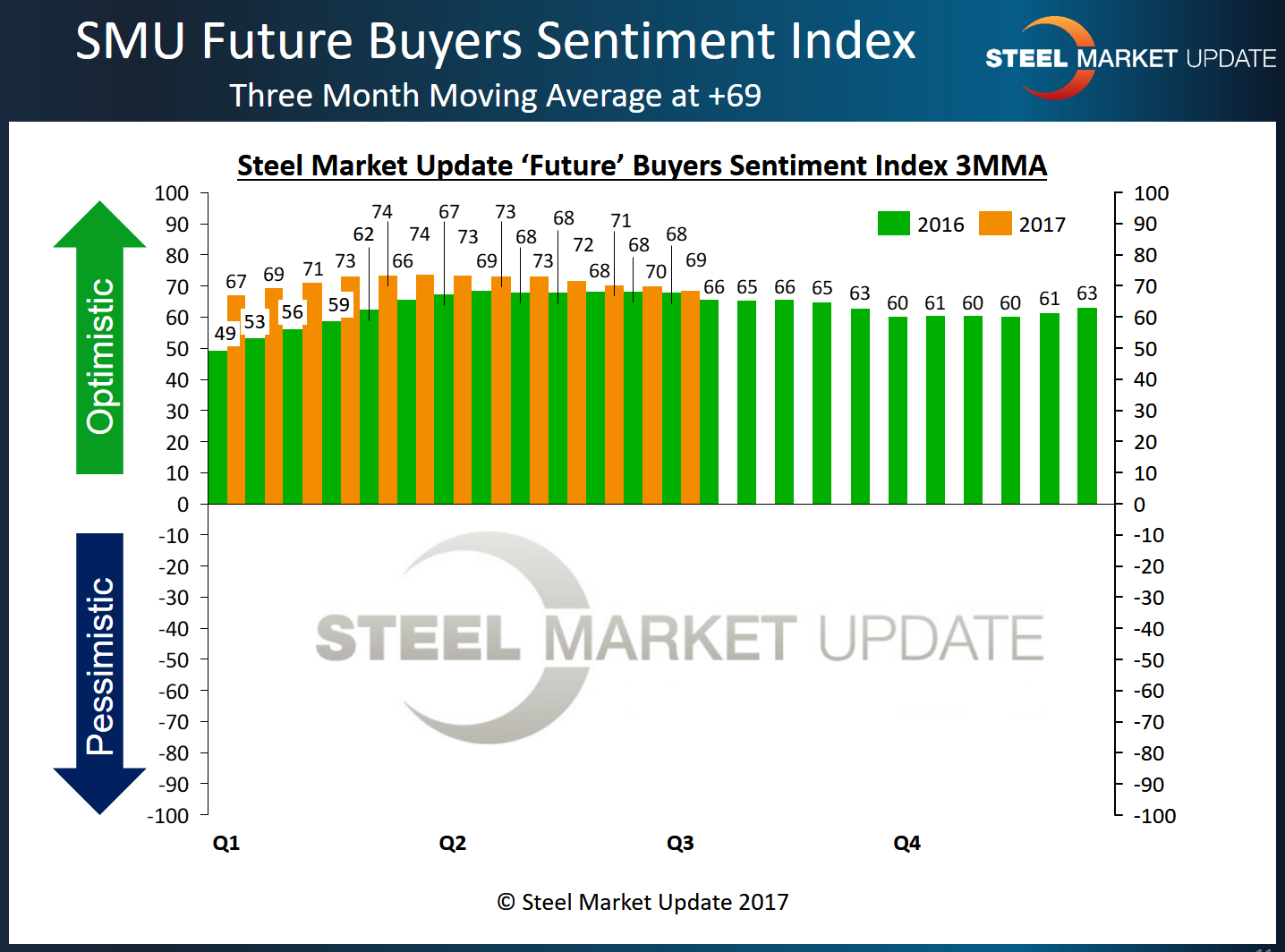

Future Sentiment, which is how flat roll buyers and sellers see their company’s chances for success three to six months into the future, registered +64, a dip of 3 points from the mid-June survey, and down from +69 at this time last year. This is the weakest Future Sentiment number we have seen since mid-November 2016.

Looking at Future Sentiment as a three-month moving average takes some of the volatility out of the index. As a 3MMA, the index registers +69, down from +72 a month ago. The +69 continues to be well within the optimistic parameters of our Index and is above the +67.83 we measured one year ago.

What Respondents are Saying

Most respondents’ comments reflected concern about the trade debate under way in the nation’s capital. Business conditions are poor, said one trading company executive. “We are not selling until there is clarity on 232.” Added a mill executive, “232 is a roadblock.”

One respondent from a leading service center said business is good, “but Section 232 could change this outlook overnight.” Said another: “Even three to six months down the road, there’s too much undetermined by the 232 trade investigation to feel confident.”

Historically speaking, as a single data point Current Sentiment is still fairly positive at +65, which is within sight of the index’s peak of +77 in March this year. But the trade debate in Washington clearly has made the steel market nervous. “There’s lots of uncertainty at the moment,” summed up another respondent.

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry. Positive readings will run from +10 to +100 and the arrow will point to the right-hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left-hand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 34 percent were manufacturers and 46 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.