Prices

July 6, 2017

232 Investigation Report Keeps Steel and Scrap Markets Well Bid

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

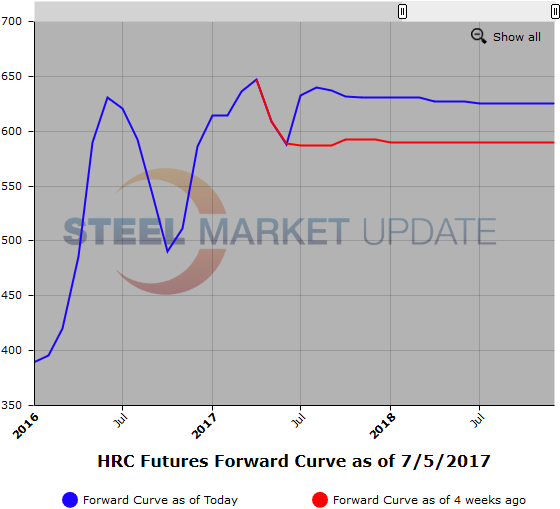

If you compare prices between last week and this week, you will see the HR futures market has found support and has risen between $8 and $10/ST. There’s a twofold reason. First, some restocking took place at service center levels, which extended lead times from mills, thus pushing mill prices slightly higher, as was recorded in the latest week’s indexes. Second, more importantly, is the 232 investigation that has been ongoing since mid-April. While no evidence of direction from DOC has been published or made public, it has provided positive sentiment to steel/scrap pricing. DOC reports were originally expected to be presented to POTUS and staff by end of June, but it has been delayed, or at least the announcement has been delayed. The release is now anticipated post G20 summit and potentially later. The moving target announcement date has left HR futures sellers more cautious and selling liquidity a bit thinner.

Most of the HR futures transaction activity occurred in the 2H’17 and more specifically in Q4’17 with the majority of prices transacted falling between $630 [$31.50/cwt] -$640/ST [$32.00/cwt]. In addition, Q1’18 also traded at $635/ST as part of a spread to Q4’17. Futures activity was moderate as 17,000 ST traded, in part due to the holiday shortened week and caution on the part of interested sellers.

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.

Scrap

Further, with Ramadan ending late June, the export market 80/20 (LME steel scrap) has seen a strong runup in price as some buying came back into the market on the back of cargoes trading in the mid 290 levels for 80/20. Futures prices in the near date quarter have pushed above $300/MT on healthy volumes. However, today, $298/MT traded Aug’17 SC in 1000 MT. Stronger than anticipated pentup rebar demand has been cited as the reason for the increase of cargoes being transacted at the higher prices (up $20/MT in the last few weeks). Strong export activity will potentially limit obsolete scrap movement from the coast to midwest markets and stabilize prices for shred.

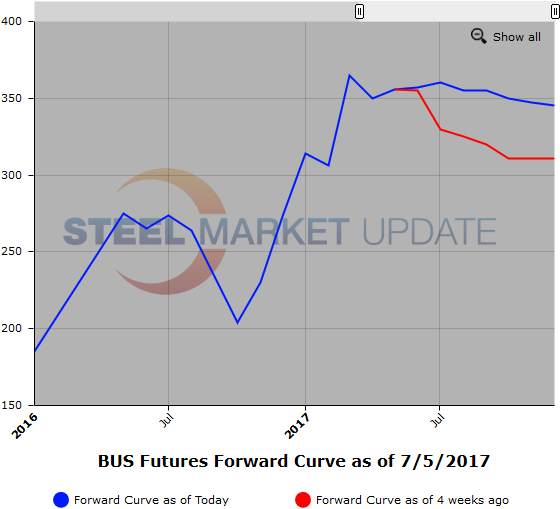

More of the same as prime scrap spot market prices look to continue moving sideways to slightly higher. In the BUS we have seen futures price bids move higher as HR futures traded higher and we move into summer shutdowns for a number of manufacturing plants, along with strong demand from tube producers. Last bids in Q3 & Q4’17 BUS were around $345-$350 per GT with sellers showing caution as they await the 232 investigation report. $340/GT traded Q4’17 BUS last.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.