Market Data

June 22, 2017

Sentiment Shows Slight Dip as Market Awaits Section 232

Written by Tim Triplett

The sentiment among buyers and sellers of flat rolled steel remains largely positive, according to Steel Market Update’s latest steel market analysis, although it has dipped a bit in the past month as the industry awaits a ruling on Section 232 and whether the government will further restrict steel imports on the basis of national security.

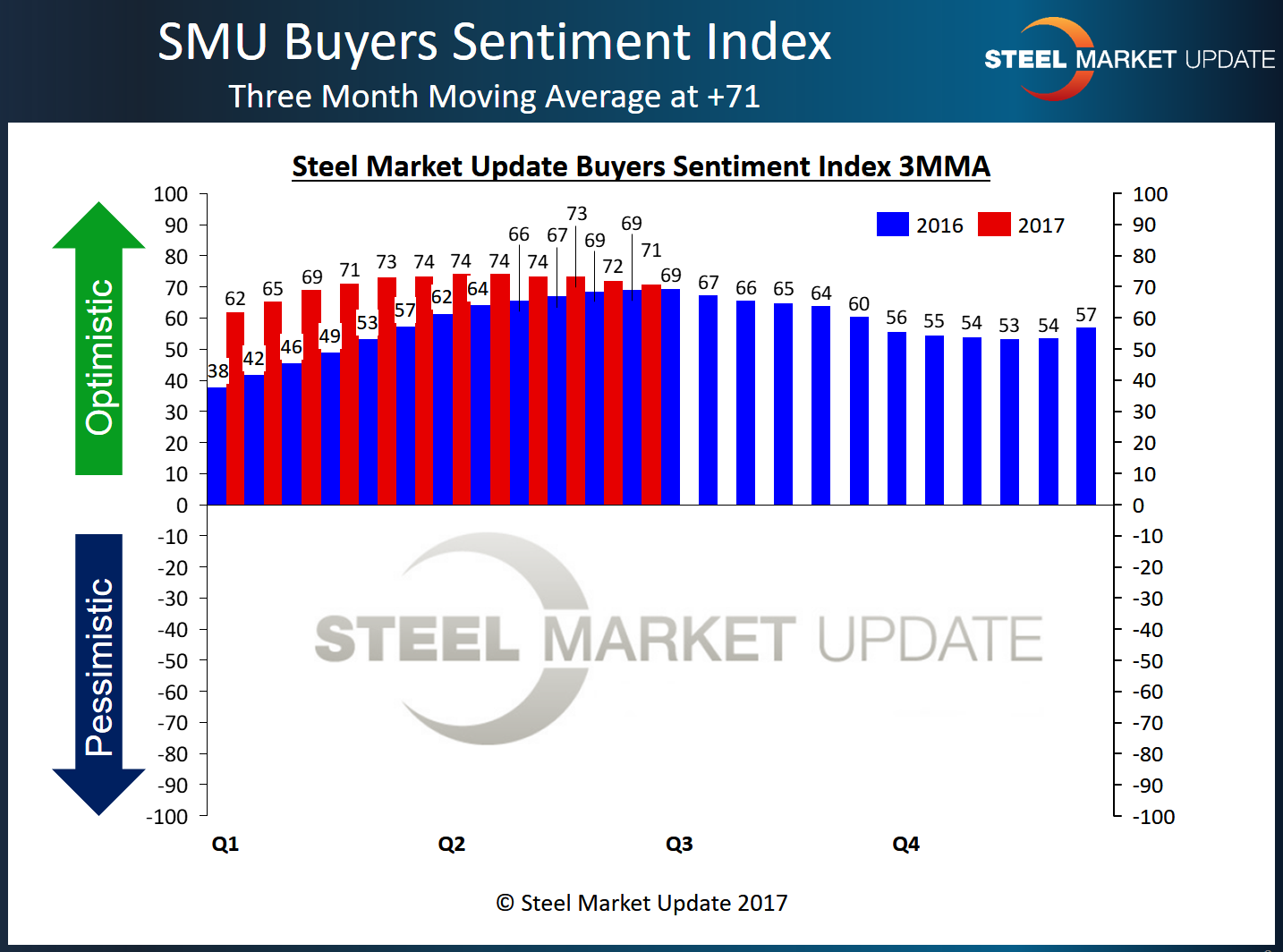

As a single data point, the SMU Steel Buyers Sentiment Index is at +65, down 5 points from last month and down 4 points from this time last year. At +65, the index shows most respondents are still fairly optimistic about business conditions. The highest reading for the index was +77 in March 2017.

Looking at Current Sentiment as a three-month moving average takes some of the volatility out of the index. As a 3MMA, the index registers +71, down 2 points from last month, but up from +69 at this time last year. The rising trend was broken a couple of months ago and has slowly been trending lower.

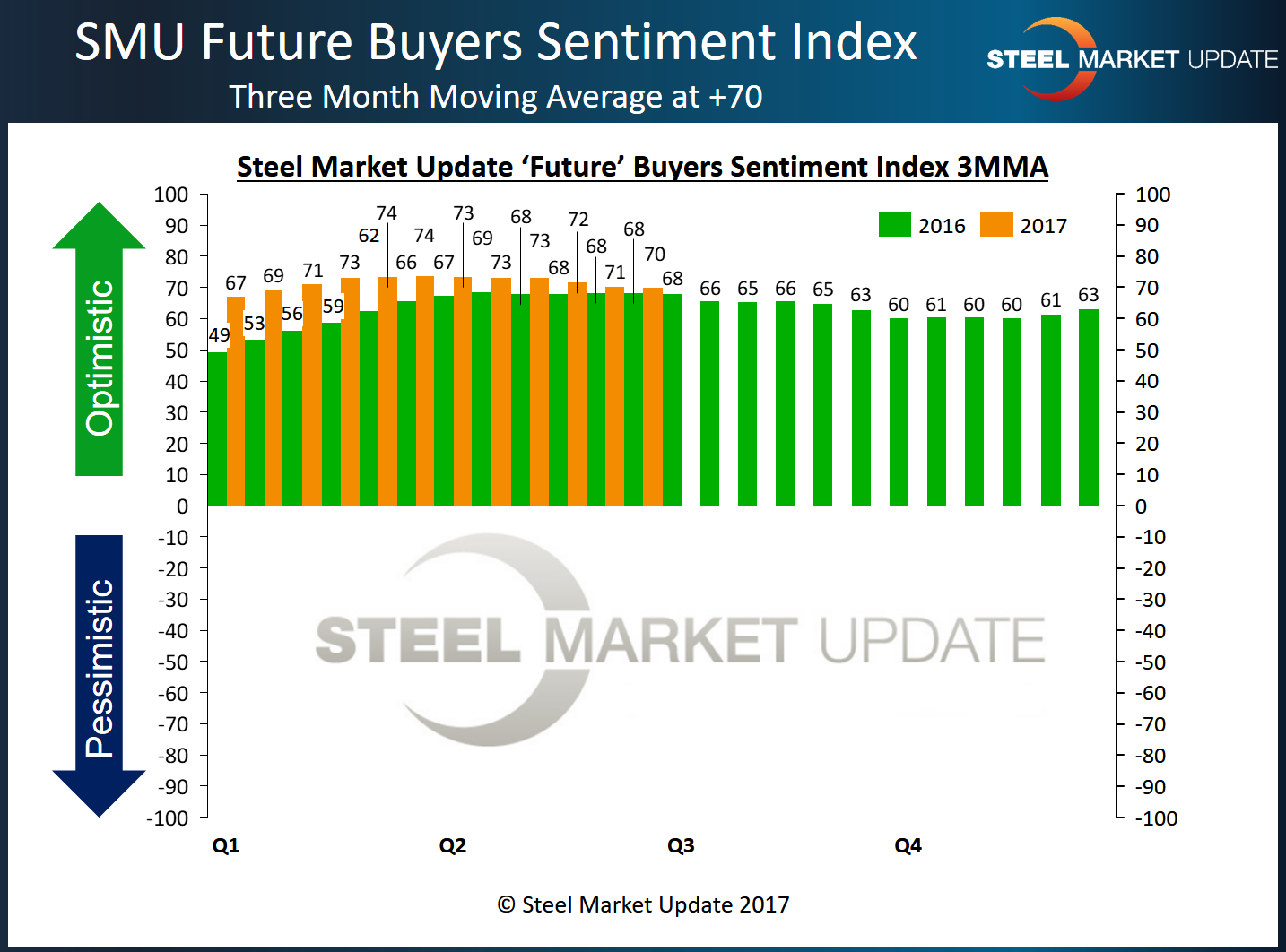

Future Sentiment Holds Steady

Future Sentiment is how buyers and sellers of flat rolled steel see their company’s chances of being successful three to six months into the future. As a single data point, the SMU Future Buyers Sentiment Index registers +67, the same as a month ago, but down from +71 a year ago. Looking at Future Sentiment as a 3MMA, the index is now at +70, down from +72 last month, but up from +68 last year.

What Respondents Are Saying

“Section 232 could push things either way,” said one mill executive. ‘Imports are silent as we await 232,” said another.

One service center executive considers his prospects for success to be only “fair.” As he commented, “There’s still a lot of cheap service center pricing being thrown around, sending confusing messages to buyers.”

About the SMU Steel Buyers Sentiment Index

SMU’s Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right-hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left-hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to over 650 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 35 percent were manufacturing and 48 percent were service centers/distributors. The balance of the respondents are steel mills, trading companies, and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.