Prices

June 22, 2017

Hot Rolled Futures: Consolidation of Rising Prices

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

Lack of certainty in forecasting future HR business continues to create excess price volatility. Longer lead times along with slightly lower production and more price increase announcements expected are generating some concern given the latest lean inventory data for service centers.

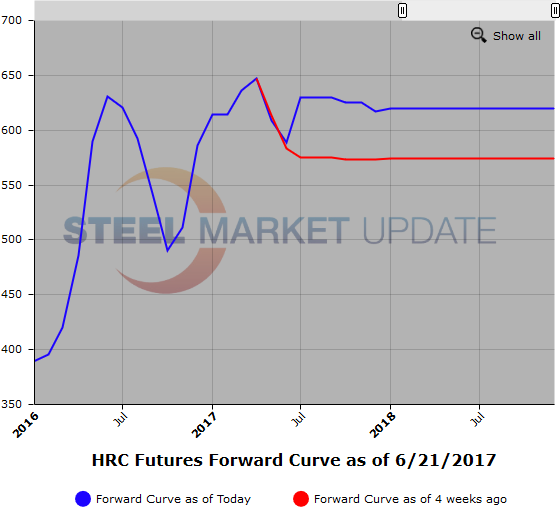

HR futures prices have continued to press higher but the pace has slowed dramatically as the market waits for some actionable news from the administration regarding section 232 report and the timing of possible implementation. Statements by Wilbur Ross regarding Section 232 report mid week along with a healthy increase in reported HR spot price indexes nudged participants to lift available offers and push nearby futures prices up to and above $630/ST. Some consolidation has occurred in the futures markets today as we have seen futures get sold off from yesterday’s highs.

This week a modest 17,380 ST volume traded in HR futures while open interest climbed slightly. The current shape of the HR futures curve as reflected by the weighted average of prices traded by quarter is as follows: The Q3’17 HR weighted average price of futures prices traded this past week reflects a $35/ST premium over Spot (the index that the CME uses to settle the HR contract). The Q4’17 HR weighted average price of futures prices traded this past week reflects a $28/ST premium over Spot (the index that the CME uses to settle the HR contract). The Q1’18 HR weighted average price of futures prices traded this past week reflects a $29.50/ST premium over Spot (the index that the CME uses to settle the HR contract).

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.

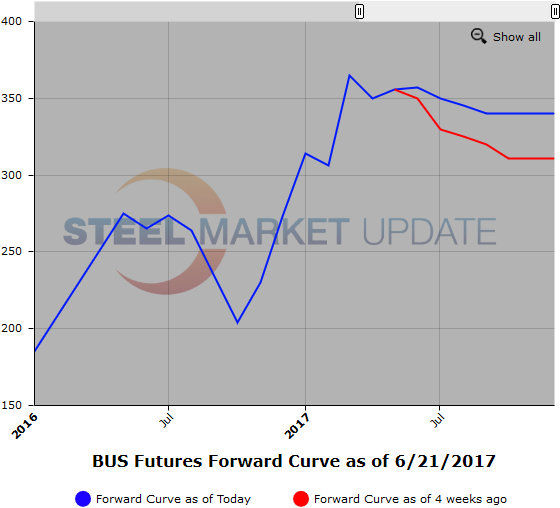

Scrap

Midwest prime scrap spot continues to move sideways in the mid to upper $350/GT range on continued expectations of supply tightness due to auto plant furlows. Steady export flows keeping East coast scrap heading East and thus supporting midwest scrap prices. BUS futures have been holding steady. The futures curve remains backwardated but the current discount to spot ($357/GT) is not large at just $12/GT for spot to Q3’17. Q3’17 BUS traded at $345/GT earlier this week which is $5 above the last Q3’17 trade from the prior week. Current Q4’17 buying interest has been coming in between $335 and $340/GT.

In the export 80/20 scrap market prices have been trading higher on the back of a number of cargoes with the last 80/20 reported trading at $281.50/MT. LME scrap futures have been softer along the curve this week which has it converging with spot which has moved up from the mid $270/GT range to the low $280/GT range.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.