Prices

June 21, 2017

Global Trade of Cold Rolled Coil Through Q1 2017

Written by Peter Wright

We are continuing our investigation to quantify the players in the global trade of both HRC and CRC. We now have data through Q1 2017. This information is sourced quarterly from the Iron and Steel Statistics Bureau in the UK. Data is not very current because many countries are slow in reporting, but we feel that the history does explain where we are now and shines a light on the relative position of the U.S. in the global picture.

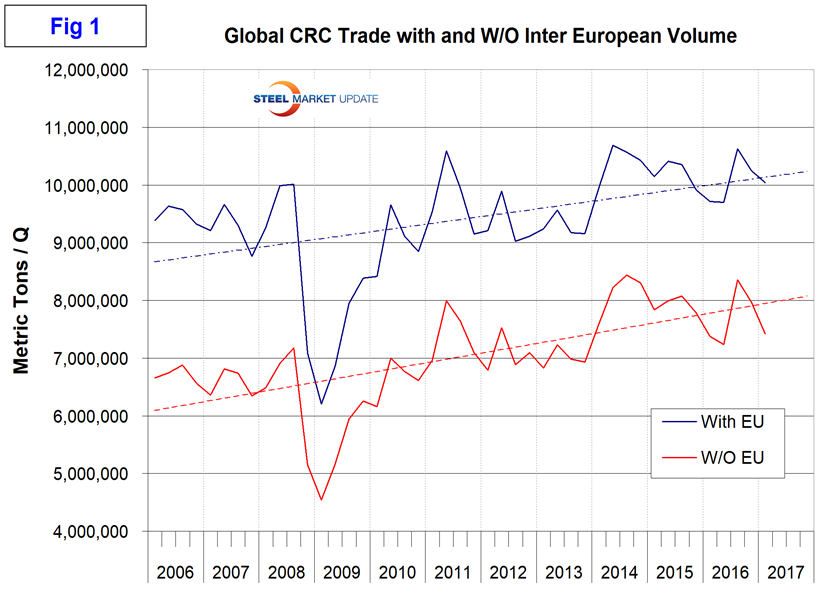

In 2016 as a whole, 40,208,000 metric tons of cold rolled coil were traded internationally. Excluding the tonnage traded within the EU, the global total in 2016 was 30,867,000 metric tons. Total trade of CRC declined in Q4 2016 and again in Q1 2017 when it reached 7,421,000 metric tons. Figure 1 shows the total global tonnage quarterly since Q1 2006 and also the total excluding the inter EU volume.

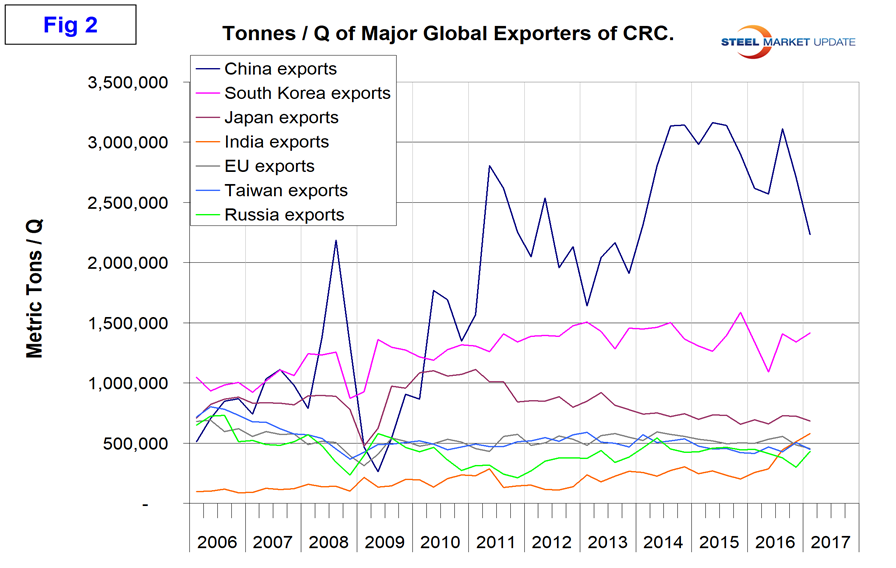

In this analysis, we use only the total excluding the inter EU trade to provide what we think is a more representative base for comparisons. The highest tonnage quarter since our data began was Q3 2014 with a total of 8,439,000 tons. The seven major exporters in the five quarters 2016 through Q1 2017 in order of volume were China, South Korea, Japan, the EU, Taiwan, India and Russia. Together these seven made up 83.8 percent of total global CRC trade in the last five quarters. The main takeaway is that India has more than doubled its export volume in the last year and that China is down by 28 percent between Q3 2016 and Q1 2017. Figure 2 shows the relative size of China as an exporter and that South Korea is second place and well ahead of the rest of the pack.

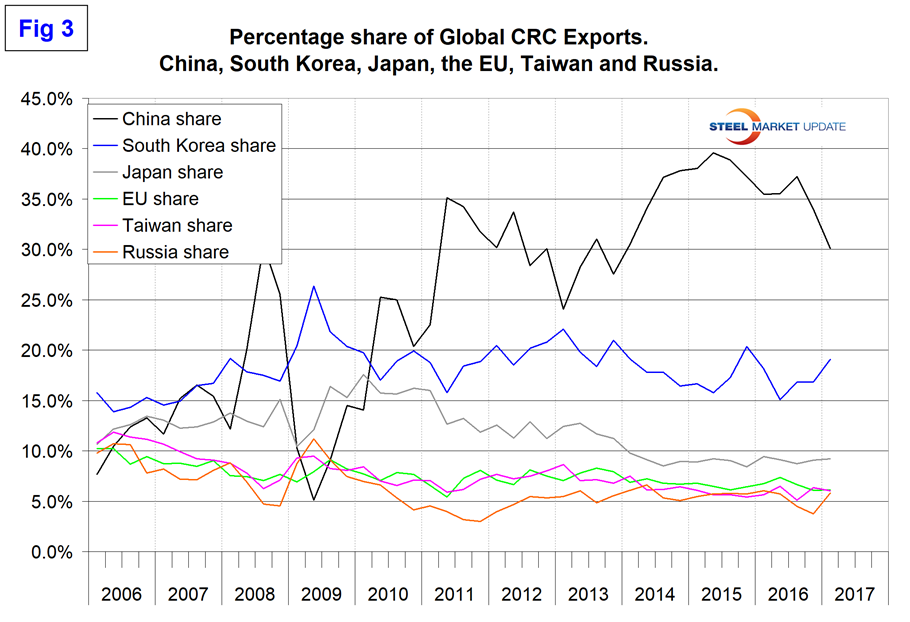

China exported 11,010,000 metric tons of CRC in 2016 and 2.2 million tons in Q1 2017. Figure 3 shows the export market share of the top seven nations.

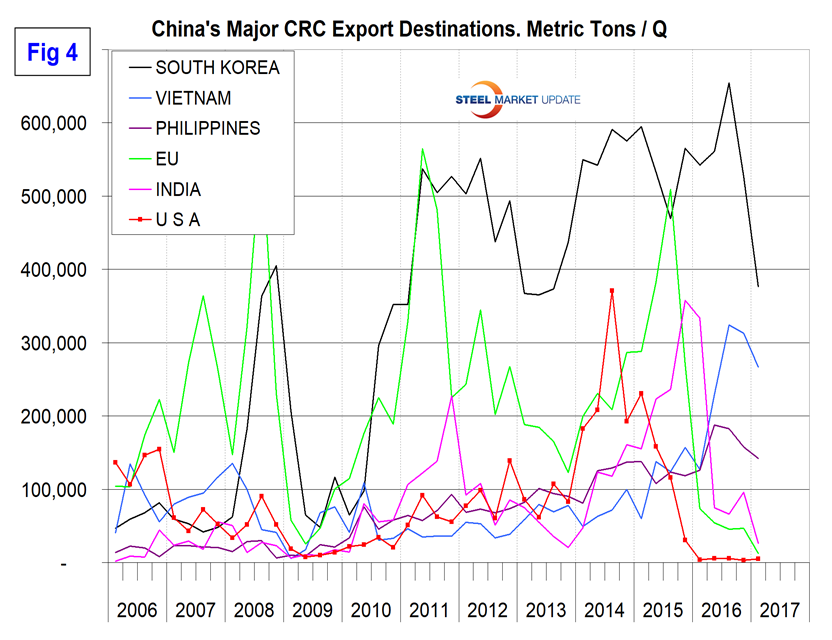

China has had a market share of more than 30 percent for the last 13 quarters with a declining trend since Q2 2015. There have been dramatic changes in the destination mix of Chinese CRC exports in the last five quarters, as much of the world plays defense against the Chinese onslaught. South Korea is by far the largest volume destination for China’s exports as shown in Figure 4, but Vietnam has expanded rapidly and is in second place.

The EU and India have successfully followed the lead of the U.S. in limiting the volume of Chinese material. China’s exports of CRC to the U.S. declined from 536,000 tons in 2015 to 18,000 in 2016 and to 5,111 tons in Q1 2017.

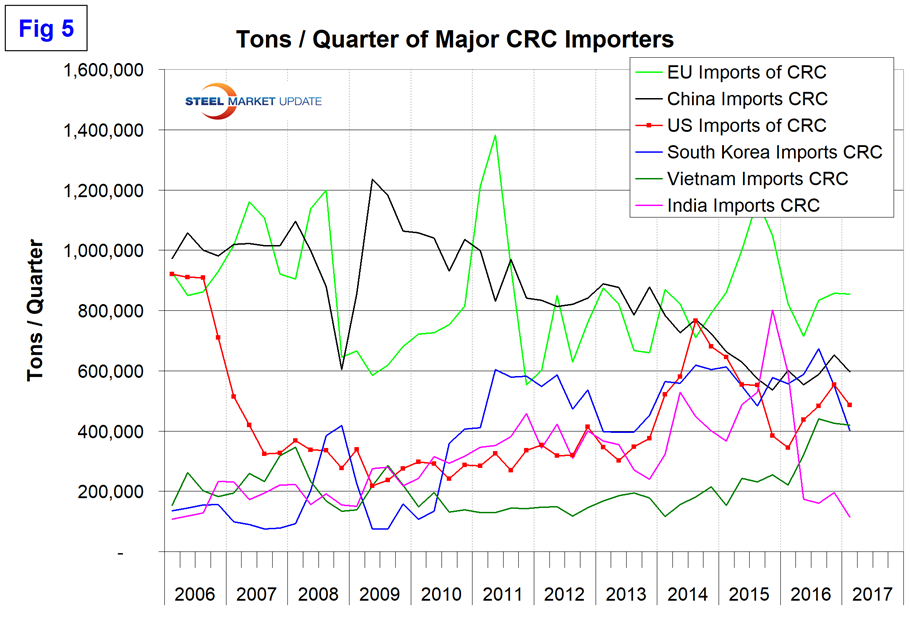

Figure 5 shows the top six importing nations through Q4 2016.

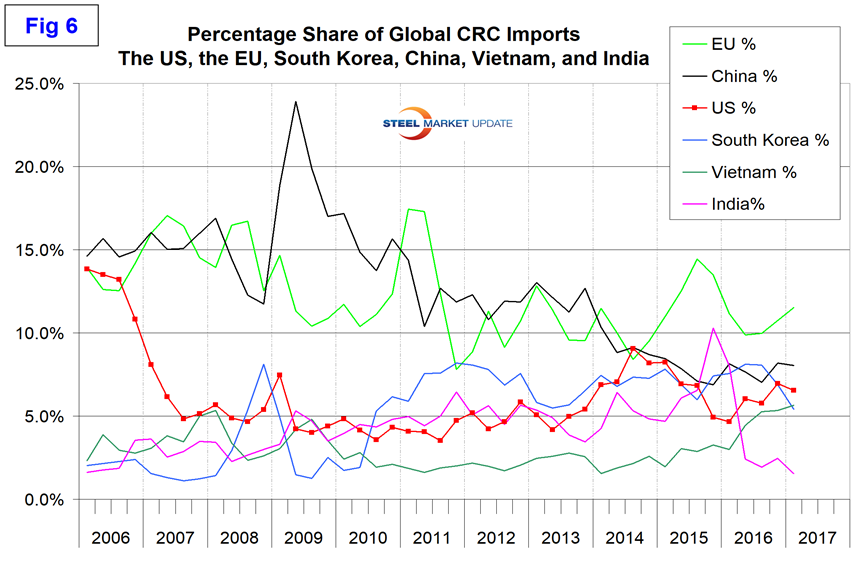

In the first quarter, the European Union was in first place, the U.S. was third and China second. The Chinese imports are almost all alloy steel. Figure 6 shows the import share of the top six players.

The reason for including both tonnage and share charts is that if the base is broadened the share of individual nations drops at the same time as their tonnage could increase.

The United States imported 6.5 percent of total global CRC trade in Q1, down from 6.9 percent in Q4 2016, which was the highest share since Q1 2015. As China was taken out of the equation, they were replaced by other suppliers.

As readers can imagine, there is a huge amount of date behind this analysis covering most (probably 99 percent) of the tonnage by source and the same by destination. This is a work in progress as we experiment with the best way to distill the data into the most revealing summary. We plan to repeat this exercise quarterly for HRC, CRC and global scrap trade for our premium subscribers.