Prices

June 8, 2017

Futures: HR Steel and Prime Scrap Buck the Downward Price Trend in Metals

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

This week we had a big reversal/correction week on week as HR futures curve prices traded higher as buyers reached for offers helped by this week’s mill price increase announcements, longer mill lead times, Trump’s Cincinnati comments and possible tariffs that could stem from Section 232 investigation , and sideways prime scrap prices. Initially buyers held back waiting to see if the futures prices would move lower, but the mill price increase announcements along with a smaller than expected drop in spot prices gave the markets a push in the opposite direction. The move does not appear to reflect any change in the current market fundamentals but rather market sentiment regarding a new trade environment.

Last week steel indexes posted a big drop ($10/$21) which took HR futures price down along with it, as Q3’17 HR traded $567/ST[$28.35/cwt] and Q4’17 traded $570/ST[$28.50/cwt].

Start of this week price support came in with buying driving up Q3’17 HR to $587/ST[$29.35/cwt] up $20/ST and Q4’17 HR being offered @ $590/ST[$29.50/cwt]. Today Q4’17 traded at $594[$29.70/cwt] and $595/ST[$29.75/cwt] which is up $25/ST from the prior week’s lows.

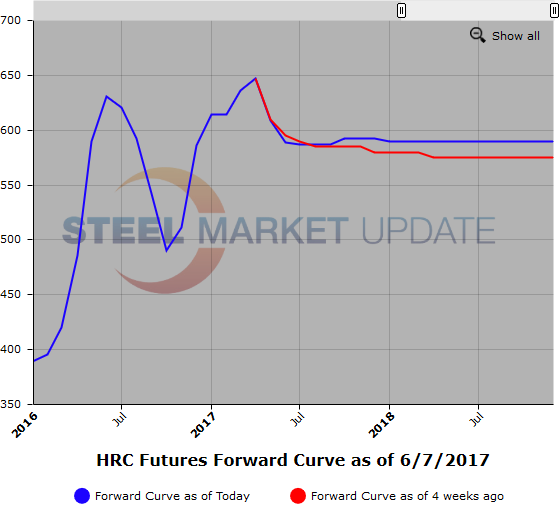

To show this shift in the HR futures curve around spot lets take a month ago and compare to today. A month ago spot HR was at $622/ST[$31.10/cwt] and Q4’17 was at $575/ST[$28.75/cwt] nicely backwardated.(-$47/ST). Today with spot reported around $580/ST[$29.0/cwt] and Q4’17 trading at $595/ST[$29.75/cwt] and now offered at $600/ST[$30.0/cwt] the market is in contango ($20/ST). Spot plus 1 month on out is basically flat with Q4’17 spread to 1H’18 trading flat price. The whole price differential falls between spot and 1st futures month. Open interest rose nicely this week to 13,660 contracts as 25,220 ST HR futures traded this past week in moderately active trading.

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.

Scrap

Midwest prime scrap spot continues to move sideways on continued expectations of supply tightness. Potential extended auto plant shut downs muddying the picture. Lots of discussions of prime scrap being imported but current prices do not reflect improving supplies. Detroit prices were reported basically unchanged from last month.

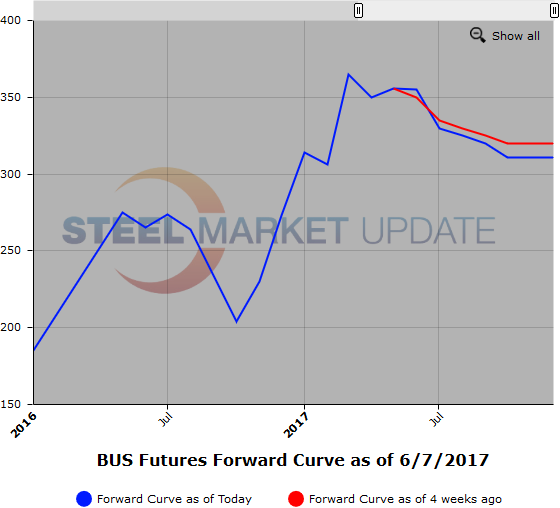

BUS futures have been holding steady. Today 2H’17 BUS traded at $325/GT which reflects softening prices going into the latter half of the year.

The prime to obsolete scrap spread appears to be widening as shred prices are expected to drop $10/$15 a ton. In the export 80/20 scrap market prices continue to hover in the low to mid $270/MT range with a few recent cargoes changing hands for July delivery. Today Jun/Dec’17 traded at $274/MT pointing to a relatively flat futures curve at the moment.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.