Prices

June 5, 2017

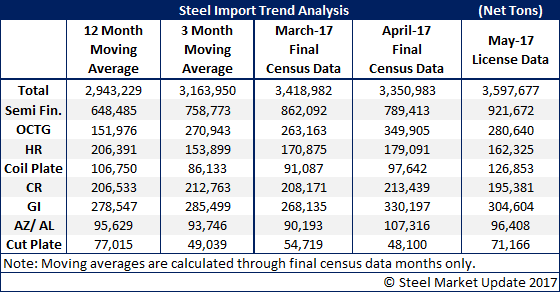

April Final Imports = 3,350,983 Tons

Written by John Packard

On Friday, the U.S. Department of Commerce released Final Census Data on foreign steel imports for the month of April 2017. As expected, the month was another large one with imports totaling 3,350,983 net tons. This is above both the 3-month and 12-month moving averages.

License data for the month of May approached 3.6 million net tons.

One of the key factors in the higher import tonnages is the amount of foreign slab and billet being brought into the country by the domestic steel mills. There were 789,413 net tons of semi-finished products imported by the mills during the month of April. License data is suggesting that number could increase to over 900,000 net tons of slabs/billets during the month of May.

Other items that have to be of concern to the domestic steel industry are: OCTG (oil country tubular goods) which hit 349,905 net tons in April. Galvanized is another item topping 300,000 tons with 330,197 net tons in April and once again May appears to be close to topping the 300,000 ton level. Galvalume imports are also high with 107,316 net tons in April and May is on pace to come close to the 100,000 ton level.