Prices

June 1, 2017

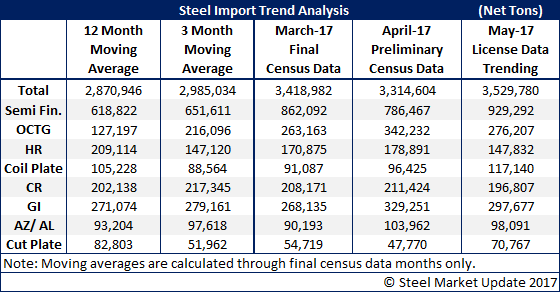

Foreign Steel Imports Trending Toward 3.5 Million Tons

Written by John Packard

As the month of May comes to a close we are seeing import license data from the U.S. Department of Commerce suggesting foreign steel imports of 3.5 million net tons. This would be 200,000 tons higher than April and 100,000 tons above March – both of which we extremely high months for imports based on what we have seen since the AD/CVD trade suits were filed in 2015.

As reported earlier in May the biggest line item was semi-finished steel imports which are going directly to the domestic steel mills. Semi’s appear poised to be 200,000-300,000 tons greater than both the 12-month moving average as well as the 3-month average.

Hot rolled imports are muted while galvanized imports are trending toward another 300,000 ton month.