Prices

May 23, 2017

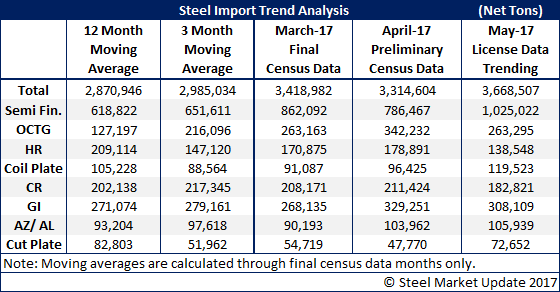

May Foreign Steel Imports Trending Toward 3.6 Million Tons

Written by John Packard

The U.S. Department of Commerce (DOC) reported foreign steel import license data earlier today. May licenses continue at a 3.6 million net ton pace which is quite disturbing (and probably not well timed based on the Section 232 hearing happening on Wednesday). However, almost one-third of the imports are attached directly to the steel mills themselves. The import license trend is for 1 million net tons of semi-finished steels – which are only used by steel producers.

Looking at flat, hot rolled continues to be low trending toward 138,000 net tons which is below both its 12-month and 3-month moving averages. Cold rolled is also down while galvanized continues to buck the trend and looks like it will exceed 300,000 net tons for the second straight month. Other metallic (most of which is Galvalume) is also on pace to exceed both its 12-month or 3-month moving averages.