Analysis

May 14, 2017

Construction Still Has Legs

Written by Sandy Williams

Construction has expanded in the U.S. for over 30 quarters, and it still has legs, said Alex Carrick, Chief Economist at ConstructConnect.

ConstructConnect presented a webinar May 11, entitled “Bump or Slump? 2017 Prospects for Design & Construction. AIA chief economist Kermit Baker and AGC of America Chief Economist Ken Simonson joined Carrick in discussing the construction industry.

Why does Carrick think the industry still has legs? First of all, in the past ten years residential construction has been short of the historical annual average of 1.5 million units per year. The accumulative total shortfall during that period is about 6 million units, said Carrick, about 4 years worth of normal construction. When residential gets back on track it will become an “engine of growth,” he said. In addition, Millennials are expected to begin starting families and move out from urban areas to the suburbs which should spur residential construction as well.

Second, the stock markets are doing great without help from the resource sector, commodity prices are increasing and global trading is improving.

Third, the U.S. has broken free of its dependency on fossil fuel imports, improving the trade balance and instilling confidence within the economy.

There are risks facing the industry, however, many having to do with the Trump Administration. Although tax cuts, deregulation and infrastructure spending sound good upfront, other Trump polices have negative impacts on the economy.

Carrick noted the travel ban and anti-immigration stance of the Administration is affecting tourism and foreign student enrollment at universities. The immigration policies have also left high tech industries worrying about their ability to recruit global talent.

American Made and American Jobs First policies are helpful to some industries while detrimental to others. The American Jobs First policy returns wage negotiation power back to labor, especially in the current tight labor market where unemployment is at 4.5 percent, said Carrick. The protectionist American Made policies raise both domestic costs and import prices, he added. Both policies could lead to “traditional inflation flare-ups” said Carrick.

Simonson added during the question answer period, that there are two words he associates with protectionism: retaliation and inefficiency. There is no way to know what response countries will have to import tariffs or Made in America policies. Also, over a long period, industries come to rely upon protectionist policies, said Simonson, and you get creeping inefficiency.

Construction starts and employment numbers

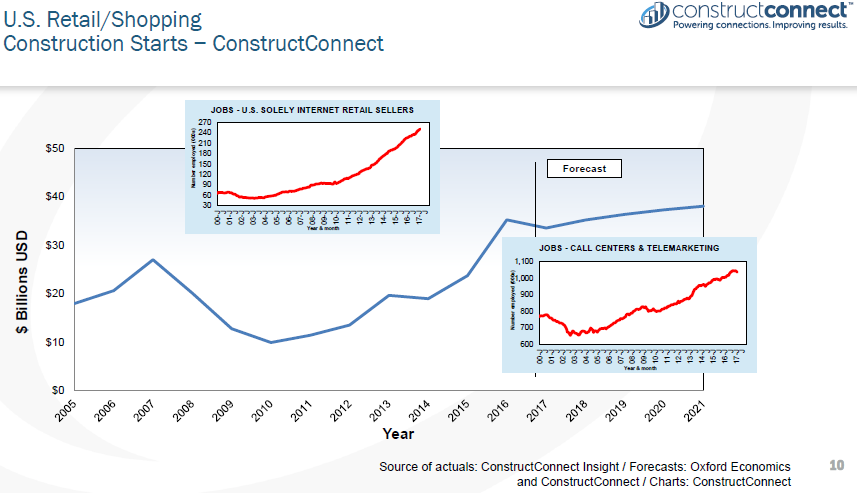

When looking at construction starts for the construction sectors it helps to also look growth for jobs in the sectors. Watching the trends in employment can improve forecasts for starts. For instance, retail/shopping construction starts are doing pretty well right now but if you look at the sharp increase in jobs for internet retail sellers and telemarketers it highlights concerns about whether brick and mortar stores will give way to online stores and distribution centers.

Hotel and Motel construction is highly cyclical and the sector has had significant job growth. In April 55,000 new jobs were reported for the sector. This includes food services and drinking establishment employment that never dipped and continues to improve. Carrick noted that when one hotel renovates others often follow suit.

Private office construction follows vacancy rates determined by jobs in the financial sector and legal services. Financial jobs plummeted during the recession but are back to 2006-2007 levels. Legal services, however, fell in ’09 and have been relatively flat since. The forecast for private office construction shows an increase through 2017 and 2018 before declining beginning in 2019

Warehouse and storage jobs have been on the rise since 2010. Warehouse construction began picking up around then as well and since 2015 has been trending upward. Giant distribution centers are being built and the next wave, said Carrick, is smaller local distribution centers to deliver items like groceries, hot meals, and flowers. ConstructConnect expects the upward trend to continue through 2021.

Industrial and manufacturing construction starts are expected to accelerate slowly in the next few years. 2016. Manufacturing jobs plummeted from near 17.5 million in 2000 to less than 12 million in 2009. Although jobs have increased slightly since then they are not expected to return to the peak years. Jobs in automotive have returned but much of manufacturing has shifted to automation and robots. Fewer exports are going out due to the strong U.S. dollar and protectionist policies will likely result in higher inputs costs. ConstructConnect forecasts a 0.5 percent y/y drop in industrial construction spending for 2016, followed by increases of 7.5 percent in 2018, 3.3 percent in 2019, 3.2 percent in 2020, and 2.2 percent in 2021.

Hospital construction grew in 2015 as the medical industry became more confident about the ability of Obamacare to deliver. In 2016, starts plummeted as the election clouded the future of healthcare insurance. What is continuing to do well, however, is nursing homes and assisted living construction and, as the baby boomers age, jobs for care providers are also increasing. Construction in the sector is on an upward trend for the next few years.

Education construction is being determined by demographics. There is more momentum in K-12 construction starts to accommodate young students. Jobs in K-12 are also accelerating faster than in higher education. Where Millennials decide to live as they have kids will also determine school construction. Suburban living will spur new construction while urban living will require repurposing older buildings. Higher education construction is being driven by research ventures and wealthy alumni dollars. Educational construction starts are expected to increase slightly between now and 2021.

Heavy engineering and civil construction starts are expected to remain on an upward trajectory and be helped by improvement in the oil and gas industry and infrastructure, if spending is ever approved. Coal jobs have plummeted and will not be turning around, said Carrick. Coal is being supplanted by cheaper natural gas. Technological changes making appliances and lighting more efficient and heating homes with gas have caused electrical usage to flatten out.

Economic Indicators and AIA

Kermit Baker, Chief Economist at the American Institute of Architects, said leading economic indicators suggest the economy remains healthy but the surge in late 2016 is waning. Economic growth slowed in the first quarter of 2017. The current economic cycle is in its eighth year and is the second longest in the past 50 years. The longest was a 10 year cycle from 1991-2001. Baker said there is concern about “borrowed time” and when growth will ease off.

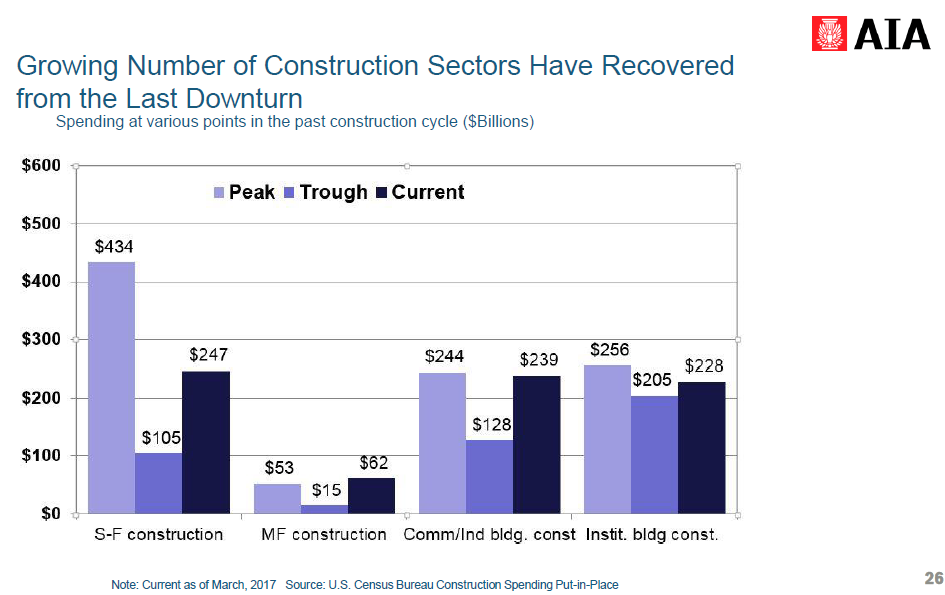

The chart below, from AIA and the US Census Bureau Construction Spending Put-in-Place, shows how construction sectors have fared since the downturn. Multifamily construction spending has exceeded its peak during the cycle but single family construction is well below. Commercial is nearing its peak but institutional spending has been slow to catch up. Total nonresidential construction spending in Q1 2017 is up 5 percent the same period in 2016.

The key risks facing the construction industry, said Baker, is housing affordability for owners and renters, labor shortages, and overbuilding in some markets.

Affordability

Large metro areas are seeing price-to-income ratios exceeding historical averages preventing younger households from buying in those markets. A clear regional pattern emerges for households 35 and younger. The top ten markets for home affordability for the demographic are mostly in the interior areas of the U.S. with the 10 most unaffordable markets in large metropolitan areas of New York, Florida and the West Coast. Austin, Texas is also one of the ten least affordable markets for younger homeowners.

Labor shortage

Available skilled workforce in the construction has been in decline. Gender is one of the challenges the industry is facing. In the U.S. half of the workforce is made up of women but only three percent of women work in construction, a percentage that hasn’t grown in 15 years and, in fact, has declined.

Second, is age. Construction work relies on younger workers, said Baker, but the Millennial generation, the largest in history, has the smallest percentage working in construction of the past 50 years. A survey of 18-25 year olds showed that construction was the least mentioned career path with just 3 percent considering it.

A third factor affecting the construction workforce is the heavy reliance on immigrants, particularly Hispanics, and whether tightened immigration policies will cause available worker levels to decline.

Overbuilding

Multi-family construction experienced overbuilding as strong rent growth spurred construction. Rents increases are finally beginning to slow but not before reaching levels that pushed potential renters out of the market. Increases in apartment rent prices continue to outstrip home and commercial real estate prices, said Baker.

ABI outlook

The Architecture Billings Index (ABI) began recovering in 2012, peaked in 2014 and began slowing in 2014-2016. AIA expects the volatile Index to be positive but slower in 2017 compared to last year.

New design contracts are coming in faster than completions. In 2011 backlogs were at 4 months, and are now at 6 months. Design firms are facing labor shortages and finding it difficult to easily expand to keep up with demand.

All the real estate sectors are entering or well into the late stages of the investment cycle, said Baker based on vacancy/availability rates and rental rate changes.

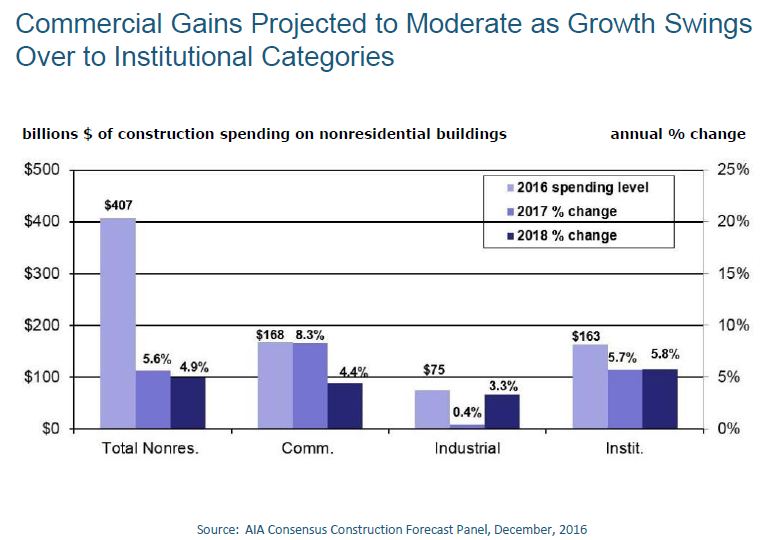

Below is AIA’s forecast for nonresidential construction spending.

Policies affecting construction

Ken Simonson, chief economist at the Associated General Contractors of America, talked about government policies that are affecting construction.

“There are seven areas of policy uncertainty affecting construction which have grown since election day or even the latest tweet,” said Simonson.

1) Infrastructure. Promises of investment in infrastructure have not materialized and there have been contradictory signals from the Administration. A plan was said to be imminent and later it was said there would not be time for the Senate to take it up until 2018.

2) Immigration. The tone towards immigrants has changed, said Simonson, with more vigorous action by customs and enforcement. More people are being deported and less coming in, changing the workforce dynamics. Industries that are losing foreign employees are competing for the available worker pool. Communities are feeling the loss of workers and families by less demand for schools, stores, and a reduced tax base.

3) Trade policy. Some companies have decided to keep plants open or do more domestic construction. Foreign countries that resist sending imports here due to trade policies, will hurt the trucking, transportation and ports; outweighing benefits to manufacturers. Lumber and steel prices are likely to go up.

4) Regulatory relief. Some regulations have been rolled back but others delayed. Most regulations are at the state and local level rather than federal. Simonson noted that although Trump approved the Keystone XL pipeline it will not go forward until Nebraska agrees and that may take additional time.

5) Healthcare. Hospital construction will likely be on hold until administrators know more about reimbursement and utilization rates after repeal of Obamacare. Spending cuts at NIH and CDC will hinder construction investment.

6) Fiscal. What kind of tax cuts will be made and who will they benefit? Many of Trump’s spending and many of Trumps cuts have been ignored by the House and others need to be negotiated. Building and infrastructure spending will be uncertain until a bill is passed which may not be until after the fiscal year.

7) Monetary: Will interest rates go up and how will they impact on housing and state and local bonds?

The steel use in construction will be particularly strong for high rises and office buildings, said Simonson. Some slowing is expected in apartment construction, especially luxury buildings, but the predilection for younger households to remain in cities bodes well for high rise construction. Baker added that lumber tariffs may lead to more study of steel use in single family homes.

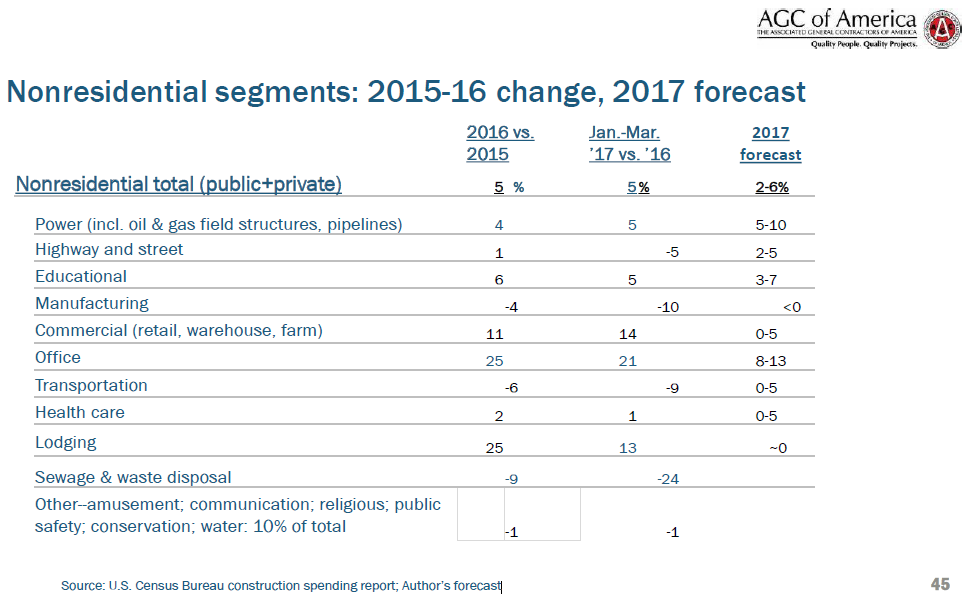

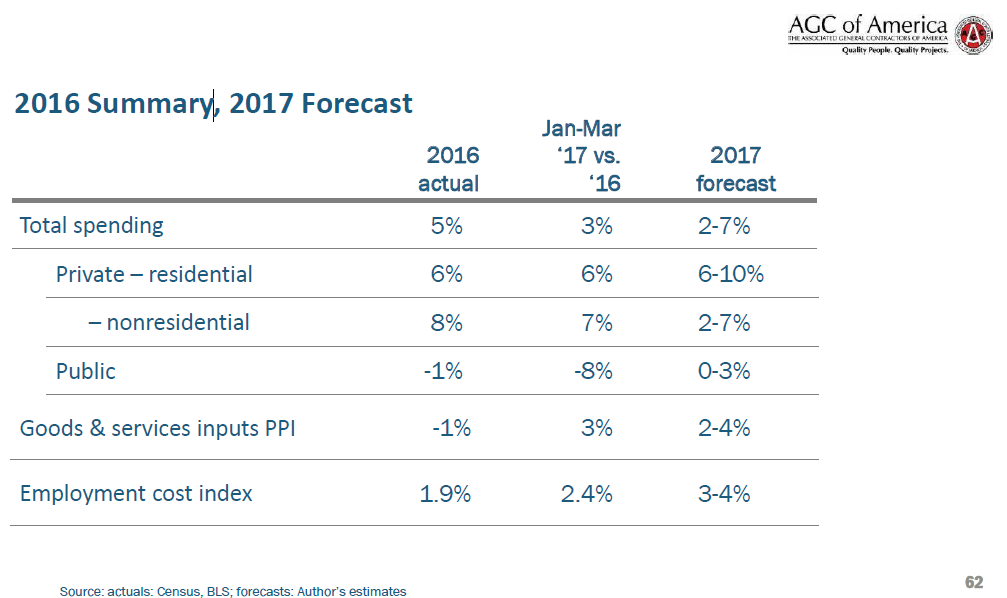

Below are the forecast charts from ConstructConnect and from AGC: