Prices

May 11, 2017

Hot Rolled Futures: Buying the Dips

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

We have seen some evidence late this week of participants “buying the dips” in what has been a rather thin and choppy HR futures market. The HR market looked quite soft earlier this week, but lack of a clear sell signal on Wednesday seems to have given some folks the signal driver to buy the dip. Most of the spot indexes have given the markets a divergent signal for the second week in a row. It appears the mills seem to have shown greater pricing discipline supported by longer lead times and stubbornly tight scrap supplies.

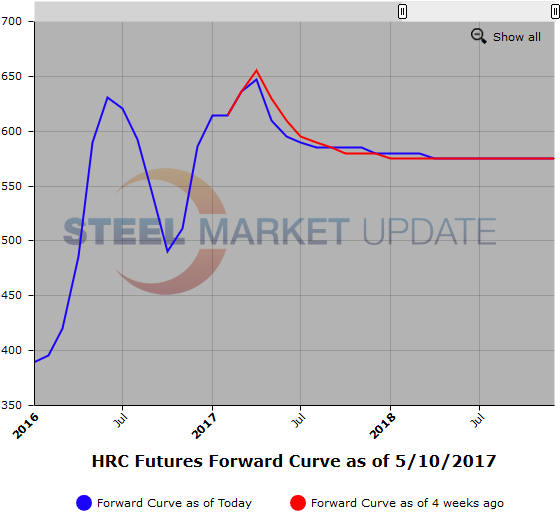

This past week in the futures we traded a modest 17,300 ST mainly in the balance of Calendar 2017. Jul/Aug’17 traded at $580/ST as did Q3’17 earlier this week. Q3’17 also traded at $577/ST. Today we had a flurry in the Q4’17 period at $580/ST, $585/ST and $590/ST was paid up from lower offer levels we saw late last week.

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.

Scrap

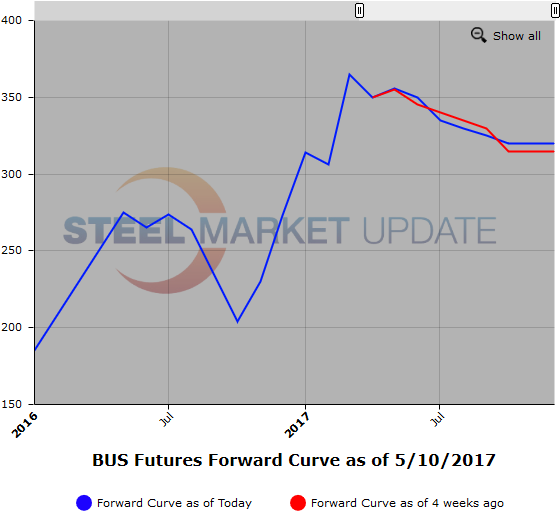

There has been continued support on 80/20 Scrap and BUS. The BUS was up $6 from April at $356/MT. Early discussions point to June to be sideways to May prices as market sentiment is that near term BUS has support, basis tightness in supply that will be further exacerbated by auto shut down for maintenance and flows of primary into the market are expected to be down. The BUS curve is basically unchanged over the last few weeks due to supply uncertainty. However we did see the metal margin spread trade today at $268 as Q4’17 HR traded at $586/ST versus the BUS trading at $318/GT. The trade was a touch lower than where we have seen the Q4’17 offered recently.

Scrap (80/20) seems to have short term support but getting a sense that there may be some softening sooner on that front. We have moved up nicely over the last week and a half as the Turkish mills helped push prices back up on their latest restocking. The front months have been basically holding $275/280 per MT the last few days on light trading volumes as the market looks for another buy signal.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.