Overseas

May 11, 2017

Analysis of Foreign vs. Domestic Hot Rolled Coil Prices

Written by Brett Linton

The following calculation is used by Steel Market Update to identify the theoretical spread between foreign hot rolled steel import prices (delivered to USA ports) and domestic (USA) hot rolled coil prices (FOB Domestic mills). We want our readers to be aware that this is only a “theoretical” calculation as freight costs, trader margin and other costs can fluctuate ultimately influencing the true market spread.

Our primary numbers for this exercise are from Platts as we compare European HRC (FOB Ruhr), Turkey HRC export pricing (FOB Turkey), and Chinese HRC export prices (FOB Chinese port). Be aware that Chinese hot rolled is not available to the U.S. market so the Chinese spread is nothing more than an exercise of what if… SteelBenchmarker is the secondary data provider of foreign hot rolled coil prices and is noted further down in this article.

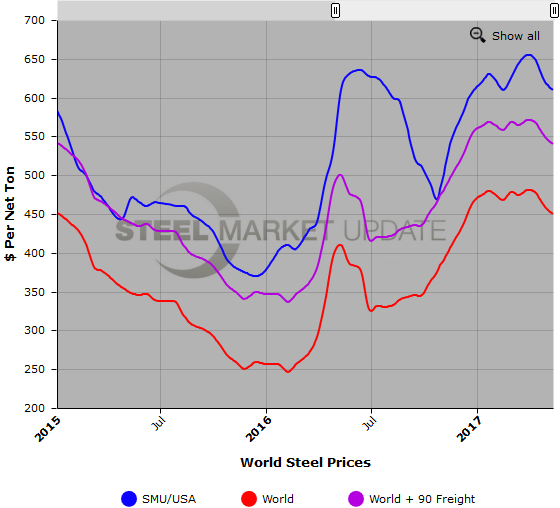

![]() SMU adds $90 per ton to these foreign prices taking into consideration freight costs, handling, trader margin, etc. This provides an approximate “CIF US ports price” that can then be compared against the SMU US hot rolled price average (FOB Mill), with the result being the spread (difference) between domestic and foreign hot rolled prices. As the price spread narrows, the competitiveness of imported steel into the United States is reduced. If the spread widens, then foreign steel becomes more attractive to US flat rolled steel buyers. A positive spread means US prices are theoretically higher than foreign prices, while a negative spread means US prices are cheaper than foreign prices.

SMU adds $90 per ton to these foreign prices taking into consideration freight costs, handling, trader margin, etc. This provides an approximate “CIF US ports price” that can then be compared against the SMU US hot rolled price average (FOB Mill), with the result being the spread (difference) between domestic and foreign hot rolled prices. As the price spread narrows, the competitiveness of imported steel into the United States is reduced. If the spread widens, then foreign steel becomes more attractive to US flat rolled steel buyers. A positive spread means US prices are theoretically higher than foreign prices, while a negative spread means US prices are cheaper than foreign prices.

As of today (Thursday, May 11) Platts published European HRC prices at $523 per net ton ($530 Euros per metric ton), down $12 from two weeks ago and down $2 from one month ago. Calculating in $90 per ton for import costs, that puts prices at $613 per net ton from Europe delivered to the US. The latest Steel Market Update hot rolled price average is $610 per ton for domestic steel, down $15 per ton compared to the last time we did an update on world prices on May 2nd, and down $40 per ton over one month ago. This puts the theoretical spread between European and US HR prices at -$3 per ton, down from +$0 two weeks ago, and down from +$35 one month ago. This means that currently US sourced HR is theoretically $3 per ton cheaper than getting HR steel imported from Europe.

Chinese HRC prices were reported at $379 per net ton ($418 per metric ton), down $2 from two weeks ago and down $22 over one month ago. Adding $90 in estimated import costs, that puts prices around $469 per ton delivered from China (if China were able to ship to the United States, which they are not). The theoretical spread between the Chinese and US HR price is +$141 per ton, down from +$154 per ton two weeks ago and down from +$159 per ton one month ago. Meaning that if Chinese HR were able to be shipped to the US, it would be approximately $141 per ton cheaper than buying domestic steel.

Platts published Turkish export prices at $463 per net ton FOB Turkish port ($510 per metric ton), down $4 over two weeks ago and down $18 from one month ago. Adding $90 in import costs, the Turkish HRC “to the US ports” price is $553 per ton. This puts the theoretical spread between the Turkish and US HR price at +$57 per ton, down from +$68 two weeks ago and down from +$79 one month ago. This means that HR from the US is theoretically $57 per ton more expensive than importing HR from Turkey.

We have learned through our trading sources that Turkish hot rolled was sold last week for $580-$590 into the West Coast USA. We have also heard $575 prices in the Gulf. However, we spoke at length with one of the trading companies dealing with Turkish steel and he advised us that due to the Section 232 investigation and the lack of transparency regarding the risk of bringing new orders into the country that they are taking a month off and taking a wait and see attitude.

SteelBenchmarker World Export Price

The SteelBenchmarker world export price for hot rolled bands is $450 per net ton ($496 per metric ton) FOB the port of export according to data released by SteelBenchmarker on Monday May 8th. This is down $13 per ton from the previous release on April 24th and down $28 from one month ago. Adding in $90 in estimated import costs, that puts prices around $540 per ton delivered to the US. As previously mentioned, the latest Steel Market Update hot rolled price average is $610 per ton.

Therefore, the theoretical spread between the SteelBenchmarker world HR export price and the SMU HR price is +$70 per ton, meaning foreign HRC imported into the US is theoretically now $70 per ton cheaper than steel purchased domestically. This spread is down from +$72 from our previous analysis and down from +$82 one month ago.

This $70 spread is $5-10 per ton lower than the average spread seen over the last few months. This time last year, the spread was +$110 per ton, and continued on to reach record high spreads over the summer, with the June 27th 2016 spread of +$210 being the record high in our 7+ year recorded history, and the July 14th 2016 spread of +$204 being the second highest. Prior to 2016, the previous highest spread was +$94 in May 2014. The lowest spread in our history was -$70 in August 2011 (meaning domestic steel was theoretically $70 per ton cheaper than foreign steel). The lowest spread in 2017 so far was the February 13th spread of +$52 per ton. The average spread for 2017 YTD is +$68.

We want to again remind our readers that the calculations shown above are “theoretical” but in most markets are probably a good indicator of where you can expect to find offers being made. However, we are not living in normal times and the combination of dumping suits and now the Section 232 self-initiation review by the U.S. Department of Commerce is turning the market on its head. We will continue to watch market developments closely.

Freight is an important part of the final determination on whether to import foreign steel or buy from a domestic mill supplier. Domestic prices are referenced as FOB the producing mill while foreign prices are FOB the Port (Houston, NOLA, Savannah, Los Angeles, Camden, etc.). Inland freight, from either a domestic mill or from the port, can dramatically impact the competitiveness of both domestic and foreign steel.

Below is a graph comparing SteelBenchmarker world HR export prices against the SMU domestic HR average price (we will build new data using Platts and replace the SteelBenchmarker data once we have collected a sizable history). We also have included a comparison with freight and traders’ costs added which gives you a better indication of the true price spread. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at 800-432-3475 or info@SteelMarketUpdate.com.