Market Data

May 4, 2017

SMU Steel Buyers Sentiment Index 3MMA +73.50

Written by John Packard

Twice per month, Steel Market Update (SMU) conducts a review of how buyers and sellers of flat rolled steel feel about their company’s ability to be successful in the existing market (Current Sentiment) as well as three to six months out (Future Sentiment). Earlier today we crunched the data and found the flat rolled steel industry is still very optimistic about the industry as the data continues to be very close to record highs.

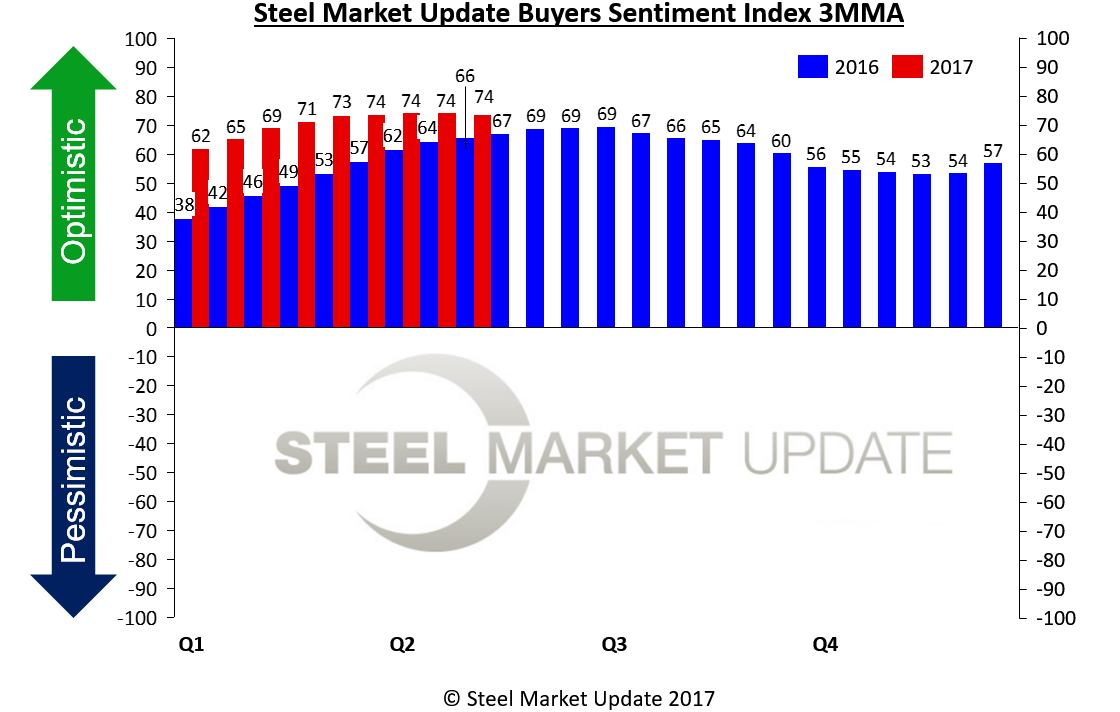

Looking at the existing market from a single data point perspective, our Current Sentiment Index is +73, up one point from the middle of April but down 4 points from the all-time high of +77 recorded during the first week of March 2017.

SMU prefers to look at the data based on a three-month moving average (3MMA) which helps smooth out the data to give us a better look at the trend. The 3MMA for Current Sentiment is +73.50 which is -0.50 below the +74.0 registered during the middle of April. Our 3MMA high point was +74.17 recorded one month ago. We have been slowly trending lower since then.

Future Sentiment

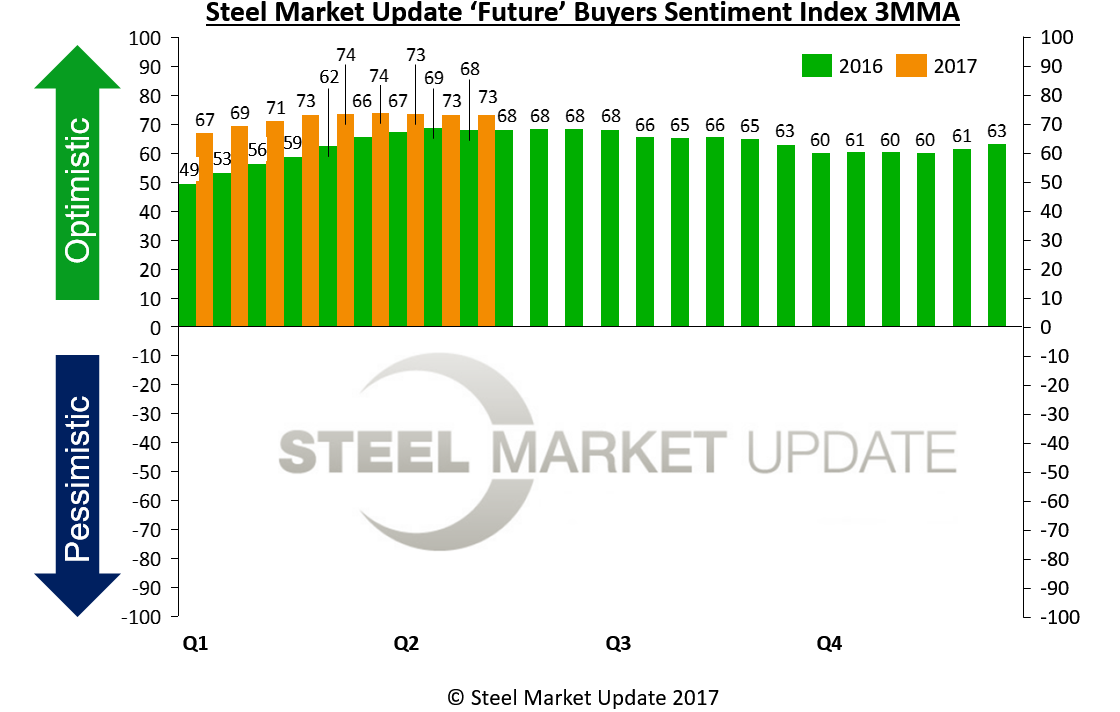

Future Sentiment, how buyers and sellers of steel feel about their company’s ability to be successful three to six months into the future, came in at +75 which ties the highest level since earlier in the year.

When looking at Future Sentiment based on the 3-month moving average it came in at +73.0, unchanged from mid-April but, still at the lowest level since early February 2017

What Our Respondents are Saying

“Automotive sluggishness is concerning / but overall demand is relatively steady.” Service center that then went on to say, “If Washington comes through and further limits imports then the domestic market will be fine in 2017 and presumably 2018.”

“We are a manufacturing company purchasing off contract from service centers. Pricing is locked quarterly, and we budgeted for most of the market increase. No signs of availability issues from our supplier. Would prefer lower prices, but we are in a stable condition.” Manufacturing company

“Some uncertainty when it comes to pricing, moving up or down in the next few months?” Service center

“Still concerned about price volatility. trying to keep inventory positions as short as possible.” Service center

“Strong 1st QTR. 2nd QTR demand still as strong for all business sectors.” Manufacturing company

“Some slowdown as everyone is waiting to see what the market will do on pricing.” Service center

“Too many uncertainties. Especially regarding trade policies and US economic conditions.” Trading company

“So many dynamics in the market right now, hard to predict which path the market will follow.” Service center

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 40 percent were manufacturing and 44 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies, and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.