Prices

May 4, 2017

Imports – Is This the Boom Before the Bust?

Written by John Packard

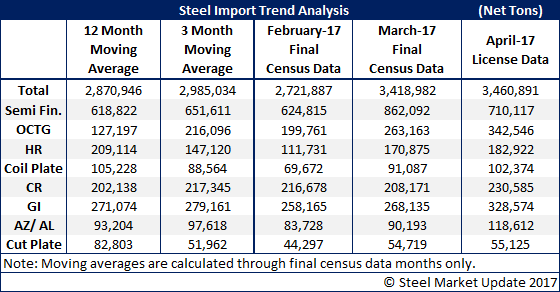

The U.S. Department of Commerce recently released Final Census Data for March 2017 foreign steel imports. The month officially came in at 3.4 million net tons. This is a huge month. What is probably worrying the steel mills is the license data for April is indicating there will be another boom month for imports as they are expecting to also come in around 3.4 million net tons.

This is the beginning of the story and not the end. Steel Market Update has been following imports for many years looking for changes in the numbers.

How about this for a change, even though March and April are coming in around 3.4 million tons, Vietnam is beginning to disappear from the market.

Galvanized – in February Vietnam shipped 22,800 net tons to the U.S. When we look at March the Vietnamese GI number dropped to 15,600 net tons. In April, it dropped again to 9,000 net tons.

Cold Rolled – in January 2017 Vietnam shipped 62,600 net tons of CRC, February = 24,500 net tons, March = 14,600 net tons and April = 131 net tons (one hundred thirty-one net tons).

Late today we got a note from a manufacturing company located in the Southern region of the United States. We were told, “Traders are cancelling some orders and getting very nervous. Some are not even offering CR or GALV for time being. Most foreign mills are shipping soon as possible and early to get material on the water….” They went on to say they had a large order cancelled that was scheduled for July shipment.

We also heard from a consulting source this morning that there is a lot of turmoil in Turkey and this source told us he would not be going back to Turkey anytime soon.

Beware the “Trump Bump” and stay close to your sources of supply. One of the steel mills who competes regularly against foreign coated steels told us earlier this week, “…On imports we had to get a bit more aggressive for late summer, but I expect ‘232 common sense’ to kick in as we get closer to June and savvy buyers will incorporate safety in their value equation.”