Market Data

April 30, 2017

April at a Glance

Written by John Packard

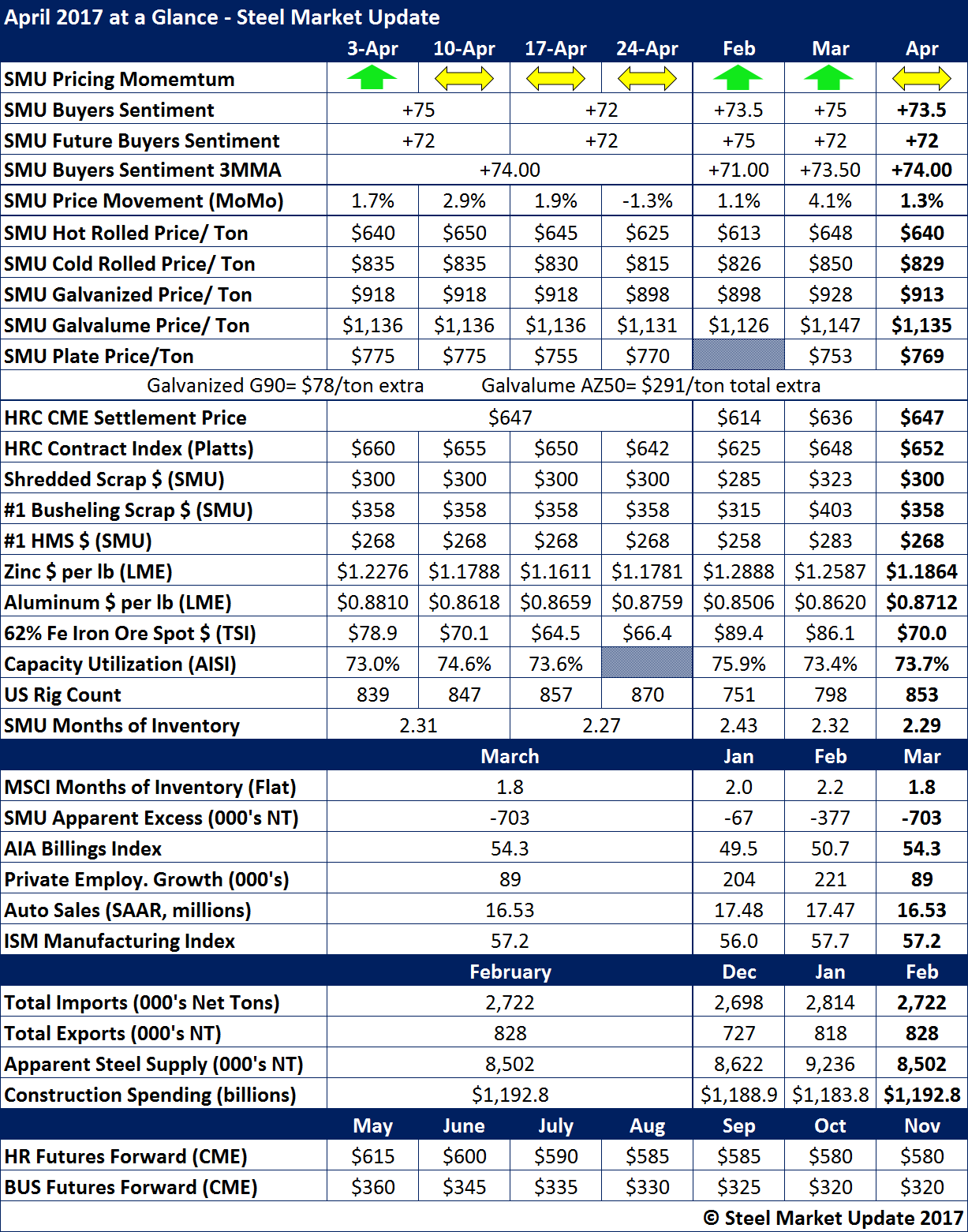

The month of April began with SMU Price Momentum Indicator pointing toward higher prices and by the second week of the month we had moved our Indicator to Neutral which is where it is now as the month ends.

Our 3MMA for the SMU Steel Buyers Sentiment Index appears to be peaking at +74. The individual data points for the month averaged +73.5 so, we expect May to begin below the +74 level unless we get a surprise in this coming week’s flat rolled steel market trends analysis.

SMU hot rolled prices averaged $640 per ton, slightly below the CME settlement price of $647 and below the Platts HRC average of $652 per the month.

Scrap prices were down in April as was zinc which at $1.1781 per pound at the end of the month is well below its peak of approximately $1.34 per pound.

Iron ore in China dropped and at the end of the month was averaging $66.4/DMT for 62% Fe fines.

Rig counts keep rising, ending the month at 870 rigs.

The MSCI inventories were quite low at 1.82 month’s supply as of the end of March. Based on the MSCI numbers the SMU Service Center Inventories Apparent Excess/Deficit model had distributor flat rolled inventories as being -703,000 away from being balanced.