Canada

April 25, 2017

Steel Framing May Benefit from Canadian Wood Countervailing Duties

Written by John Packard

A ruling was made by the ITC on wood from Canada that could have long lasting implications for the flat rolled steel industry.

On April 24, 2017, the International Trade Administration (ITC) released their Preliminary Determination of Countervailable subsidies of softwood lumber from Canada. The ITC found that there were subsidies on wood from Canada. With the affirmative ruling importers of record are now required to make deposits to cover duties on studs, boards, dimensional lumber, timbers, stress grades, selects and shop lumber.

In 2016, imports of softwood lumber from Canada were valued at an estimated $5.66 billion.

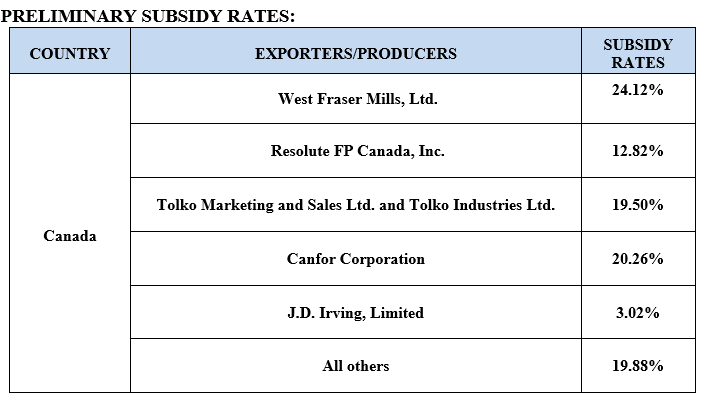

Here are the findings regarding the subsidy rates by company. Companies not listed are subject to a 19.88 percent duty.

Wood Duties Will Give Steel Framing a Cost Advantage

What impact will this have on the steel business? One of the first places we looked is the competitiveness of cold metal framing (steel studs, joists, etc.) and we spoke with Larry Williams, Executive Director of the Steel Framing Industry Association.

We asked Mr. Williams if the countervailing duties against Canadian wood would have any impact on the metal framing industry.

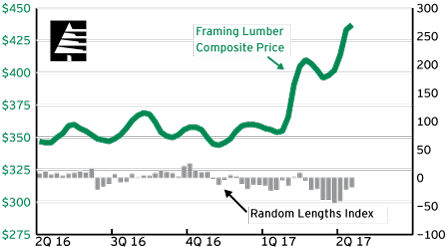

He told us, “We are watching this development pretty closely. I believe that the market had already begun to anticipate this, and you can see this in the framing composite prices published by Random Lengths:

In the mid-rise market segment, where we see the most potential for cold-formed steel framing – and also had the greatest competitive challenge from the wood industry- we have been very competitive on first costs (installation). Our contractor members report that the $3.88 / sq.ft. gap (see the spreadsheet) isn’t hard to overcome, especially when lower soft costs on items like insurance (see the ppt “Gap Analysis”) are factored in.

The gap shown in the 2014 study (spreadsheet) had already tightened up as the housing market got its footing and wood framing carpenter wages have gone up.

“Using the 2014 data, a 19% CVD would give cold-formed steel framing the first cost advantage on most projects, and things like insurance cost savings is icing on the cake.

“Even without the duties, however, there are other factors that suggest the upward pressure on wood prices was already building:

- The mountain pine beetle has already destroyed 54% of the pine forests in British Columbia and in areas the loss is 80 to 90%. Even with an aggressive replanting program, new growth will not come on line for years and in the meantime timber companies will be forced to reduce the number of trees they’ll be allowed to cut.

- There’s not much room to increase production in the Pacific NW without hitting sustainable harvest levels, and there are isn’t enough skilled labor in the South to meet new demand with the existing capacity base (Forest Economic Advisors)

- Metrostudy predicts the number of housing starts to rise 14% this year to 1.3 million homes. That’s near the 1.5 million start where supply begins to become a problem.

- The saw mills are currently maxed out, and there have been only a couple of new mills announced they won’t be online soon. Also, even if there are plans to significantly increase capacity it takes two years for a new saw mill to be operational.

“Then add to that the rash of fires that has plagued wood-framed mid-rise projects across the country and you have a compelling “safety” story to tell.”

One of the unintended consequences of the U.S. government’s action against Canadian wood may well benefit the steel industry (now we will have to wait and see how long before foreign steel producers figure it out…).

So, a long way of saying that we could be entering a period where cold-formed steel has some significant competitive advantages.”