Prices

April 25, 2017

March & April Foreign Steel Imports Surging as Domestic Mills Lead the Way

Written by John Packard

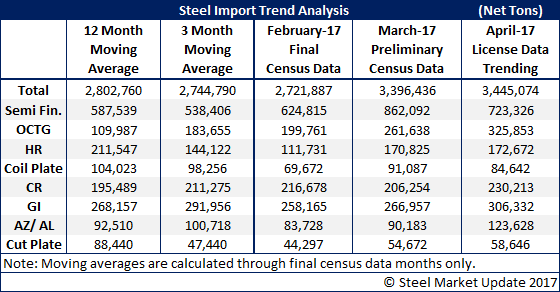

The U.S. Department of Commerce released import license data for April as well as Preliminary Census Data for the month of March. The Preliminary Census Data will be finalized in about a week’s time and usually there are only minimal revisions. March foreign steel imports are being reported as being 3.4 million net tons. This is quite a high number, especially with the number of dumping suits that are in play.

One of the major reasons for the jump in imports are the steel mills themselves. The mills took in 862,092 net tons of slabs/billets during the month of March. The last time we had imports at, or above 860,000 tons was October 2014 when the mills took in 984,827 net tons of semi-finished steels.

April is trending just below March and we are looking at another month with foreign steel imports well above 3.0 million net tons. Semi’s continue to be the biggest item as the domestic mills appetite for foreign substrate grows as the economy improves. Note, there are a number of steel mills in the United States that do not make their own steel. Included are California Steel Industries, NLMK USA in Farrell, PA, ArcelorMittal Nippon Summitomo Calvert, AL operation and the Acero Junction mill. Domestic steel mills are also importing hot rolled and full hard cold rolled coils for conversion.

SMU Note: It will be interesting to see how the Trump/Ross Department of Commerce translate “national security” as it relates to the steel industry. We believe steel buyers and companies who buy products that would normally not be considered needed for national security are not looking at the language used to define what is harmful to the United States. We published the White House fact sheet on Thursday of last week. If you have not read it we suggest that you do.