Prices

April 13, 2017

Hot Rolled Futures: Crossroads in Price Direction?

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

Interesting week in HR futures as spot retraced back to the mid $650/ST after moving higher the prior week. HR futures trade volume has been low this week at under 7,000 ST which does not really reflect the market interest we experienced in increased inquiries. Liquidity has been present but merchants have been waiting for prices to dip while the natural sellers have been holding offers at recent levels.

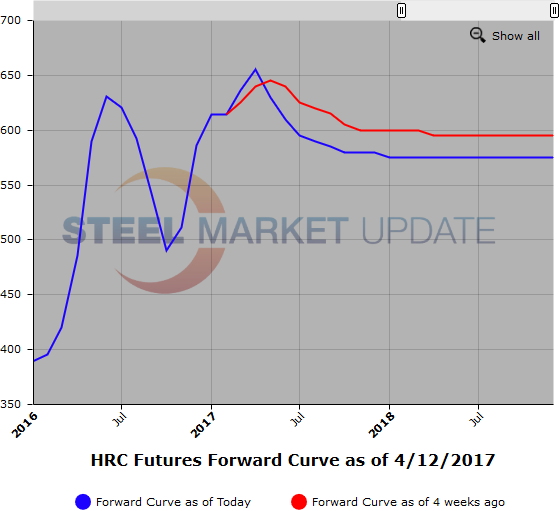

This past week Jun’17 traded at $610/ST. Jul/Aug’17 traded at $608/ST. 2H’17 traded at $585/ST. Q2’18 traded at $578/ST and $580/ST. Today Aug’17 traded at $605/ST and Sep’17 traded at $600/ST.

Market interest suggests we might be at a crossroads on price direction. While we experienced some price softness in the nearer dates this week, sellers have been wary to reach to meet the lower bids. However recent buyers in Aug/Sep’17 helped to bring the latter half of the curve a bit higher. The shape of the backwardated curve has shifted. With the exception of the nearby months the curve is getting flatter as the nearby dates decline faster than the latter half of the curve.

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.

Scrap

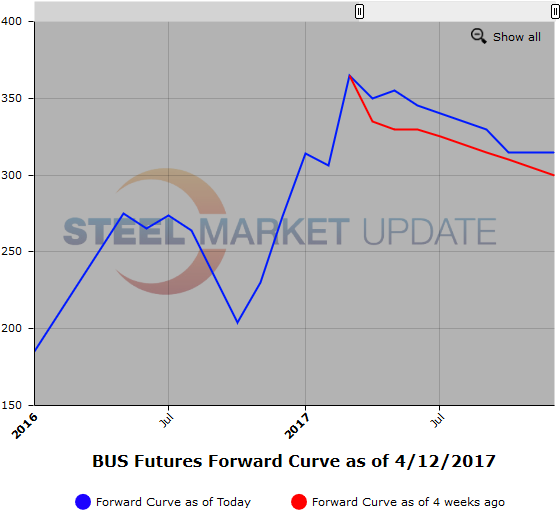

April’s BUS index surprised dropping $15/GT to $350/GT. However, early chatter has BUS potentially trading higher as some participants who held back buying for April will likely be in the mix for May. Increasing inquiries from U.S. importers of scrap/pig iron on the heals of rising oil prices and pig iron prices could add to prime scrap demand. The BUS futures curve remains relatively unchanged with 2H’17 offered at $325/GT and Cal’18 offered at $315/GT.

With LME steel scrap index holding just above $270/MT we have seen good volume trading in the front months of May and June at levels just below spot. The curve is currently pretty flat for the first 5 months. (265/275). Flat curve could suggest that market is anticipating another move higher due to pent up demand and improving steel markets in Europe.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.