Prices

April 13, 2017

Flat Rolled Steel Market "Sloppy"

Written by John Packard

Steel Market Update is asked many times where we think flat rolled steel prices are heading. Our current SMU Price Momentum Indicator is at “Neutral” which means we believe the market to be in transition and, prices could move in either direction from this point. We adjusted our indicator just recently from Higher to Neutral as we have been finding the market a bit “sloppy” for lack of a more precise term.

Evidence of the “sloppy” nature of the market can be seen in the data we have been collecting in our flat rolled steel market trends analysis that we perform twice per month. History has shown us we can have radical changes in direction and they can happen very quickly based on a wide range of factors. But right now we are seeing our data moving about without a clear picture of direction.

Capitulation by the service center segment of the steel industry is one of those key factors we watch carefully. You won’t find a definition in your steel terminology books as to what “capitulation” means. Here is our interpretation:

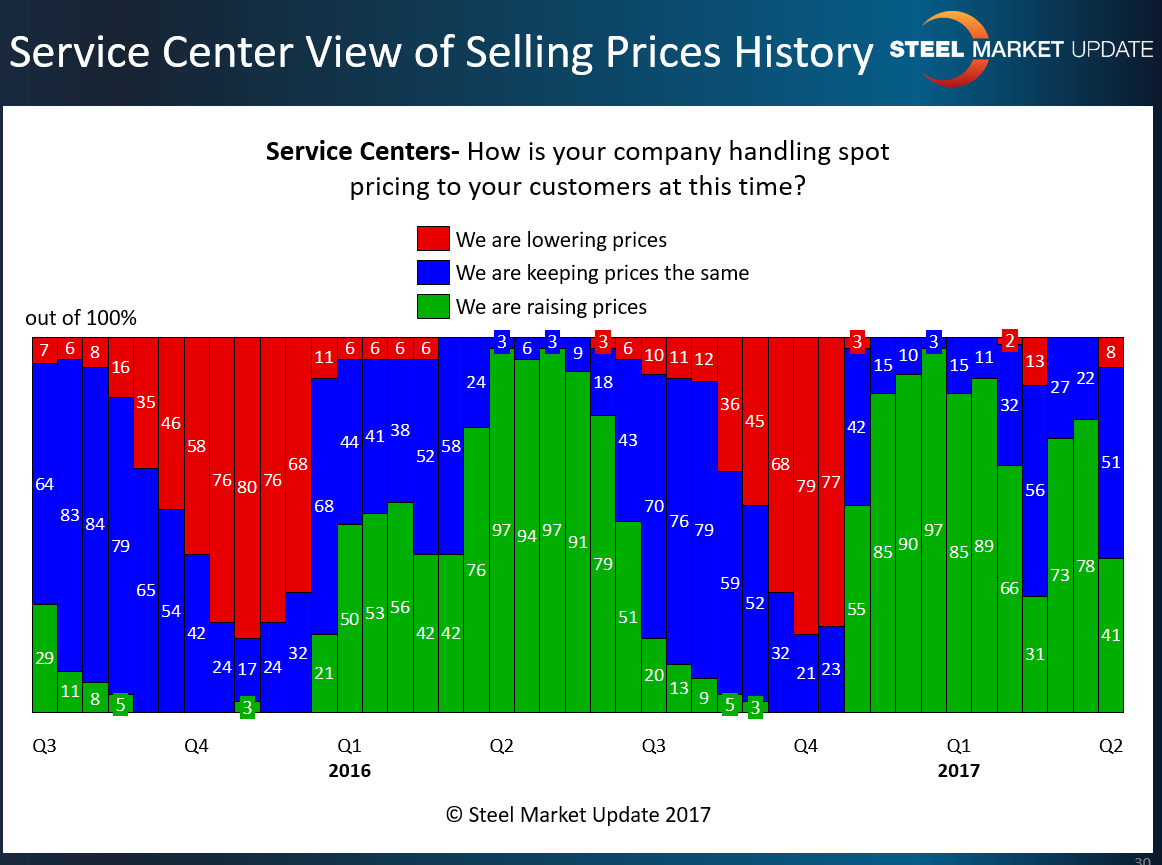

Capitulation is when 75 percent or more of the service centers responding to our questionnaire report their company as lowering flat rolled steel spot prices. We have found at that point, service center executives are being negatively impacted through devaluation of inventories, margin compression (or flat out losses) and excessive competition in the spot markets. Their wish at that point is that the domestic steel mills will raise prices (which they will then support) turning around the cycle and adding value, margin, etc. to their bottom line.

The issue we are seeing in the data is one of insecurity. As you can see by the graphic above, the service centers over the past four or five survey periods (2-2.5 months) are confused as to what they should be doing with spot pricing. It appears the desire is to keep the numbers up, but doubt at some service centers is holding them back.

The doubt could be from a hole developing at a particular mill who then goes into the market and cuts a deal to get rid of their hole or, it could be from gyrations in the price of ferrous scrap. It could be one competitor having to relieve inventories and their move may be misinterpreted creating a cascade of doubt in other service centers. There could be many reasons including concern about growing inventories should their incoming orders be greater than their business.

Steel Market Update wonders if the high levels of imports of cold rolled and galvanized at much cheaper numbers than domestic may be putting pressure on lead times out of the domestic mills as well as pricing.

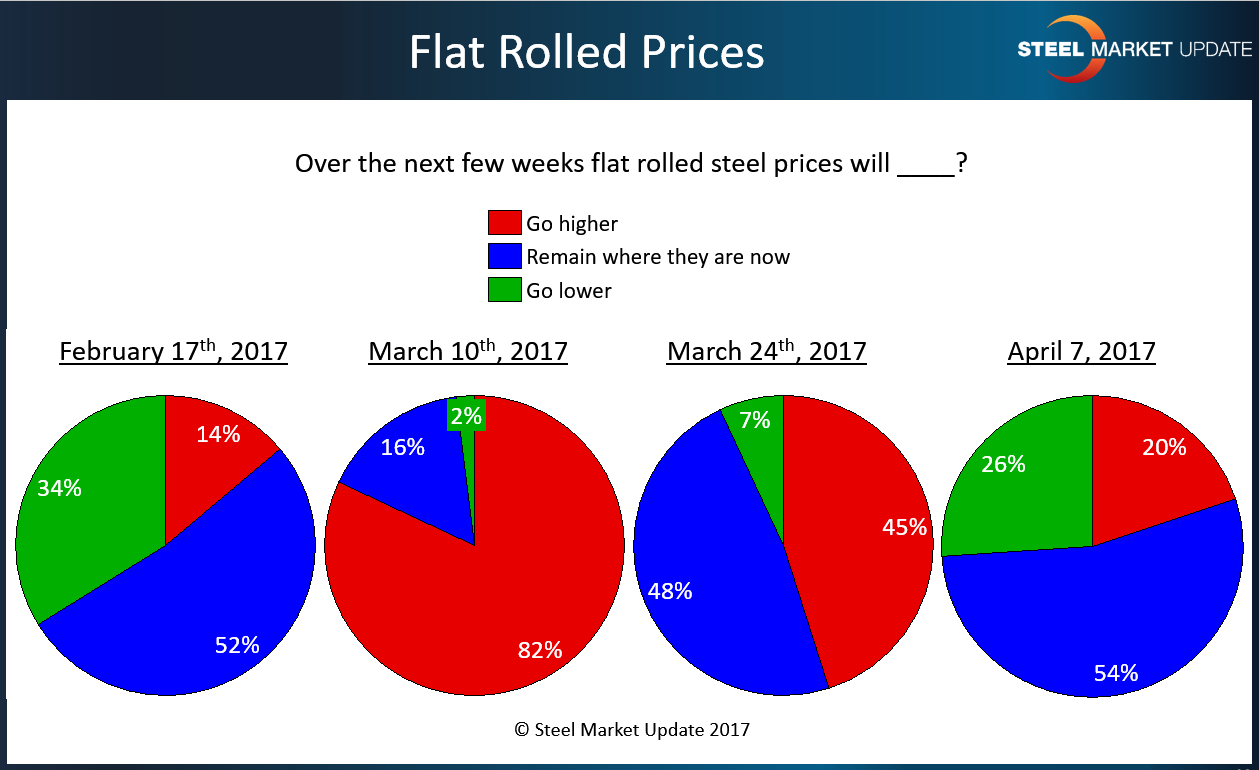

Look at the graphic below, over the past four surveys, buyers and sellers of flat rolled steel have been jumping about when it comes to where they believe flat rolled steel prices will be over the next few weeks. How hard is it to project pricing over a few week period? Normally, during an up or down cycle the direction of pricing is clearly understood. That does not appear to be the case right now.

This is one of the reasons why we have moved our Price Momentum Indicator to Neutral. We are waiting for signals from the steel gods as to where prices go from here.

You can hear and feel the frustration out of some steel buyers. Recently we received an email from a buyer who told us (in part), “…So between the still huge delta between HRC and coated and the huge zinc extras, there is so much room for the markets to give up and not feel any pain whatsoever. All mills are willing to negotiate at their spot – heard AK was out in the market with some “temporary automotive adjustment tons – one time deal in May” tons. We are holding our breath on the OCTG Korean AD reviews – of course, we are praying for a higher penalty which we think will signal future reviews. We all really thought by now we would have more direction from the new executive branch but they seem preoccupied with other issues so it is still limbo. I am not seeing strength – resolve on the part of SDI to be king of the painted market – but not strength. What does strength look like – turning down an order? Being firm on an asking price? No, no strength. Dammit.”

A manufacturing company told us, “Foreign coated transactions are falling, as $60/ton has come out of the Asean HR index over the past month. Foreign offers are up by $20 over March, but final transactions are being negotiated down by $40 Vs March. You have to give them credit for asking, but also have to give them credit for prudence and knowing when their hand is over played. The domestics should take the lesson before they kill this market and then resort to crying to Uncle Wilbur.”

An automotive service center said, “…yes there are definitely signs of weakness. Mills are coming back to me with requotes of lower prices on material they quoted last week.”

Service center executive, “SDI order book has continued to gain strength due to pipe and tubing orders for oilfield. Nucor AR as well. BRS seems to be very open to pushing for more tons.”

A large service center, “The new mills are discounting as required (largely based on freight) to take business away from competitors. I can’t say if BRS and AJ contribution to supply has been a pricing factor. But simply adding supply would serve to push prices lower all things being equal. Overall, I don’t sense that their price actions have been a key driver in the market to date. However, as their production grows and demand softens into the summer, it could be a bigger factor. Regarding imports; I think in tandem mill products the generally inflated US spread over HRC creates some room for negotiation by domestics mills. Whether this is strictly tied to combating imports or just winning domestic share, I would say it’s mainly domestic competition. I don’t find domestic producers discounting delivers beyond their current lead-time in order to compete with potential import arrivals. However, discounting for volume in general has the effect of making the buy decision for imports more difficult.”

National brand service center, “See some weakness with one southern EAF on galvanized products for April and May where they’ve been aggressive on any potential volume purchases. A couple integrated mills have had some small holes appear in their Auto galv lines in recent weeks. While not large volume wise not sure if it a “sign”? HR actually looks to be gaining steam to the point where some mills have stopped looking for additional contract volumes at this time. Downstream products are of concern due to the price gap against imports…So far domestics are ignoring the import numbers on CR and Coated as they hope that stronger Q2 demand which will be their downfall….”