Prices

April 13, 2017

First Look at April Steel Imports

Written by John Packard

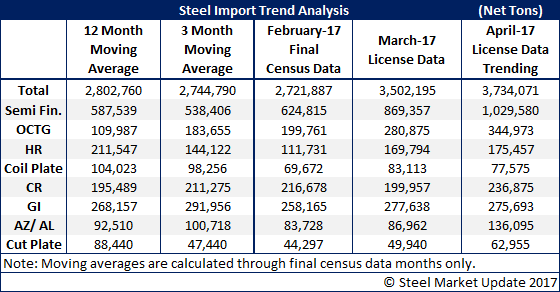

Around the middle of the month Steel Market Update (SMU) will analyze the US Department of Commerce Steel Import Monitoring & Analysis (SIMA) system to see how foreign steel imports are tracking and project total imports for the month based on the mid-month daily average. What we have been tracking is a very high number of steel import licenses both in March and now again in April. We anticipate both months will end up well over 3 million net tons of imports, well above both the 12-month and 3-month moving averages.

As we mentioned in our last article on this subject, the biggest single import item continues to be semi-finished steels with the vast majority of the tons being slabs (with a small number of billets). Both slabs and billets are used in the production of steel and are purchased by the domestic steel mills.

We are seeing a surge in Oil Country Tubular Goods (OCTG) even with the new US DOC ruling against Korea exports of the product to the United States. Korea continues to be the largest exporter of OCTG to the U.S. with 99,000 tons in March, and so far through the 11th of April, Korea has another 75,000 tons of license requests (with 20 days in the month to go)…

Cold rolled and coated products (galvanized/Galvalume) continue to be at very high levels in spite of positive trade suit rulings against many foreign countries and suppliers.

SMU is noting one change in cold rolled: Vietnam has no license requests for the month of April and only had 14,600 tons in March. The surprising growth in cold rolled is coming from Russia with 27,600 tons of license requests in March and already another 17,000 tons (through 11 days) in April. Right now the Russians have twice as many license requests for April than all of Canada…

In galvanized, Canada is our main trading partner, but Turkey, UAE, Vietnam, Korea and Thailand are all countries to watch.

Galvalume imports are coming from Taiwan, Korea and Vietnam (larger volumes than other countries).

The 3.7 million tons we are forecasting in our table is probably a bit over-stated based on only 11 days of license data. The last time the U.S. imported 3.7 million tons of foreign steel was February 2015 at 3.711 million tons (January 2015 was 4.39 million tons). We are of the opinion that the ultimate number will be closer to 3.0 million tons than 3.7. Either way, the number is too high from a steel mill perspective and the question then becomes what are they going to do about it? More suits, ask the President for a Section 201 or, decide to lower the excessive spreads that exist on cold rolled and coated product base prices vs. the hot rolled base price?

Stay tuned.