Prices

April 11, 2017

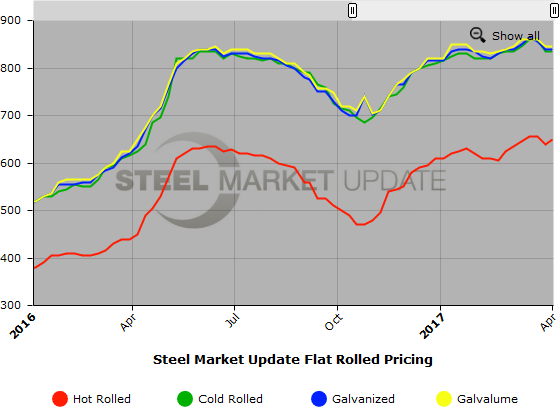

SMU Price Ranges & Indices: Still Stuggling for Direction

Written by John Packard

Flat rolled prices were essentially unchanged this week with the exception of hot rolled coil which seems to have a few more “legs” in the product due to an improving energy market and limited foreign steel imports. The pressure on HRC right now is coming from the two new players: Big River Steel and Acero Junction who are both reported to be below the going offer rates at the rest of the domestic steel mills. Steel Market Update has made the decision to take the initial offers out of these two mills with a grain of salt and we are being advised that, at least in the case of Big River Steel, their new offers are “in-line” with those of the rest of the industry (+/-$10/ton).

We have been hearing of “weakness” in cold rolled and some coated order books. We have seen numbers in coated steels drop by about $20 per ton even as our range have remained the same as last week. In some cases the weakness is being attributed as a hole in a schedule while other reasons are being referenced as a way of fighting foreign steel imports.

We will need to watch these developments over the coming weeks to see if momentum has shifted and prices will begin moving lower from here or, if the market is just trying to adjust to the recent jump in extras on coated (for example).

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $640-$660 per ton ($32.00/cwt-$33.00/cwt) with an average of $650 per ton ($32.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago while the upper end remained the same. Our overall average is up $10 per ton compared to last week. Our price momentum on hot rolled steel is pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU price range is $810-$860 per ton ($40.50/cwt-$43.00/cwt) with an average of $835 per ton ($41.75/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged compared to one week ago. Our price momentum on cold rolled steel is pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU base price range is $40.50/cwt-$43.50/cwt ($810-$870 per ton) with an average of $42.00/cwt ($840 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged compared to last week. Our price momentum on galvanized steel is pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $888-$948 per net ton with an average of $918 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-10 weeks

Galvalume Coil: SMU base price range is $41.00/cwt-$43.50/cwt ($820-$870 per ton) with an average of $42.25/cwt ($845 per ton) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week while the upper end declined $10 per ton. Our overall average is unchanged compared to one week ago. Our price momentum on Galvalume steel is pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1111-$1161 per net ton with an average of $1136 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks

Plate: SMU price range is $740-$810 per ton ($37.00/cwt-$40.50/cwt) with an average of $775 per ton ($38.75/cwt) FOB delivered. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged compared to last week. Our price momentum on plate steel is now pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. We will add plate prices to this graph once we have gathered a few months of data. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.