Government/Policy

April 2, 2017

President Trump’s Executive Orders on Trade Contain No New Initiatives

Written by John Packard

President Donald Trump signed new Executive Orders (XO’s) on trade and trade enforcement that contain no new initiatives. This is what we were told by trade attorney Lewis Leibowitz over the weekend.

He told us:

• “The Executive Order on trade enforcement has no new initiatives. It only requires the Commerce Department and Homeland Security to identify measures to collect more antidumping and countervailing duties. Uncollected duties amount to a small portion of assessed duties.

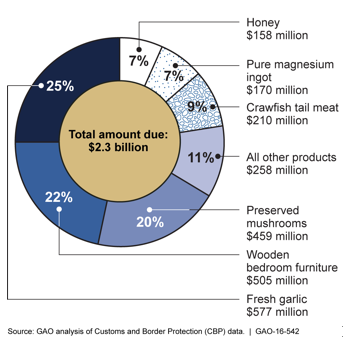

• The vast majority of uncollected duties stem from a very few cases, and not from steel trade. Most uncollected duties stem from cases on agricultural products and wooden bedroom furniture from China. See the pie chart below from last year’s GAO report estimating $2.3 billion in uncollected AD/CVD duties. So, don’t expect any changes in the steel marketplace from increased collection efforts for AD/CVD duties.

Mr. Lebowitz then went on to discuss the “retrospective” duty collection system, which he called “truly unique in the world.” Importers only pay a cash deposit of estimated AD/CVD duties, not the actual assessed duties. He told us that “domestic interests really like the retrospective system because the importers do not know and cannot know how much duty they will ultimately owe on their imports. As a result, most importers don’t import goods subject to AD/CVD and leave the market to domestic producers and those foreigners that are not covered by the orders. If final duties were imposed at the time of the entry, like almost all other countries do, there would not be any uncollected AD/CVD duties.”

He told us of the 33,000 total importers of goods subject to AD/CVD, only 818 (2.5 percent) had uncollected duties. Of the 818 importers four accounted for 26 percent of the uncollected duties.

He told us the reason importers don’t pay duties is because of the size of their magnitude. “The system of notifying importers years after they import that they owe much higher duties than they thought simply wipes out small importers who then cannot pay the duties. Not bad faith, just bad luck (and an irrational system).”

He told Steel Market Update that many countries break the rules of trade and that the United States is one of the leading violators. He told us, “It happens when politics trump the rule of law. Getting rid of political considerations is difficult. Resorting to protectionism to ‘cure’ those defects is a foolish response because millions more will be hurt than helped. In steel, 60 workers use steel in manufacturing for every steel worker. If imported steel is kept out of the U.S., the cure will be radically worse than the disease.”

Mr. Lewis surmised that one of the results coming out of the study mandated by the President’s Executive Order could be that the US Customs bond amounts for all importers could increase. He recommended that steel traders oppose any effort to do this as “they are not really the problem.”

Lewis Leibowitz will be a speaker at this year’s SMU Steel Summit Conference in Atlanta on August 28, 29 & 30th. Details can be found on our website: www.SteelMarketUpdate.com/Events/Steel-Summit