Logistics

March 21, 2017

Shipping Season Open on the Great Lakes

Written by Sandy Williams

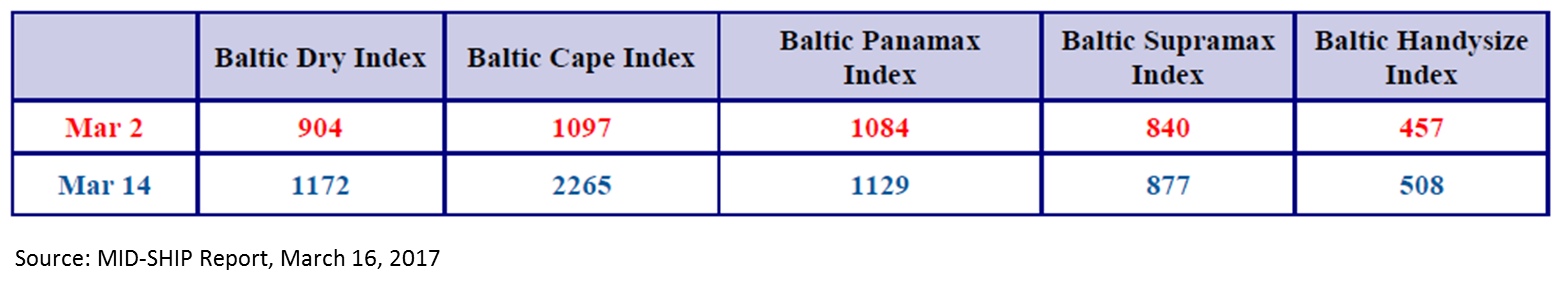

The shipping season opened on the Great Lakes this month. In general, freight shipments within the U.S. are moving without complications in March. Rate increases have been noted for most seaborne freight with the Baltic Dry Index approaching highs last seen in November 2016.

Seaborne Freight

The Panama Canal continues to break monthly records for tonnage. In February daily average tonnage reached 1.18 million tons, up 1.7 percent from January according to a report by the Panama Canal Authority.

MID-SHIP Report notes that period charter activity has increased and “we are seeing signs of a new, slow and sustained recovery” in both the freight and commodity markets. The Baltic Dry Index, as of March 20, was at 1,205. The BDI tracks dry-bulk rates based on vessel size and shipping route and is a used as a benchmark for overall trade volume.

Spot rates have increased in the Capesize, Supramax and Handysize markets. The Panamax market lost ten percent of its value last week and is trading at November levels of $9,000 per cay, said MID-SHIP. The rate is three times higher than a year ago but ship-owners are concerned that a major correction may be looming. Rates have dropped in the Pacific by almost 20 percent in the week preceding March 16 and the Atlantic rates fell $2000 to $14,000 per day from a high of $16,000 the previous week.

River

River freight is moving along pretty well so far this month with some reports of high water and fog delays but very little ice for this time of the year. Barge traffic on the Ohio, Illinois, Tennessee, and Cumberland Rivers is expected to experience some delays due to lock repairs in the coming weeks.

Oversupply continues to vex the barge market. MIDSHIP says barge companies are “seeking ways to cut their losses by parking their equipment to contend with the reduced demand.” Demand is expected to weaken further as the South American grain harvest competes with US exports this spring.

Trucking

The flatbed load to truck ratio jumped 4 percent to 35.8 loads per truck nationally in the week March 5-11. It was the sixth weekly increase in a row. Flatbed rates were down one cent per mile to a national average of $2.01 per mile. Rates varied from $1.60 per mile in the Phoenix area to $3.07 per mile near Harrisburg, PA, according to DAT Trendlines. National on-highway diesel fuel price was $2.539 per gallon as of March 20, 2017.

The American Trucking Association reported that the For-Hire Truck Tonnage Index decreased 0.1 percent in February following a 2.9 increase in January.

“February’s numbers, especially the year-over-year drop, might surprise some as several other economic indicators were positive in February,” said ATA Chief Economist Bob Costello. “However, I’m not worried about the decline from February last year as it was really due to very difficult comparisons more than anything else: February 2016 was abnormally strong.

“Looking ahead, signs remain mostly positive for truck tonnage, including lower inventory levels, better manufacturing activity, solid housing starts, good consumer spending, as well as an increase in the oil rig count – all of which are drivers of freight volumes” he said.

FTR, a trucking consulting firm, also looks toward a better year for the industry in 2017 and expects moderate growth. FTR says that the optimism that the trucking industry is feeling about the Trump administration comes with some risks associated with some of the economic polices being proposed.

“We are also closely tracking government policies and actions,” said Starks. “The main concern continues to be the possibility of trade wars, which could have immediate and detrimental impacts on freight transportation.”

Rail

The Association of American Railroads reported US weekly rail traffic during the week ending March 11, 2017 was up 4.4 percent year over year to 510,638 carloads and intermodal units. Carloads totaled 253,664, up 4.3 percent, and intermodal volume was up 4.5 percent to 256,974 containers and trailers.

Great Lakes

The 2017 Great Lakes shipping season commenced on February 28th with the departure of the U.S.-flat tug/barge unit Dorothy Ann/Pathfinder from Erie, PA to Cleveland, Ohio to shuttle iron ore from the Cleveland bulk Terminal to ArcelorMittal.

The St. Lawrence Seaway was officially reopened for the season on March 20 with the passage of the CSL St. Laurent through the St. Lambert lock. The ship featured mural of a Canadian goose in flight, commissioned by Canada Steamship Lines, as a tribute to Canada’s 150th anniversary and 357th anniversary of the City of Montreal. Last year’s shipping season was a dismal one for the St. Lawrence Seaway with traffic declining by 3.4 percent to 35 million metric tons. The decline in volume was attributed to a 13.3 percent decline in ore shipments.

The St. Lawrence Seaway was officially reopened for the season on March 20 with the passage of the CSL St. Laurent through the St. Lambert lock. The ship featured mural of a Canadian goose in flight, commissioned by Canada Steamship Lines, as a tribute to Canada’s 150th anniversary and 357th anniversary of the City of Montreal. Last year’s shipping season was a dismal one for the St. Lawrence Seaway with traffic declining by 3.4 percent to 35 million metric tons. The decline in volume was attributed to a 13.3 percent decline in ore shipments.

The Soo Locks are scheduled to open after midnight on March 25. The locks are closed for ten weeks beginning in January for annual maintenance. The locks allow transit of iron and coal to the steel industry from Lake Superior to mills along the lower Great Lakes.

According to the Lake Carriers Association U.S-flag freighters moved 83.3 million tons of cargo in 2016 on the Great Lakes. Iron ore headed for steel production totaled 44.1 million tons; limestone loads for construction and steel production totaled 21.2 million ton; and coal, mostly for power generation, totaled 13 million tons.