Market Segment

March 7, 2017

Chinese Steel Market Analysis for the Week Ending March 5th

Written by John Packard

The following analysis of the steel markets in China is from Beijing Metal Import & Export Co.,Ltd and is being reproduced by Steel Market Update with permission. We edited the original copy to assist our readers in understanding what the group is trying to relay to us. Here is what they had to say (edited version):

Please allow me to update China steel market (Feb 27 – March 05, 2017) as usual as follows:

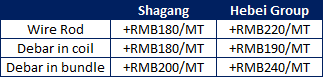

In the last week, the China steel market still fluctuated on a high level as we expected in last weekly report. At the beginning of last week the market decreased slightly along with the drop of Futures market, but turned firm again after Shagang/Heibei Group announced their new prices of 1st ten days of March on March 01 2017. Even as raw materials kept dropping yet China steel mills still increased there EXW prices again. We mentioned that 50% production in Tangshan is limited from March 01 to March 15, hence steel mills have enough confidence to increase their prices. In last week, Shagang/Hebei Group all increased EXW price heavily, details as following:

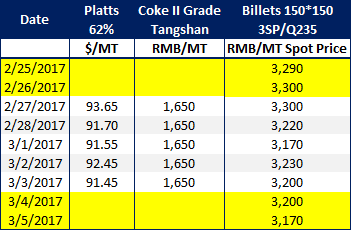

But the futures market is still not following the spot market since 5 ministries under the State Council released a joint statement to remind market that there is a big risk in futures market. In the whole week, the futures market dropped continuously. Below are daily price changes just for your information.

Please note that the China government decided to reduce total 50 million tons steel productions in 2017 in government work report, hence main steel mills have more pricing power in the future.

Actually coke prices have been unchanged for nearly 2 weeks, if coke prices turn firm again [go higher], China will purchase more high quality iron ore from Brazil/Australia, hence steel prices will continue to go up due to increasing cost of raw materials.

Spot stock will be decreased during the first half of March. But the market will meet a big pressure once all the mills restart to produce after the production limitation policy is canceled.

In the short term, the Chinese steel market will still fluctuate at a high level [expected to move higher].

For exports, China export volume in Feb 2017 touched the lowest level in the past 3 years. And now China prices are not favorable for many markets.

Below are our offers today just for your reference. Kindly please note that the market changes very fast, our offer will be adjusted according to the market level.