Government/Policy

March 2, 2017

Commerce Issues Preliminary AD Duties on Rebar from Japan, Taiwan and Turkey

Written by Sandy Williams

The Department of Commerce, on March 1, issued affirmative preliminary determinations on the antidumping investigations of imports of steel concrete reinforcing bar (rebar) from Japan, Taiwan, and Turkey.

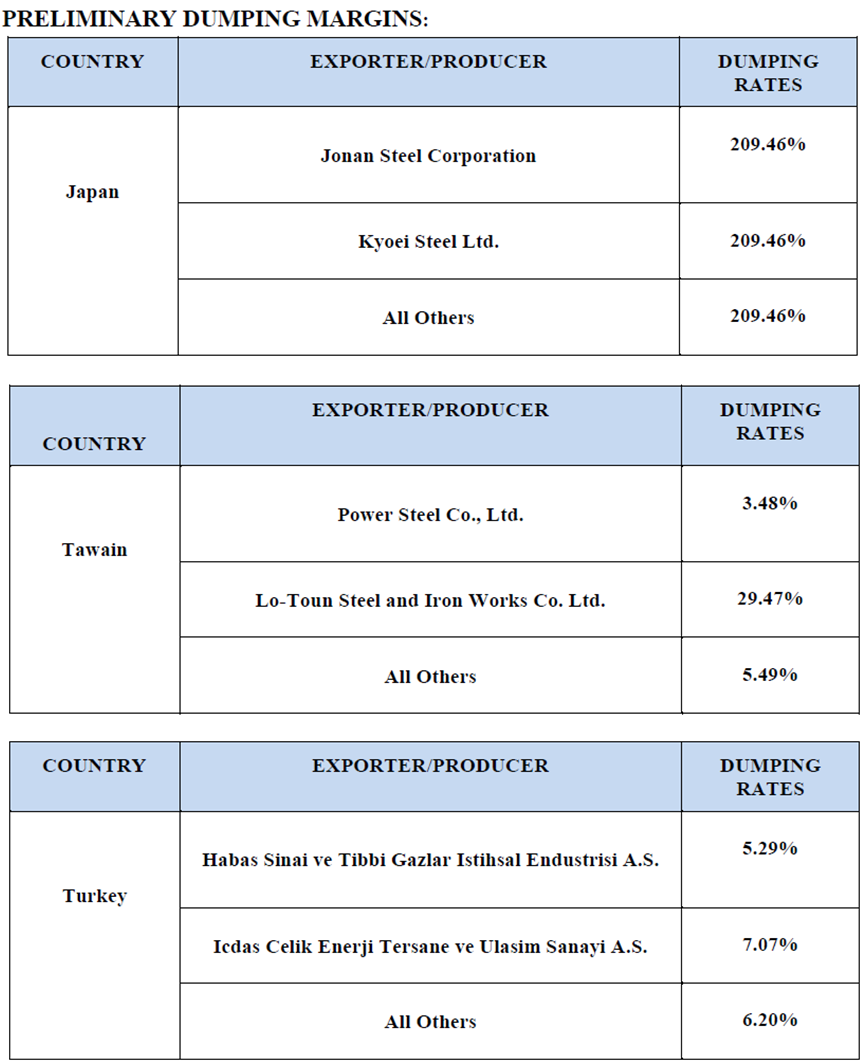

Japan received preliminary dumping margins of 209.46 percent; Taiwan dumping margins ranged between 3.48 percent and 29.47 percent; and Turkey margins ranged from 5.29 percent to 7.07 percent.

The merchandise covered by these investigations is steel concrete reinforcing bar imported in either straight length or coil form (rebar) regardless of metallurgy, length, diameter, or grade or lack thereof. Subject merchandise includes deformed steel wire with bar markings (e.g., mill mark, size, or grade) and which has been subjected to an elongation test. It also includes rebar that has been further processed in the subject country or a third country, including but not limited to cutting, grinding, galvanizing, painting, coating, or any other processing that would not otherwise remove the merchandise from the scope of the investigations if performed in the country of manufacture of the rebar.

Next Steps:

Commerce is expected to announce its final determination on May 16, 2017 for Japan and Turkey, and on July 6, 2017 for Taiwan.

If the US International Trade Commission also makes an affirmative final determination of injury to the domestic industry from these imports, Commerce will issue AD orders. ITC is scheduled to make its final determinations in June 2017 for Japan and Turkey, and in August 2017 for Taiwan.