Market Data

February 26, 2017

Steel Buyers Basics: Coating Costs

Written by Mario Briccetti

The following article was written by Mario Briccetti, one of our Steel 101 workshop instructors and the director of the consulting firm: Briccetti & Associates. Mario has written other articles about the costs associated with coating galvanized and Galvalume steels. Those articles can be found in our website in the “Steel Buyers Basics” section of the website. Mario’s contact information is at the end of this article.

Last week at least two domestic steel mills increased their galvanized coating extras. Without a doubt the other mills will follow over the coming days. The reason for these increases is clear, it is due to the continued increase in the cost of zinc (galvanized coating is almost 100% zinc). Last year I created a spreadsheet program to calculate the impact of zinc and aluminum costs on coating costs and in this article I am going to quantify the impact of rising zinc costs on the production cost of galvanized steel.

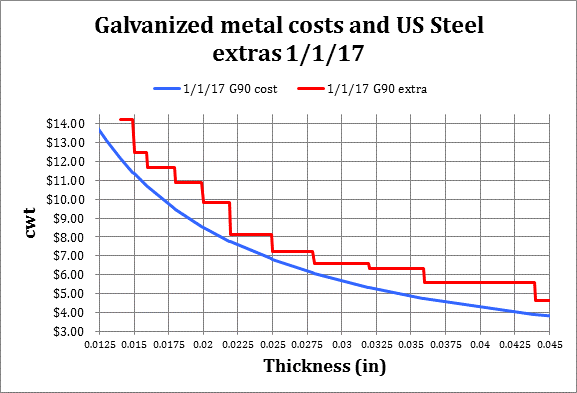

Mills changed their galvanized cost adders starting at (or close to) the start of 2017 when the US delivered price of zinc ingot was $1.24/lb. Below is a graph of zinc costs for G90 material on thicknesses from .0125” to .045” (the smooth line) and US Steel’s published galvanized adders (stair-step line) as of January, 1 2017. (Note: different mills have various extras but most are about the same as USS.)

As you can see, the zinc portion of the cost to make galvanized steel rises as steel thickness falls (right to left on this graph). Also, the difference between the cost of coating steel with zinc and the extra is quite small. For instance, at 0.025” minimum thickness the difference between the mills cost for zinc and the price they charge is only $0.42/cwt. That $0.42/cwt covers all of the mills galvanized processing costs just to break even on this size. Worse, an increase of only $0.10/lb. in zinc prices would mean the steel mills are losing money on just the metallic portion of coating G90 at 0.025” min thickness. During our Steel 101 January 2017 workshop, we speculated that these prices would have to go up with any increase in zinc and indeed that is now coming to pass.

Side Note: The domestic steel mills have not changed Galvalume extras. That’s because zinc is only 43.5% of the Galvalume coating and the price of aluminum hasn’t risen so sharply. It’s also because the Mills have a wide margin between metal costs and extras for Galvalume and so they can absorb some cost increases.

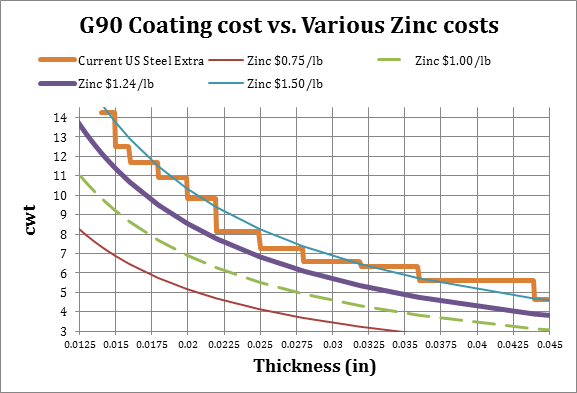

Below is a graph of galvanized coating costs for various prices of zinc ingot. Just a zinc cost rise of $0.26 from January (and $0.20) from today puts the Mills completely under water from their current galvanized extras.

In my opinion it is completely reasonable for the steel mills to again change their galvanized extras. In fact, as of January 1st, the cost of zinc suggests that they should have charged more for their extras at that time.

I believe there are three reasons the mills did not ask for a greater increase in galvanized extras back in January. First, they announced increases in galvanized extras in November 2016 when the price of zinc ingot was lower. Second, the mills typically use the futures market to assure supply and to lock in the price of zinc in advance of their actual production needs – again back in November their costs were lower. Finally, the mills (at least USS) used a galvanized extra chart that was the same as they had used in the past and perhaps were not willing to move beyond those amounts for operational or commercial reasons.

Zinc has continued to rise since the end of last year and what may happen in the future is hard to estimate. Zinc has a global commodity price (like silver or aluminum) and its main usage is as the coating for galvanized steel. Often, its price is correlated to steel demand. But just as often, its price variations can be due to new mines opening, labor unrest in the supply chain, financial speculation or just plain animal spirits in the metals market.

I don’t want to speculate and make any predictions about the zinc market. What I will suggest to steel buyers is to stay on top of the market price of zinc. Steel buyers need to understand the impact the cost of zinc has on the costs of coating steel and be prepared for adjustments in the coasting extras charged by the domestic steel industry.

I have a tool available to help you calculate and track these costs for your particular coated specification, it’s a spreadsheet program that handles the calculations for any thickness of Galvanized, Galvalume, Galfan or ZAM – if you would like a copy please contact me at MarioBriccetti@gmail.com or by phone: 502-380-6163.