Logistics

February 21, 2017

Shipping and Freight Report, February 2017

Written by Sandy Williams

Freight shipment by various transportation modes seems to be moving fairly well as February winds down. Seaborne freight is improving and barge traffic is resuming normal operations after the winter. Trucking saw some seasonal slowdown after the holidays and rail traffic was up year over year in recent weeks.

The Association of American Railroads welcomed Elaine Chao’s appointment as Secretary of the Department of Transportation and commented on White House proposals for reducing regulations and controlling costs.

The trucking industry also welcomed Chao and expressed concerns regarding the administration’s protectionist policies that may affect NAFTA trade.

Seaborne Freight

MID-SHIP Group says the shipping market is cautiously optimistic. The oversupply of vessels has moderated with fewer new vessels expected to arrive this year and next. Scrapping of vessels slowed in fourth quarter as market rates improved but MID-SHIP speculates scrapping activity may increase in early 2017.

Demand in the seaborne market continues to improve. “A combination of market forces with-in the steel industry, government interventions in China and India to curtail environ-mental impact and reduce energy consumption have contributed to higher imports and led to higher seaborne demand.”

Congestion is expected to be a problem at ports in the coming weeks as coal imports increase. Wait times have increased for coal vessels in Indonesia, impacting more than 100 vessels. Vessel lineups are expected to increase in Brazil and Argentina as the export season begins in March, said MID-SHIP.

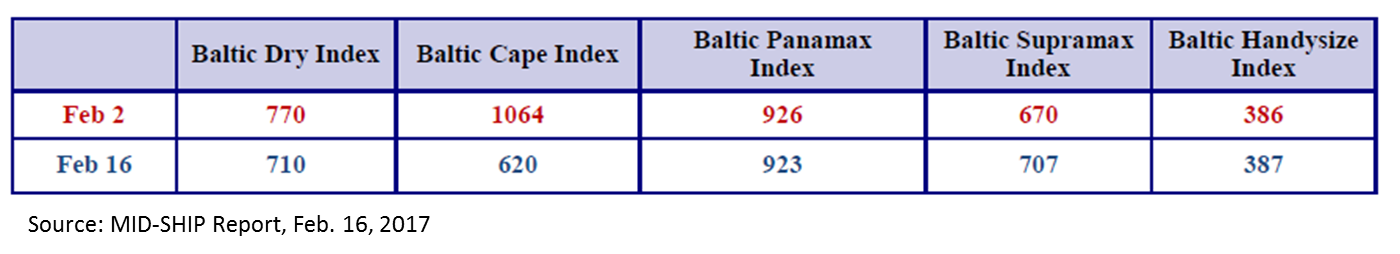

The Baltic Dry Index closed at 757 on February 20, 2017. The BDI tracks dry-bulk rates based on vessel size and shipping route and is a used as a benchmark for overall trade volume.

River

River traffic is operating smoothly as warmer temperatures prevail on most of the river system. Fog continues to be a problem along the U.S. Gulf coast causing some delays for barges between the mouth of the Mississippi and Baton Rouge as well as the Gulf Intracoastal Canal East and West, said MID-SHIP.

Barge lines have been able to begin loadings in NOLA last week for northbound shipments as far as Clinton, Iowa with further destinations expected shortly. Upper Mississippi locks are expected to resume operations between February 28 and March 4.

MID-SHIP reports import cargo volumes to the Mississippi are “unimpressive” expect for aluminum and fertilizer imports. Aluminum imports are continuing to surge.

Rail

The Association of American Railroads (AAR) y reported U.S. rail traffic for the week ending February 11, 2017 was 518,431 carloads and intermodal units, up 2.6 percent compared with the same week last year.

Total carloads for the week ending February 11 were 253,670 carloads, up 3.9 percent compared with the same week in 2016, while U.S. weekly intermodal volume was 264,761 containers and trailers, up 1.5 percent compared to 2016.

Edward R. Hamberger, president and CEO of the Association of American Railroads (AAR) commented on the Executive Order by the Trump administration, “Reducing Regulation and Controlling Regulatory Costs.” The industry is pleased to see discussion and action on the regulatory system, said Hamberger.

“Regulators too often today lose sight of clearly defined end goals that would ultimately benefit the general population. We ought to propose more desired results and less prescribed means to that end. We believe that a more nimble regulatory structure will foster greater economic growth and we are excited to partake in this important effort to improve the regulatory system.”

Hamberger said, “That is why the freight rail industry continues to offer principles for reform, including that rules should be based on a demonstrated need, as reflected in current and complete data and sound science; and non-prescriptive regulatory tools, like performance-based regulations, should be deployed wherever possible to align the interests of the regulator and the industry, and to foster and facilitate innovation to achieve well-defined policy goals.”

Trucking

The American Trucking Association reports the For-Hire Truck Tonnage Index fell 6.2 percent in December, following a revised 8.4 percent jump during November. The Index registered 133.8, a 0.7 percent decrease from the previous December. For the full year 2016, tonnage was up 2.5 percent.

“Looking ahead, there are some positive signs for truck tonnage,” said ATA Chief Economist Bob Costello. “This includes the continued spending by consumers, larger wage gains, and solid home construction,” he said. “Factory output will continue to be soft, but it should be better this year than last year. And most importantly, the supply chain continues to make progress reducing bloated inventories, which will help truck volumes going forward.”

DAT Trendlines reports flatbed-load-to-truck ratio continued to increase, gaining 13 percent in the week of Feb 5-11 for 24.6 loads per truck nationally. The national average flatbed rate jumped 4 cents to $1.96 per mile. Spot rates ranged between $1.65 per mile in Phoenix to $2.53 per mile in the Harrisburg/Baltimore region. Van and reefer rates and loads continued to decline during the period which is typical for what is considered a slow month for freight, said DAT Trendlines.

Diesel On-Highway fuel price as of Feb. 13, 2017 was $2.565 per gallon, a 0.007 increase from the previous week and an increase of 0.585 year over year.

Trucking industry expresses concern about trade

Reactions to proposed trade policies by the Trump administration have been mixed. The American Trucking Association wants to find a way to work with the administration and Congress to grow jobs and support the trucking industry.

“Trade and trucking are synonymous, and the increased movement of freight yields more good paying jobs and growth in American companies,” said Bill Sullivan, executive vice president of advocacy for ATA, in a recent article for HDT Truckinginfo

“We want to help the administration and Congress build a trade framework that helps grow our economy, including the trucking industry,” he continued. “Since 1995, the value of goods traveling between the U.S. and Canada has risen dramatically – nearly 168% to $712 billion, supporting thousands of jobs in the trucking industry. For U.S. trade with Mexico, trucks move 83% of the trade between the two countries, in all making 5.5 million crossings in 2015. We will work to support any trade policies that help grow good-paying American jobs and the trucking industry.”

Discussions to abandon or rewrite NAFTA have raised concerns for the industry. According to the U.S. Department of Transportation October 2016 report, trucks carried 65.2 percent of U.S.-NAFTA freight. Trucks accounted for $31.9 billion of the $50.3 billion of imports (63.4 percent) and $29.0 billion of the $42.9 billion of exports (67.6 percent).

Marina Whitman, professor of Business Administration and Public Policy at the University of Michigan, told HDT that some aspects of Trump’s trade plans would certainly benefit truck fleets. “Reforming corporate taxes and certain moves to deregulate the industry would certainly be beneficial for fleets,” she said. “On the other hand, the strong protectionist slant taken by the Trump administration is, I think, significantly damaging to industry in general and trucking in particular, since trucking is highly sensitive to any disruption in this highly integrated market.”

“And if any of President Trump’s protectionist proposals become fact, they will put a real damper on trade in general,” she noted. “The Canadians are very concerned about the animus aimed at Mexico from the Trump White House, because their industries – particularly their automotive industry – is highly integrated with Mexico. And they are very worried they will get caught in the fallout from a major U.S.-Mexico trade dispute. And that would be bad for trucking because the physical movement of goods and services is highly important to that economic success.”

“There are no other markets trucking can look to if these agreements end,” she added. “Digital commerce cannot make up the shortfalls that will occur in the trucking industry if that happens.”

Greg Wright, a professor of economics at the University of California, Merced, said the global supply chain is incredibly sophisticated and NAFTA is an example of that. Wright told HDT, “Auto transmissions are made in Canada and brake lights in Mexico, etc. and trucking keeps the whole process going. So, I would say that U.S. truckers should be very wary of any effort to close the southern border to commerce.”

“Trump’s proposals are particularly dangerous because they are so extreme,” he continued. “A new 20% import tariff between two countries that participated in a free trade zone is sure to set off a series of legal actions in NAFTA adjudication panels, WTO adjudication panels, and U.S. and Mexican courts. It is also very likely to provoke retaliation from Mexico in the form of raised tariffs and other barriers. This could dramatically cut the demand for moving freight across the border as well as interfere with the legal ability to do so.”