Canada

February 16, 2017

Canadian Distributor Flat Rolled Shipments/Inventories in January

Written by Brett Linton

Total Canadian steel shipments for all products in January were 411,800 net tons, an increase of 42.0 percent from the month before and an increase of 5.7 percent from January 2016. Total steel inventories at the end of the month stood at 1,178,200 tons, up 0.6 percent from last month but down 5.8 percent from the same month one year ago.

The daily average receipt rate for January was 19,971 tons per day (21 day month), up from 18,640 tons per day in December (20 day month). Total January steel receipts were 419,400 tons, 46,600 tons higher than the December figure. According to the MSCI, total steel product inventories stood at 2.9 months at the end of January, down from 4.0 months the month before.

Flat Rolled

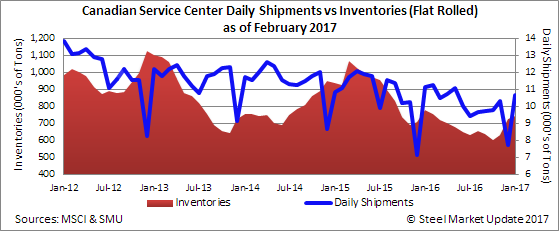

Canadian shipments of flat rolled products for the month of January were 224,400 tons, an increase of 45.1 percent from December and an increase of 1.0 percent from the same month one year ago. Inventories at the end of the month were 742,400 tons, up 2.4 percent from last month but down 4.7 percent from the same month one year ago. The daily receipt rate for January was 11,524 tons per day, down from 12,280 tons per day in December. Total tonnage received was 242,000 tons, down from 245,600 tons the month before. Flat rolled inventories stood at 3.3 months in January, down from 4.7 months of supply in December.

Plate

Canadian shipments for plate products in January were 70,500 tons, an increase of 26.6 percent from the previous month but a decrease of 10.2 percent from January 2016. Inventories at the end of the month were 178,200 tons, down 0.6 percent from last month and down 8.7 percent from the same month one year ago. The daily average receipt rate for January was 3,305 tons per day, up from 2,380 tons per day the month before. Plate inventories ended the month at 2.5 months, down from 3.2 months the month before.

Pipe and Tube

Canadian shipments for pipe and tube products in the month of January were 52,000 tons, an increase of 39.0 percent from the month before and an increase of 17.3 percent from the same month last year. Inventories at the end of the month were 113,500 tons, down 4.6 percent from last month and down 16.1 percent from the same month one year ago. The daily average receipt rate for January was 2,214 tons per day, up from 1,825 tons per day the month before. Total months on hand for pipe and tube inventories stood at 2.2 months, down from 3.2 months at the end of December.